Kenya's Real Estate sector has been a significant contributor to the country's GDP, growing at a Compounded Annual Growth Rate (CAGR) of 5.5% for the past 5 years. In Q3’2023, the sector expanded by 5.4%, reaching Kshs 785.9 bn compared to Kshs 743.4 bn recorded in the same period in 2022. This surge in growth highlights the sector's increasing importance, with its contribution to the national GDP reaching 10.5%, up from 10.0% in the previous quarter. Several factors have contributed to the Real Estate sector's growth, including; i) the government’s continued emphasis on the affordable housing agenda, ii) aggressive expansion strategies pursued by both local and international retailers, iii) rapid population and urbanization growth rates, iv) the reopening and expansion of the hospitality sector amidst economic recovery, v) enhanced investor confidence, vi) the Kenya Mortgage Refinance Company's (KMRC) persistent efforts to increase access to homeownership through long-term, low-interest home loans for potential buyers, vii) a heightened appetite for Mixed-Use Developments (MUDs) due to their convenience, and viii) ongoing infrastructure improvements across the country creating new investment opportunities.

Despite the above cushioning factors, various challenges continue to impede the optimum performance of the Real Estate sector such as increased construction costs, existing oversupply of physical space in select sectors, and difficulties in accessing financing in light of elevated credit risk and rising interest rates. In support of this, gross Non-Performing Loans (NPLs) advanced to the Real Estate sector increased by 29.5% to Kshs 97.9 mn in 2023 from Kshs 75.6 mn recorded in 2022. To address this shortfall in funding, stakeholders in the Real Estate sector have been actively exploring alternative financing avenues, including Real Estate Investment Trusts (REITs), which are regulated by the Capital Markets Authority (CMA). The CMA established a comprehensive framework and regulations for REITs in 2013, enabling developers to raise capital through this avenue.

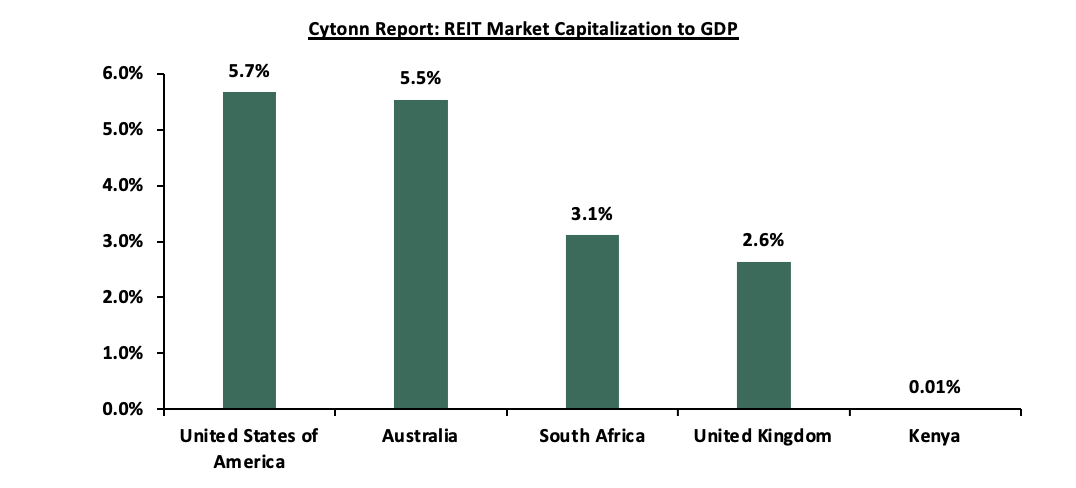

However, since 2013, the Kenyan REIT market continues to be subdued owing to various challenges such as the large capital requirements of Kshs 100.0 mn for trustees which limits the role solely to banks, prolonged approval process for REIT creation, high minimum investment amounts set at Kshs 5.0 mn which discourage investments, and lack of adequate knowledge of the financial asset class by investors. Notably, REIT market capitalization in Kenya remains significantly lower compared to other jurisdictions as shown below;

Source: European Public Real Estate Association (EPRA), World Bank

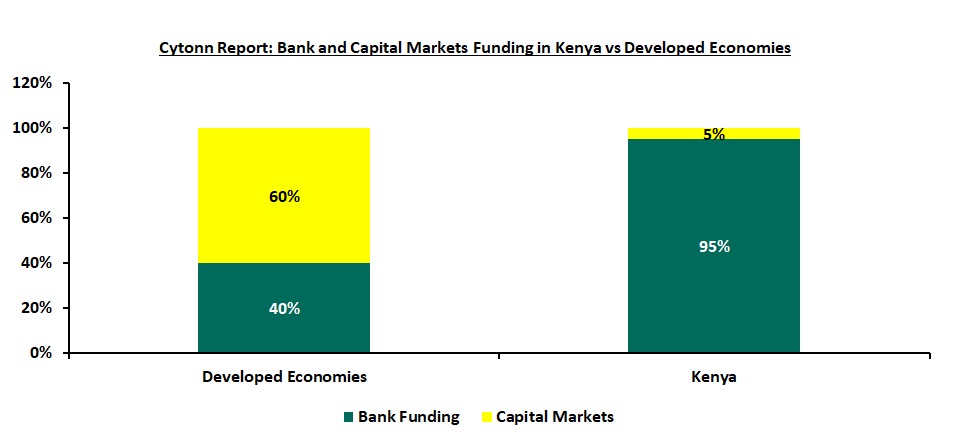

The REITs challenge is further compounded by Kenya’s underdeveloped capital markets as compared to other African countries such as South Africa. Currently, there exists only one listed REIT in the country, albeit one that is not actively trading. The above indicates a sector that has remained moribund since REIT regulations were put in place in 2013. Due to this, most property developers rely on conventional sources of funding such as banks, compared to other developed countries. According to the Capital Markets Authority (CMA)’s Q4’2020 Capital Markets Soundness Report, financing for construction in Kenya was majorly sourced from the banking sector at 95.0% while capital markets contributed only 5.0%. The table below shows the comparison of development funding in Kenya against developed economies;

