Following the release of the H1’2022 results by Kenyan insurance firms, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed insurance companies and the key factors that drove the performance of the sector. The report is themed ‘’Improved Efficiency Cushions Insurance Sector’s Core Earnings Growth”, where we assess the main trends in the sector, and areas that will be crucial for growth and stability going forward, seeking to give a view on which insurance firms are the most attractive and stable for investment. As a result, we shall address the following:

- Insurance Penetration in Kenya

- Key Themes that Shaped the Insurance Sector in H1’2022,

- Industry Highlights and Challenges,

- Performance of The Listed Insurance Sector in H1’2022, and,

- Conclusion & Outlook of the Insurance Sector.

Section I: Insurance Penetration in Kenya

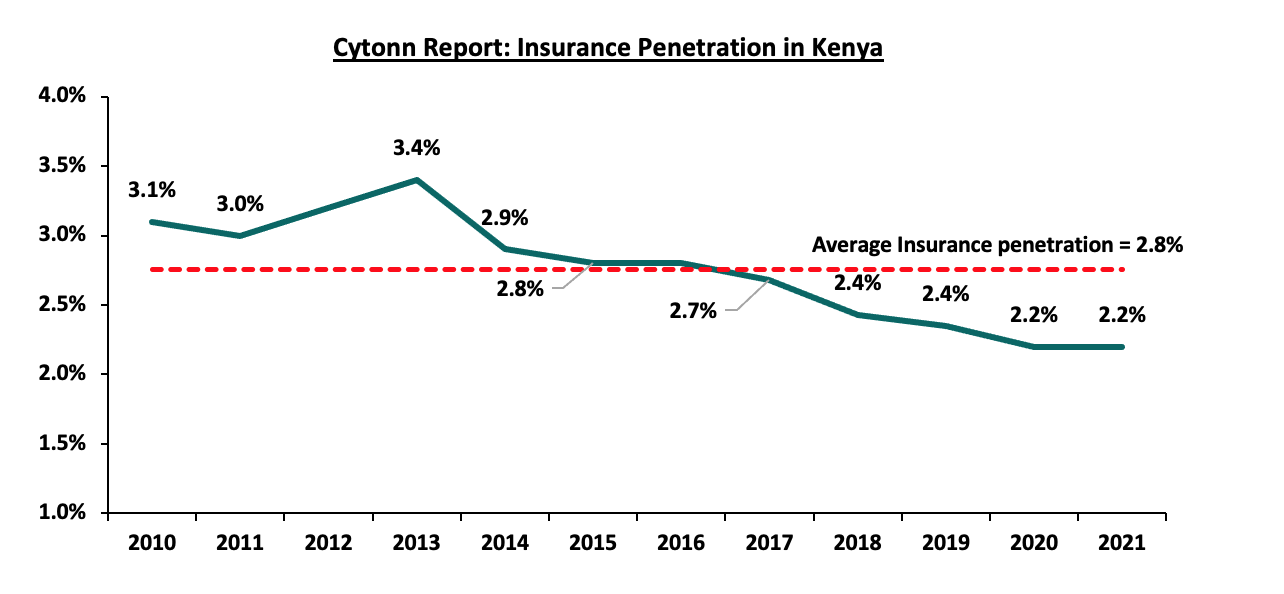

Insurance uptake in Kenya remains low compared to other key economies with the insurance penetration coming in at 2.2% as at 2021, according to the Central Bank of Kenya’s Kenya Financial Sector Stability Report 2022. The low penetration rate, which is below the global average of 7.0%, is attributable to the fact that insurance uptake is still seen as a luxury and mostly taken when it is necessary or a regulatory requirement. Key to note, Insurance penetration remained unchanged at 2.2% in 2021, same as what was recorded in 2020, despite the economic recovery that saw an improved business environment highlighting the low insurance uptake in the country.