Source: World Bank, Capital Markets Authority (CMA)

Subsequent to the putting in place of REIT regulations in 2013, four REITs were authorized in the Kenyan market, all structured as closed-ended funds with fixed numbers of shares. However, currently none of them are actively trading on the Main Investments Market Segment Nairobi Securities Exchange (NSE). With the recent delisting of ILAM Fahari I-REIT, LAPTrust Imara I-REIT remains the only listed REIT in the country, having been quoted on the restricted market sub-segment of the Main Investment Market of the NSE. However, we note that Imara did not raise money upon listing. Acorn I-REIT and D-REIT are not listed but trade on the Unquoted Securities Platform (USP), an over-the-counter market segment of the NSE. The table below highlights all the REITs authorized by the Capital Markets Authority (CMA) in Kenya;

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

# |

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

October 2015 |

Main Investment Market |

Delisted on 12th February 2024 |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

March 2023 |

Main Investment Market: Restricted Sub-segment |

Restricted |

Source: Nairobi Securities Exchange, CMA

We believe REITs are crucial to closing the funding gap in Real Estate. Because of their unique status as an investment avenue that grants access to capital markets, REITs have the potential to complement various projects in Kenya, including the burgeoning affordable housing initiative. We have previously done four topicals namely; i) Real Estate Investment Trusts (REITs) as an Investment Alternative in 2019, ii) Real Estate Investment Trusts in Kenya in 2021, iii) Real Estate Investment Trusts Performance in Kenya in 2022, and, iv) Real Estate Investments Trusts (REITs) Progress in Kenya in 2022. This week on our topical, we shed light on the progress of REITs in Kenya and explore strategies to enhance their performance. Our discussion encompasses the following key areas:

- Overview of REITs,

- Types of REITs,

- Role of REITs in Affordable Housing Agenda,

- Advantages and challenges associated with investing in REITs,

- Progress and performance of REITs in Kenya,

- Case studies of REITs in other countries,

- Recommendations, and,

- Conclusion.

Section I: Overview of REITs

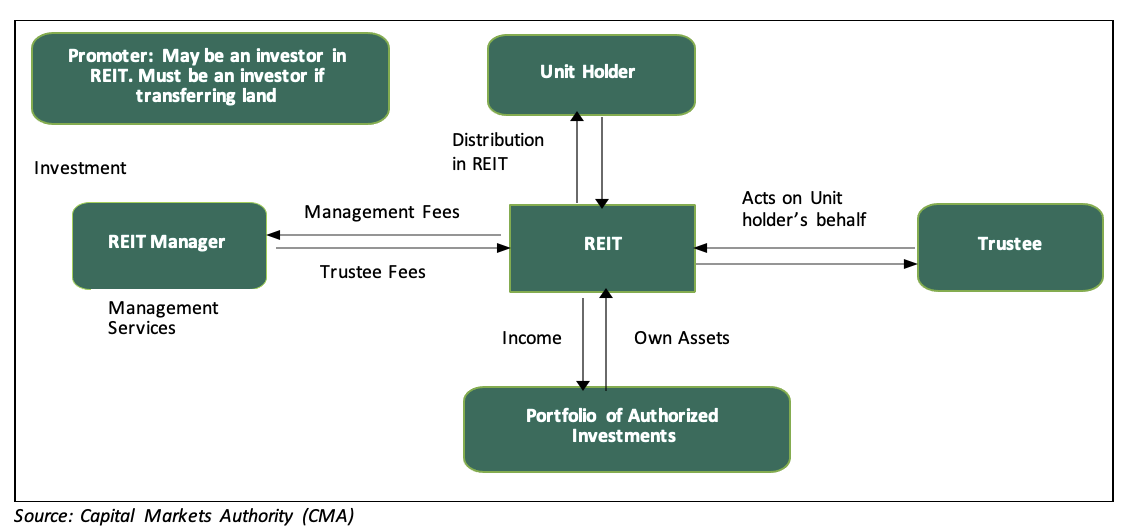

REITs are essentially regulated collective investment vehicles that allow investors to contribute money’s worth as consideration for the acquisition of rights or interests in a trust that is divided into units with the intention of earning profits or income from Real Estate as beneficiaries of the trust. Investors can purchase and sell shares of REITs on the stock market. REITs source funds to build or acquire Real Estate assets, which they sell or rent to generate income. At the end of a fiscal year, the generated income is then dispersed as returns (dividends) on investment to the shareholders. There are four important parties who collaborate to guarantee the protection of REITs interests and to help promote accountability and transparency inside the REIT structure. These parties include:

- The Promoter: This party is involved in setting up a REIT scheme. The promoter is regarded as the initial issuer of REIT securities and is involved in making submissions to the regulatory authorities to seek relevant approvals of a draft trust deed, draft prospectus or an offering memorandum. Some of the REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust,

- The REIT Manager: This is a company that has been incorporated in Kenya and has been issued a license by the authority (CMA) to provide Real Estate and fund management services for a REIT scheme on behalf of investors. Currently, there are 10 REIT Managers in Kenya namely; Cytonn Asset Managers Limited (CAML), Acorn Investment Management, Stanlib Kenya Limited, Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited,

- The Trustee: This is a corporation or a company that has been appointed under a trust deed and is licensed by the authority (CMA) to hold the Real Estate assets on behalf of investors. The Trustee’s main role is to act on behalf of the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed. REIT trustees in Kenya include; Kenya Commercial Bank (KCB), Co-operative Bank (Coop), Housing Finance Bank and NCBA Bank Kenya, and,

- Project/Property Manager: The role of the project manager is to oversee the planning and delivery of the construction projects in the REITs. The property manager on the other hand plays the role of managing the completed Real Estate development that has been acquired by a REIT with his main goal being profit generation.

The relationship between key parties in a typical REIT structure is depicted in the figure below;

Section II: Types of REITs

In Kenya, there are three main types of REITs:

- Income Real Estate Investment Trust (I-REITs): This’ a type of REIT in which investors pool their capital for purposes of acquiring long term income generating Real Estate including residential, commercial, and other Real Estate asset types. In I-REITs, investors gain through capital appreciation and rental income,

- Development Real Estate Investment Trusts (D-REITs): A D-REIT is a type of REIT in which investors pool together their capital together for purposes of acquiring Real Estate with a view of undertaking development and construction projects. A D-REIT can be converted into an I-REIT once development is complete where the investors can choose to sell, reinvest, or lease their shares. D-REIT investors gain from sale profits once an asset is sold in a commercial arm’s length transaction, and,

- Islamic Real Estate Investment Trusts: An Islamic REIT is a unique type of REIT that invests primarily in income-producing Shari’ah-compliant Real Estate developments. A fund manager is required to conduct a compliance test before investing to ensure it is Shari’ah compliant and that non-permissible activities are not conducted in the estate and if so, then on a minimal basis.

Section III: Role of REITs in Affordable Housing Agenda

Real Estate Investment Trusts (REITs) possess the potential to revolutionize Kenya's affordable housing landscape, by offering promising opportunities to address both demand and supply challenges. In recent years, Kenya has witnessed a surge in urbanization and population growth rates, amplifying the need for affordable housing solutions. However, traditional financing mechanisms and development processes have struggled to keep pace with this demand, creating a significant gap in the housing market. Against this backdrop, REITs emerge as a strategic tool to mobilize capital, streamline development processes, and catalyze both the demand and supply sides of the affordable housing agenda. By pooling funds from investors and leveraging expertise in project management, REITs hold the potential to transform the affordable housing sector, bridging the gap between housing supply and demand while ensuring the timely delivery of quality housing units. We now explore the multifaceted role of REITs in advancing the affordable housing agenda in Kenya, analyzing their impact on both demand and supply dynamics.

- Demand Side

- Mobilizing Capital: This investment vehicle allows individuals and institutions to pool their resources, channelling significant funds into projects aimed at addressing the housing deficit. By democratizing access to Real Estate investment opportunities, REITs attract diverse investors, facilitating the aggregation of substantial capital for affordable housing developments. While the government has been making efforts to mobilize capital for affordable housing through initiatives like the Kenya Mortgage Refinancing Company (KMRC) and the National Housing Development Fund (NHDF), REITs offer a complementary approach. Unlike government-led programs, REITs provide a private-sector-driven mechanism for mobilizing capital. They attract a wide range of investors, including both institutional and retail investors, thereby diversifying funding sources for housing projects. Additionally, REITs have the flexibility to invest in various types of Real Estate assets, including residential properties targeted at low and middle-income earners. This diversity allows REITs to adapt to evolving market demands and allocate capital efficiently to where it's most needed, thus augmenting the government's efforts in addressing the affordable housing agenda,

- Addressing Financing Gap: REITs offer developers an alternative financing avenue characterized by more favorable terms and lower borrowing costs compared to conventional sources like bank loans. By providing access to capital at competitive rates, REITs enable developers to overcome financial hurdles that may hinder the implementation of affordable housing projects. This ensures a steady flow of funds into the sector, supporting the development of housing units for low and middle-income earners. Moreover, REITs' ability to tailor financing solutions to suit developers' needs enhances flexibility and promotes innovation. Ultimately, by addressing the financing gap, REITs contribute significantly to advancing the affordable housing agenda and fostering sustainable urban development, and,

- Off-take Arrangements: Through agreements to purchase or lease a predetermined quantity of housing units, I-REITs offer developers a dependable revenue stream, enhancing the appeal of projects to investors. This reliability reduces uncertainties associated with sales and occupancy rates, fostering investor confidence and project sustainability. Additionally, by assuming the role of off-takers, REITs could contribute to the financial feasibility of affordable housing initiatives, facilitating their execution and eventual success. Thus, by providing this essential function, REITs play a pivotal role in catalyzing the demand for affordable housing units, aligning with broader efforts to address housing needs and promote inclusive urban development.