Source: CBK Financial Stability Reports

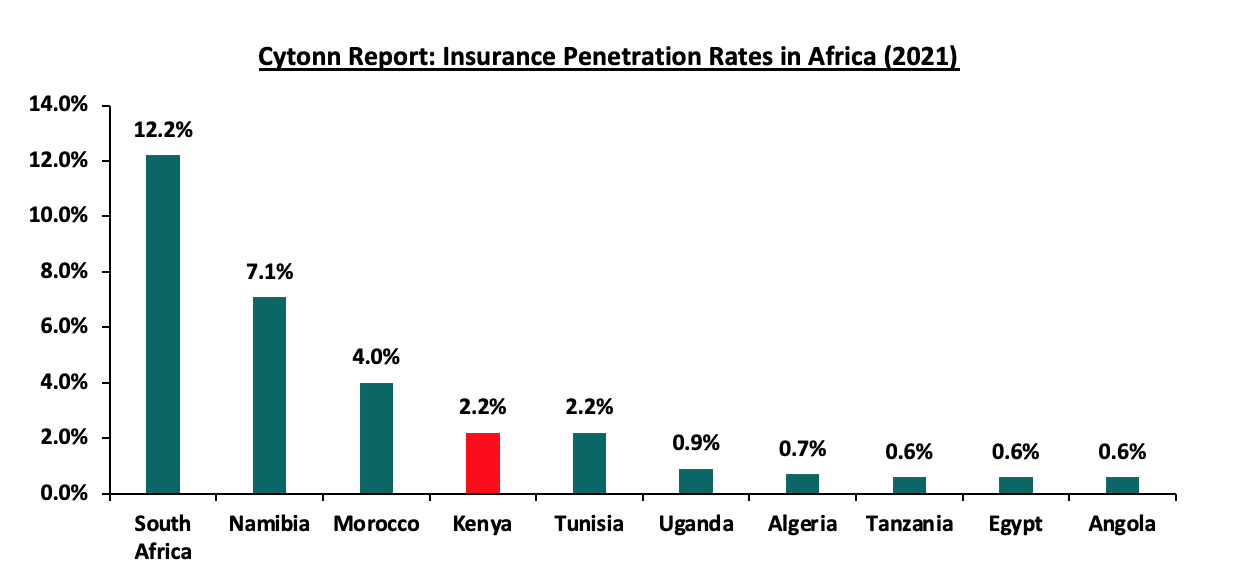

The chart below shows the insurance penetration in other economies across Africa:

Source: Swiss Re, GCR Research, CBK

Insurance penetration in Africa has remained relatively low, averaging 3.1% in 2021, mainly attributable to lower disposable income in the continent and slow growth of alternative distribution channels and technology such as mobile phones to ensure wider reach of insurance products to the masses. Additionally, there has been slow inclusion of diversified products which cater for all income levels and groups. In 2021, South Africa remained the leader in insurance penetration in the continent as a result of mature and highly competitive market, coupled with strong institutions and a sound regulatory environment.

Section II: Key Themes that Shaped the Insurance Sector in H1’2022

Despite the country recording a 5.2% GDP growth in H1’2022, the business environment remained constrained by elevated inflation and supply chain constraints worsened by the geopolitical tensions arising from Russia’s Invasion of Ukraine. According to the Insurance Regulatory Authority(IRA)’s Q2’2022 Industry report, the insurance sector showcased resilience and recorded a 13.2% growth in gross premiums to Kshs 163.1 bn in H1’2022, from Kshs 144.0 bn in H1’2021. Key to note, the general insurance business contributed 56.7% of the industry’s premium income compared to 43.3% contribution by long term insurance business. During the period, the long term business premiums grew by 20.5% to Kshs 70.7 bn from Kshs 58.7 bn in H2’2021 while the general business premiums grew by 8.2% to Kshs 92.4 bn from Kshs 85.4 bn in H2’2021. Significant to note, motor insurance and medical insurance classes of insurance accounted for 62.5% of the gross premium income under the general insurance business compared to 62.3% in H1’2021. As for long-term insurance business, the major contributors to gross premiums were deposit administration and life assurance classes accounting for 60.7% in H2’2022, compared to the 59.7% contribution by the two classes recorded in H2’2021.

In the period under review, the net claims for the long term insurance business increased by 4.7% to Kshs 41.3 bn, from Kshs 39.4 bn in H1’2021. Similarly, net claims for the general business also increased by 14.5% to Kshs 37.1 bn, from Kshs 32.4 bn in H1’2022, driven by a 23.4% growth in medical claims to Kshs 15.5 bn in H1’2022, from Kshs 12.5 bn in H1’2021.

The NASI index declined by 25.5% in H2’2022 compared to a gain of 9.4% in H1’2021 consequently deteriorating the insurance sector’s bottom line as a result of fair value losses in the equities investments. This has seen the sector continue to reduce its allocation to quoted equities, with the proportion of quoted equities to total industry assets declining to 2.8% in H1’2022, from 4.0% in H1’2021. Key to note, Year to Date (YTD), NASI has also declined by 22.3%, which will continue to have a direct impact on the sector’s bottom-line, due to the expected fair value losses on the quoted securities.