- Supply Side

- Expertise in Project Management: REITs, through the Trustees, possess extensive expertise in project management, property development, and asset management all of which are crucial in the implementation of affordable housing initiatives. Their dedicated teams ensure timely and budget-friendly project execution, minimizing delays and cost overruns. With experience in site selection and design optimization, REIT Trustees identify suitable locations and maximize affordability without compromising quality and in adherence to the Offering Memorandum and the Trust Deed. Efficient development processes enable swift delivery of housing units to meet demand. Post-construction, REITs offer ongoing asset management, ensuring long-term viability through maintenance and tenant management. Overall, their proficiency accelerates affordable housing supply, attracting investors and advancing the affordable housing agenda,

- Streamlining Development Process: REITs streamline the development process by leveraging partnerships with seasoned developers and property managers. These collaborations enhance efficiency by tapping into the expertise of industry professionals. By optimizing construction costs and improving operational efficiency, REITs ensure that affordable housing projects are executed seamlessly and within budget, and,

- Timely Delivery of Housing Units: With dedicated teams focused on project management and property development, D-REITs can effectively oversee the entire development process from inception to completion. Their experience in navigating regulatory frameworks, coordinating with contractors, and managing construction timelines allows them to expedite project delivery without compromising on quality. This timely delivery will not only benefit the community by providing much-needed housing but also will contribute to the overall economic development of the region.

In conclusion, REITs offer a promising solution to the challenges facing the affordable housing sector in Kenya and thus can play a pivotal role in increasing the supply of affordable housing units, while simultaneously meeting the growing demand for quality housing. Their ability to catalyze investment and facilitate project development makes them a valuable tool in achieving the affordable housing agenda and promoting sustainable urban development.

Section IV: Benefits and challenges associated with investing in REITs

- Benefits of Investing in Real Estate Investment Trusts (REITs)

- Diversification: Investing in REITs alongside fixed income securities and equities helps spread risk across diverse asset classes, industries, and sectors when combined into a single portfolio. REITs typically hold physical assets like land and buildings and frequently enter into lengthy leases with their tenants. This provides stability and reliability to investments,

- Stable and Consistent Income: Investors in I-REITs enjoy regular rental income, with regulations mandating the distribution of at least 80.0% of earnings as dividends to unit holders,

- Flexibility: REITs offer adaptability, allowing investors to tailor their portfolio to match fund characteristics, Real Estate market segments, and geographic preferences,

- Competitive Long-Term Returns: REITs deliver robust, long-term yields, enhancing portfolio efficiency,

- Liquidity: Unlike physical property, REIT investments offer greater liquidity, with units or shares easily tradable, particularly in publicly listed REITs,

- Tax Benefits: REITs often benefit from various tax exemptions, providing advantages for both investors and investee companies. For instance, a listed REIT grants corporate tax exemption to the underlying owners of Real Estate assets, currently set at 30.0% annually. Taxation is primarily on profit distribution to unit-holders, subject to withholding tax rates of 5.0% for residents and 10.0% for non-residents. The amendment to Section 20 of the Income Tax Act through the Finance Bill 2019 further exempts REITs' investee companies from income tax, encouraging increased investment in Real Estate development companies without the need for property transfers to the REIT. Additionally, transferring properties to a REIT attracts stamp duty exemptions under Section 96A (1) (b) of the Stamp Duty Act,

- Transparency: REITs' listing ensures transparency, with stringent financial reporting and corporate governance guidelines,

- Access to Capital: REITs enable pooling of funds for long-term Real Estate projects, supplementing existing capital sources like debt and equity markets, and,

- No Shareholder Liability: As is the case with equity investments in other publicly traded companies, shareholders have no personal liability for the debts of the REITs in which they invest.

- Challenges Associated with investing in REITs

- Inadequate Investor Knowledge - REIT instruments suffer from insufficient investor awareness and education, resulting in limited investment activity. This lack of understanding among investors was a key factor contributing to the low subscription rate of 29.0% and subsequent underperformance of Stanlib Fahari I-REIT. Additionally, it played a role in the failed issuance of Fusion D-REIT in 2016,

- High Minimum Capital Requirement for Trustees – Presently, Kenya has just four entities authorized as REIT trustees. In contrast, South Africa allows a broader range of entities, including public companies, approved institutions, or banks, to serve as trustees, resulting in a more extensive pool of trustees available. To enhance the REIT market's accessibility, it's essential to encourage more corporate entities to seek REIT trustee licenses. This necessitates a review of the minimum share capital requirement, expanding it to encompass other suitable players. Such adjustments would streamline the process of introducing REITs to the market, fostering their growth and participation,

- High Minimum Asset Size for Investment Companies - As per the regulations set by the Capital Markets Authority (CMA), the minimum threshold for initial assets stands at Kshs 300.0 mn for Income REITs (I-REITs) and Kshs 100.0 mn for Development and Construction REITs (D-REITs). These requirements pose significant challenges for many companies in the country to attain and manage the assets, making it particularly difficult for medium and small start-ups to enter the REIT market. Consequently, the high entry barriers discourage investment uptake, as achieving the initial asset thresholds typically necessitates substantial investments in Real Estate, limiting opportunities for smaller players to participate in the market,

- Subdued Performance of Select Real Estate Sectors - Despite the resurgence of Kenya’s Real Estate sector, the oversupply of physical space issue still persists as of 2023, there was an oversupply of 5.8 mn SQFT in the Nairobi Metropolitan Area (NMA) commercial office market, 3.0 mn SQFT in the NMA retail market, and 1.7 mn SQFT in the overall Kenyan retail market. This surplus has led to subdued occupancy rates and yields, presenting a significant challenge for the sector,

- Lengthy Licensing and Approval Processes - The licensing and approval procedures for REITs are arduous and time-consuming, demanding extensive documentation and adherence to diverse legal and regulatory stipulations. This cumbersome process might dissuade potential promoters from investing in REITs, prompting them to explore alternative, more streamlined avenues for capital raising,

- Opacity of Exact Returns for Underlying Assets - Despite the best efforts of the regulator to promote transparency in the operation and administration of REITs in Kenya, there exists a gap in the determination of returns from individual assets held by these trusts. This means that investors are not able to tell the exact yields of underlying assets owned by a REIT and this is mainly caused by the lack of a clear framework for the determination of returns as well as valuation standards especially with regards to investment grade commercial assets,

- Shallow Investment-Grade Asset Pipeline - The pool of available investment grade Real Estate assets in Kenya that have the ability to generate attractive and sustainable returns is shallow. For instance, Stanlib Fahari I-REIT had to apply for a regulatory exemption to extend the deadline for acquiring Real Estate assets after failing to meet the 75.0% of Real Estate income-generating assets threshold within 2 years of the REIT’s authorization to operate. The low supply of investment-grade properties for sale in the market was also a key factor that contributed to the acquisition of Stanlib Fahari I–REIT’s properties in Nairobi’s Industrial Area, a generally low-performing zone in the property market, amidst pressure to beat CMA’s deadline to invest at least 75.0% of the REIT’s total net asset value in Real Estate within 2 years of its authorization, and,

- Inconsistent Income - Rental income may be inconsistent over the investment period, attributable to various factors such as termination of lease agreements and failure to renew the same or secure tenants in good time for income continuity. Efficient management of REITs becomes a key factor in the realization of good returns.

Section V: REITs progress and performance in Kenya

In 2013, Kenya and South Africa joined the ranks of African nations adopting REITs as an investment vehicle, following the lead of Ghana and Nigeria, who established their REIT frameworks in 1994 and 2007, respectively. Presently, in Kenya, there are only four authorized REITs: i) ILAM Fahari I-REIT, ii) Acorn Student Accommodation I-REIT, iii) Acorn Student Accommodation D-REIT, and, iv) LAPTrust Imara I-REIT. However, ILAM Fahari I-REIT, the only one that was actively trading on the NSE, was delisted on 12th February 2024. As a result, LAPTrust Imara I-REIT has remained the sole REIT listed on the Nairobi Securities Exchange (NSE), although it is currently not actively trading. The REIT which was set to remain restricted for the next three years, has traded only once since its listing in March 2023. LAPTrust Imara I-REIT had sought permission to withhold trading for three years in a bid to provide the I-REIT sufficient time to build a performance track record, allowing investors to gain confidence in the asset class. The two Acorn REITs launched in February 2021 trade on an over the counter platform of the NSE referred to as Unquoted Securities Platform (USP). Despite Kenya's adoption of REIT regulations in 2013, in the same year as South Africa, the country lags behind South Africa, which boasts 33 listed REITs. This section evaluates the performance of Kenya's REIT industry, including market activities and progress in implementing policy proposals by the Capital Market Authority to enhance the REIT sector's attractiveness to investors.

Notable Activities

Some of the recent notable activities in the Kenyan REIT’s sector include;

- Licensing of NCBA Bank Kenya PLC as REIT Trustee: On 5th February, the Capital Markets Authority (CMA) licensed NCBA Bank Kenya PLC to become a Real Estate Investment Trust (REIT) trustee in Kenya. The recent licensing of NCBA Bank Kenya PLC as a REIT trustee by the Capital Markets Authority (CMA) marks a significant development in Kenya's Real Estate investment landscape. This accreditation, issued in alignment with regulatory frameworks, reflects the CMA's commitment to bolstering the country's Real Estate capital markets, particularly in support of the government's Affordable Housing agenda. Following NCBA Bank’s recent entry, the number of licensed REIT trustees in Kenya stands at 4. These include Housing Finance Company (Kenya) Limited, Kenya Commercial Bank (KCB), Co-operative Bank of Kenya Limited, and NCBA Bank. It is expected that NCBA Bank Kenya will support investments in the Real Estate sector, contributing to the overall growth of the economy and the Affordable Housing Initiative. With NCBA Bank now authorized to act as a REIT trustee, it can play a crucial role in facilitating financing for Real Estate projects, including those aimed at providing affordable housing. For more information, please see our Cytonn Weekly #06/2024,

- ILAM Fahari I-REIT Delisting: ILAM Fahari Income Real Estate Investment Trust (ILAM Fahari I-REIT or IFIR) through a public notice dated 6th February 2023 announced it received approval from the Capital Markets Authority (CMA) to delist from the Main Investment Market Segment (MIMS) of the Nairobi Securities Exchange (NSE). The delisting, effective from Monday, February 12th 2024, followed the resolution by Unitholders of ILAM Fahari to delist in November 2023. As a result, the last day of trading for the REIT on the Main Investment Market segment of the NSE was 9th February 2024. Subsequently, ILAM Fahari initiated the process of applying to have its securities admitted for trading over the counter on the Unquoted Securities Platform (USP) of the NSE.