Key highlights from the industry performance:

- Convenience and efficiency through adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks,

- Advancement in technology and innovation making it possible to make premium payments through mobile phones,

- Continued recovery from the economic shocks that saw both individuals and businesses seek insurance uptake to cover for their activities, leading to growth in gross premiums which increased by 13.2% to Kshs 163.1 bn, from Kshs 144.0 bn in H1’2021 and,

- The sector’s investment income declined by 37.0% to Kshs 16.6 bn in H1’2022, from Kshs 26.3 bn recorded in H1’2021 for long term insurance businesses, and also declined by 26.5% for general insurance businesses to Kshs 4.6 bn, from Kshs 6.3 bn recorded in H1’2021. Subsequently, yield on investments for the Insurance sector declined by 1.9% points to 2.8%, from 4.7% in H1’2021.

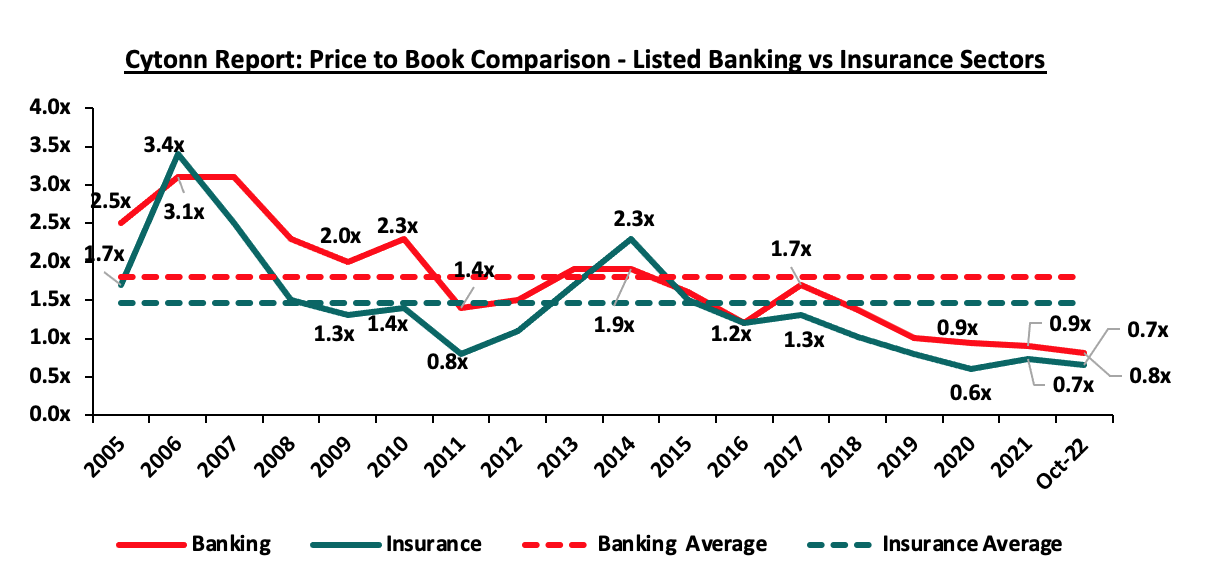

On valuations, listed insurance companies are trading at a price to book (P/Bv) of 0.7x, lower than listed banks at 0.8x, but both are lower than their 16-year historical averages of 1.5x and 1.8x, for the insurance and banking sectors, respectively. These two sectors are attractive for long-term investors supported by the strong economic fundamentals.

The key themes that have continued to drive the insurance sector include:

- Technology and Innovation

The onset of COVID-19 pandemic in 2020 acted as a catalyst towards the adoption of digital distribution of insurance products as it was a necessity. Consequently, majority of insurance companies continue to take advantage of the available digital channels to drive growth and increase insurance penetration in the country. For the fourth quarter of FY’2021/22, active mobile subscriptions declined to 64.7 mn against a population of 55.0 mn, translating to a mobile penetration of 130.9%, according to Fourth Quarter Sector Statistics Report for the FY’2021/2022 . The high mobile penetration implies that mobile phones provide sufficient headroom to increase opportunities to distribute insurance products to the younger generation of consumers and those consumers that have not been served through traditional distribution methods. Given that the process of handling and inspecting claims manually is cumbersome and imperfect, the use of Artificial Intelligence (AI) assists in investigating the legitimacy of claims and identifying those that are fraudulent. Additionally, firms are also leveraging data and AI to tailor products for their target markets. An example is Jubilee Holdings which has rolled out a digital virtual assistant, through which clients can receive real-time services that include the end to end purchase of insurance products and access to services free of human intervention.