The delisting of ILAM Fahari I-REIT reflects both the challenges faced by the REIT and its proactive response to them. Leading to its delisting, ILAM Fahari I-REIT encountered operational hurdles that necessitated a re-evaluation of its structure and operations. The decision to delist stems from a culmination of factors, including the REIT's history of undersubscription during its Initial Public Offering (IPO) and performance limitations attributed to its relatively small portfolio size. Following the undersubscription, the REIT failed to raise substantial capital for property investment. As a result, ILAM Fahari I-REIT faced constraints in expanding its portfolio, leading to concentration risks and subdued investor confidence. The delisting process was initiated following resolutions made during an Extraordinary General Meeting (EGM) held in December 2023. Key among these resolutions was;

-

- The proposed conversion of ILAM Fahari I-REIT from an unrestricted I-REIT to a restricted I-REIT which was voted for by 93.1% of unitholders,

- The delisting of the REIT from the Main Investment Market of the NSE which was passed by 93.0% of unitholders,

- The subsequent quotation of the REIT on the Unquoted Securities Platform (USP), and,

- The authorization of ICEA Lion Asset Management (ILAM) and the Co-operative Bank of Kenya as the Fund Manager and Trustee of ILAM Fahari I-REIT to take all requisite actions for the conversion and delisting.

The REIT’s delisting forms part of the REITs strategic restructuring aimed at enhancing operational efficiency and investor returns being implemented by the REIT manager ICEA Lion Asset Management (ILAM). We note that the REIT’s de-listing will have several implications to various stakeholders as outlined below;

-

- Non-Professional Unitholders: In Kenya, retail or non-professional investors in REITs are individuals have invested minimum amounts below Kshs 5.0 mn or who hold units valued at Kshs 5.0 mn and below. Non-Professional investors who accepted the redemption the offer will cease to be Unitholders upon transferring their units and receiving payment. However, non-professional investors who choose not to accept the offer will be subject to restrictions on trading units post-delisting. It is worth noting that post conversion, investments to the REIT is only for Professional investors. As such, Non-professional investors who retain their units will be collectively placed in a nominee account, ensuring compliance with REIT regulations. This structure allows them to retain ownership rights and participate in voting via the nominee account, providing a streamlined approach to manage their investments,

- Professional Unitholders: Professional unitholders of ILAM Fahari I-REIT will continue holding their units unaffected by the delisting. Post-delisting, the intention is to list units on the Unquoted Securities Platform (USP) for liquidity, although availability cannot be guaranteed. However, if the value of their units falls below the regulatory threshold, professional investors will need to top up to comply. Transactions on the USP may be subject to taxes. In the context of the Kenyan REITs, a professional investor includes any person licensed under the Capital Markets Act or an authorized collective investment scheme or a bank or subsidiary of a bank, insurance company, cooperative, statutory fund, pension or retirement fund or a person including a company, partnership, association or a trustee on behalf of a trust which, either alone, or with any associates on a joint account subscribes for REIT securities with an issue price equal to at least Kshs 5.0 mn,

- Tenants: Delisting will not impact tenants of the REIT’s properties,

- Regulators: The REIT will remain regulated by the CMA as a Restricted I-REIT, while the NSE will manage the Unquoted Securities Platform (USP), and,

- Other Contractual Obligations: Existing obligations will not be affected by the delisting.

For more information, please see our Cytonn Weekly #06/2024, Cytonn Monthly – November 2023, Cytonn Weekly #43/2023, Cytonn Weekly #42/2023, Cytonn Weekly #41/2023 and ILAM Fahari Conversion Offering Memorandum.

- Acorn Student Accommodation D- REIT Strategic Sale: In December 2023, Acorn Student Accommodation Development REIT (ASA D-REIT) announced it had sold its latest stabilized asset, Qwetu Aberdare Heights II, to the Acorn Student Accommodation Income REIT (ASA I-REIT) in a Kshs 1.5 bn deal. The acquisition of the 630-bed capacity hostel located adjacent to Qwetu Aberdare Heights I and United States International University (USIU) brings the total number of assets acquired by the I-REIT to four over the last three years. Other projects acquired by the ASA I-REIT include; Qwetu Wilsonview in February 2021, Qwetu Aberdare Heights I in October 2022 and recently Qwetu Hurlingham in June 2023.

Through the sale, ASA D-REIT will repay Kshs 600.0 mn of the Acorn Green Bond, pushing the repayment of the Kshs 5.7 bn bond to Kshs 3.0 bn ahead of its maturity in November 2024. The bond which was first floated in 2019, was issued in partnership with Private Equity Fund Helios and had attracted an 85.0% subscription rate, raising Kshs 4.3 bn of the targeted amount of Kshs 5.0 bn. The bond was priced at a rate of 12.3%, and was intended to be used to finance sustainable and climate-resilient student accommodation with a combined capacity of 40,000 beds. For more information, please see our Cytonn Q3’2019 Markets Review report. Acorn D-REIT also announced its debut dividend payout of Kshs 240.0 mn, after a three-year grace period in line with its offering memorandum, through which unitholders will achieve a dividend yield of 3.4%, - Lowering of Minimum Amounts for D-REIT to Kshs 100,000: In November 2023, the government proposed the revision of the threshold for Development REITs (D-REITs) from Ksh 5.0 mn to Ksh 100,000. The new threshold was fronted during the annual general meeting of the REITs Association of Kenya (RAK) at Enashipai Resort and Spa in Naivasha, where Investment Principal Secretary Mr. Abubakar Hassan acknowledged that the sector’s lacklustre performance and stunted growth was attributable to the high minimum share capital requirements discouraging entry to the Kenyan REIT market. This adjustment sought to attract more investors and foster a conducive environment for sustainable growth in Real Estate investment. The move reflects the government's commitment to supporting the sector amidst challenges such as high investment costs and complex processes. Investment Principal Secretary Abubakar Hassan emphasized the importance of REITs in meeting the growing demand for quality Real Estate assets, especially amid urbanization and affordable housing initiatives. By making D-REITs more accessible to a wider range of investors, including retail and smaller-scale participants, this policy change is poised to stimulate investment growth, broaden the investor base, and spur economic development in the Real Estate sector,

- LAPTrust Imara I-REIT’s Trading debut: In October 2023, LAPTrust Imara I-REIT traded for the first time since its listing. With a total of 30.0 mn shares traded in two deals valued at Kshs 600.0 mn, its share price remaining unchanged from its listing price of Kshs 20.00. The I-REIT which is structured as a close-ended fund consisting of 346.2 mn units worth Kshs 6.9 bn was initially intended to remain non-public, with no securities offered to the general market for the next three years. For more information, please see our Cytonn Weekly #43/2023. Currently, LAPTrust Imara I-REIT is listed on the Main Investment Market-Restricted Sub-Segment of the Nairobi Securities Exchange and remains inactive,

- Conversion of ILAM Fahari I-REIT from an Unrestricted I-REIT to a Restricted I-REIT: In August 2023, the Capital Markets Authority (CMA) gave its approval for the conversion of ILAM Fahari Income Real Estate Investment Trust (REIT) from an Unrestricted I-REIT to a the Restricted REIT through a Conversion Offering Memorandum. Conversion was to be carried out through a redemption offer, where 36,585,134 units held by retail investors, worth below Kshs 5.0 mn were to be redeemed at Kshs 11.0 per unit to ICEA Lion Asset Management Limited. The REIT also received applications from non-professional investors seeking to top up their portfolio with an additional 421,945 units.

Following the conclusion and subsequent lapsing of the conversion offer period by ICEA Lion Asset Managers (ILAM) on Friday 6th October, ILAM Fahari announced it would redeem a total of 36.2 mn units, against the total 36.6 mn units which were set to be redeemed, representing a redemption rate of 88.4%, whereas 421,945 units were allocated to Non-Professional investors for purposes of topping up their holdings to the Professional investor threshold. The overall oversubscription rate for the offer stood at 13.1%. In November 2023, at an Extraordinary General Meeting (EGM), 93.1% unitholders voted for the conversion of ILAM Fahari I-REIT from an unrestricted I-REIT to a restricted I-REIT and subsequent delisting. Notably, once executed, the transaction will result in ICEA LION Asset Management increasing its unitholding to 22.7% post redemption, purchasing an additional 19.9% of units valued at Kshs 397.8 mn. This will significantly increase ILAM’s holding from its initial of 2.8%.

By transitioning to a Restricted I-REIT, ILAM Fahari I-REIT aims to reset its structure, focusing on a more targeted investor base comprising Professional Investors. The conversion to a restricted REIT will allow Fahari I-REIT to offer specialized investment opportunities to their stakeholders, providing increased flexibility and potential for growth. In addition, the new structure aligns with ILAM Fahari’s strategic vision to optimize its investments and provide investors with innovative avenues to diversify their portfolio. We however note that, while this move allows the REIT flexibility for operational restructuring, potential disposal of non-core assets, and capital raising initiatives to optimize its performance, its conversion restricts investments in the instrument to only high net worth individuals thus locking out potential retail investors. For more information, please see our Cytonn Monthly – August 2023, and Cytonn Weekly #36/2023, and, - Progress towards the creation of the Kenya National REIT (KNR): In February 2023, the Capital Markets Authority (CMA) in collaboration with the Sanduku Investment Initiative, the Association of Pension Trustees and Administrators of Kenya (APTAK) and the Nairobi Securities Exchange (NSE) announced ongoing plans to create a Kenya National REIT (KNR) as an accreditation body for REITs and their stakeholders within the Kenyan REITs market. REITs that will be registered under KNR will be structured for immediate investor uptake in the capital markets as scalable asset classes with the potential to contribute to national economic growth. The Retirements Benefits Authority (RBA) and the APTAK will also work with Trustees to review the REIT investment mandates, thereby allowing participation of pension funds in the KNR REITs as an alternative asset class.

The Sanduku Investment Initiative is a Public-Private Partnership (PPP) financing model launched by President Ruto to bring together the participation of financial sector players such as; pension funds, insurance companies, SACCOs, Islamic finance institutions, and global investors. The objective of the model is to raise Kshs 1.0 tn over the next five years, as part of Kenya’s Economic Transformation Agenda. It was envisioned Sanduku will financially support the government’s priority projects such as; the Railway City Development, Nairobi International Financial Centre, Kenani Leather Park, and Makongeni Modern Suburb, among others, in line with the government’s plan for significant infrastructure initiatives and the Affordable Housing Program (AHP). After the REIT market and industry stakeholders validate the proposed KNR model, additional engagements will be conducted to ensure there is investment appetite and support. This will be followed by structuring and launching a pilot REIT under KNR. For more information, please see our Cytonn Weekly #06/2023. We note however, that since the proposal was first floated in February 2023, no further discussions with regards to the matter have been floated and KNR is yet to materialize. Further, it’s not clear what specific advantages the Sanduku initiative will be offering that is not present in the current REIT regime.