- Regulation

To ensure that the sector benefits from a globally competitive financial services sector, the regulator has been working through regulation implementations to address some of the perennial, as well as emerging problems in the sector. The COVID-19 environment proved challenging especially on the regulatory front, as it was a balance between remaining prudent as an underwriter and adhering to the set regulations given the negative effect the pandemic. Regulations used for the insurance sector in Kenya include the Insurance Act Cap 487 and its accompanying schedule and regulations, Retirement Benefits Act Cap 197 and The Companies Act. In H1’2022, regulation remained a key aspect affecting the insurance sector and the key themes in the regulatory environment include;

- IFRS 9 - IAS 39, Financial Instruments Recognition and Measurement was replaced with IFRS 9, Financial Instruments to address the classification and measurement of financial instruments, impairment, and hedge accounting. The guidelines introduce new classification and measurement especially for financial assets, necessitating insurers to make judgements to determine whether financial investments are measured at amortised cost or fair value and whether gains and losses are included in the profit or loss or other comprehensive income. The new impairment model under IFRS 9 is based on expected credit losses and subsequently, all financial assets will carry a loss allowance, meaning that insurers will have to provision higher for impairment losses. Many insurance companies have opted to use the temporary exemption from implementation of IFRS 9, by continuing to apply IAS 39, but the temporary exemption expires in January 2023. IFRS 9 will enable insurance companies to develop appropriate models for their customer debtors and develop plans that will help them lower their credit risk in the future,

- IFRS 17- The standard establishes the principle for recognition, measurement, presentation and disclosure of insurance contracts with the objective of ensuring insurance companies provide relevant information that faithfully represents the contracts. However, as a way to protect the insurance industry from the negative effects of the pandemic the International Accounting Standards Board (IASB), the international body responsible for setting up financial reporting standards deferred its implementation to be effective from January 2023 or earlier. The standard, having replaced IFRS 4, is expected to give better information on profitability by providing more insights about current and future profitability of insurance contracts. Separation of financial and insurance results in the income statement will allow for better analysis of core performance for the entities and allow for better comparability of insurance companies. However, the implementation of the new standard has particular challenges such as the need for historical information and additional finance costs in changing the finance/accounting reporting and actuarial systems. With the looming IFRS 17 compliance dates, insurance firms need to hasten the process, and,

- Risk Based Supervision - IRA has been implementing risk-based supervision through guidelines that require insurers to maintain a capital adequacy ratio of at least 200.0% of the prescribed capital ratio by 2020. However, several hardships faced by the sector such as the COVID-19 pandemic saw an extension of the compliance deadline by 6 months. The regulation requires insurers to monitor the capital adequacy and solvency margins on a quarterly basis, with the main objective being to safeguard the insurer’s ability to continue as a going concern and provide shareholders with adequate returns. We expect more mergers within the industry as smaller companies struggle to meet the minimum capital adequacy ratios. We also expect insurance companies to adopt prudential practices in managing and taking on risk and reduction of premium undercutting in the industry as insurers will now have to price risk appropriately.

- Capital Raising, share purchase and consolidation

The move to a risk based capital adequacy framework presented opportunities for capital raising initiatives mostly by the small players in the sector to shore up their capital and meet compliance measures. With the new capital adequacy assessment framework, capital is likely to be critical to ensuring stability and solvency of the sector to ensure the businesses are a going concern. In May 2022, Sanlam Limited, a South African financial services group listed on the Johannesburg Stock Exchange, announced that it had entered into a definitive Joint Venture agreement for a term of 10 years with Allianz SE, with the aim to leverage on the two entities footprints in Africa and create a leading Pan-African financial services group, with an estimated equity value of Kshs 243.7 bn. Key to note, Sanlam Limited, indirectly owns 100.0% in Hubris Holdings Limited, which is the majority shareholder in Sanlam Kenya Plc, a listed insurance and financial services entity on the Nairobi Stock Exchange. The initial shareholding split of the