Section VI: Case studies of REITs in other countries

In our previous topicals covering the REIT market in Kenya, we highlighted the REIT markets of several countries such as Singapore, Australia, South Africa, China and United Kingdom. This week, we now take a look at the lessons on the operational and policy framework in the REIT market that we can learn from these aforementioned countries, in addition to those from Belgium and the United States of America (USA);

|

Cytonn Report: Summary of Case studies of REITs in Various Countries |

|

|

Country |

Key Take-outs |

|

Belgium |

|

|

United States of America (USA) |

|

In summary, stakeholders in the REIT markets of Singapore, Australia, South Africa, China, the UK, Belgium, and the US have established favourable conditions for REITs, offering incentives to participants that enhance their appeal compared to other investment options. Our examination of these countries' REIT markets reveals valuable insights that could enhance Kenya's REIT market. Key factors contributing to the success of REITs in these nations include supportive regulatory frameworks and well-designed REIT structures. Moreover, the increasing popularity of REITs in these jurisdictions reflects growing investor confidence in REITs as a viable investment avenue.

Section VII: Recommendations

The Kenyan REIT market has the potential to grow and this is possible if there is a supportive framework set up similarly to the above highlighted case studies. In view of this, the following measures can be implemented to rejuvenate the Kenyan REIT market;

- Encourage Different Legal Entities to pursue REIT Formation: In both Belgium and the United States, REIT formation allows for flexibility in the choice of legal entities, contributing to the diversity and dynamism of the REIT market. Belgium permits various legal structures, including public limited companies, limited liability companies and cooperative companies, offering options tailored to different investor preferences and business models. Similarly, in the US, REITs can be structured as corporations, trusts, or associations, providing versatility in organizational structures. Kenya should follow suit by encouraging different legal entities for REIT formation. By expanding the range of permissible structures beyond traditional trust-based models, such as permitting corporations or limited liability companies, Kenya can accommodate diverse investor needs and facilitate easier entry into the REIT market,

- Streamlined approval process: To enhance the efficiency of Real Estate Investment Trusts (REITs) approval, consolidating the approval structure into a single agency, rather than the existing two (CMA and KRA), is recommended. Consolidating the approval process under one agency would eliminate the necessity of navigating through two distinct agencies for REITs approval. This consolidation would streamline the process, improving efficiency, reducing costs, and enhancing transparency and accountability,

- Abolish Minimum Investment Requirements: Kenya should consider abolishing minimum capital requirements for Real Estate Investment Trusts (REITs), similar to the approach adopted in the United States. Removing this barrier would encourage greater participation in the REIT market by lowering entry barriers for investors and facilitating the establishment of REITs, thus fostering market growth and innovation,

- Reduce the minimum Capital for Trustees: The minimum capital required of trustees of Kshs 100.0 mn is too high, effectively limiting the trustees to banks only. Currently there are 4 banks registered as REIT Trustees, being Kenya Commercial Bank (KCB), Co-operative Bank (Coop), Housing Finance Bank and NCBA Bank Kenya. We recommend the minimum should be brought down to Kshs 10.0 mn, to match the minimum needed for a Pension Fund Trustee. This would increase the number of Trustees that REIT Managers can pick from,

- Fostering Institutional Grade Real Estate Development: Presently, insufficient urban planning has led to a discernible void in the Real Estate sector for properties that offer more than mere residential accommodations and can generate attractive returns for investors. Addressing this gap involves promoting the development of institutional grade Real Estate assets, which would furnish robust underlying properties for REITs, thereby bolstering investor returns,

- Flexibility in Listing: Belgium's requirement of ensuring 30.0% of shares held by the public offers a balance between public ownership and flexibility for REIT promoters. Kenya could adopt a similar approach to encourage broader investor participation while ensuring adequate liquidity in the market. Additionally, Kenya could emulate the United States in providing flexibility in listing options for REITs. Allowing REITs, the choice to go public or remain private offers greater flexibility to meet diverse investor preferences and business models. By accommodating both publicly listed and privately held REITs, Kenya can promote market inclusivity and cater to the needs of a wide range of investors, thereby enhancing the vibrancy and liquidity of the REIT market,

- Education and Awareness: Conduct investor education and awareness campaigns to educate potential investors about the benefits and risks of investing in REITs. By enhancing investor knowledge and understanding, more investors may be encouraged to participate in the REIT market, contributing to its growth and development, and,

- Simplify the REIT formation process: Currently, the bureaucratic procedures involved in forming a REIT can extend the timeline to between one to two years. The CMA should streamline this process to enhance efficiency and minimize the time required for formation.

Section VII: Conclusion

In conclusion, the progress of Real Estate Investment Trusts (REITs) in Kenya showcases both achievements and opportunities for further development. While the regulatory framework laid out under the Capital Markets (Real Estate Investment Trusts) Regulations, 2013 provides a foundation for REITs, there remains challenges to address and lessons to learn from global counterparts. Embracing these recommendations can propel Kenya's REIT market, fostering economic expansion and delivering appealing prospects for Real Estate investors.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor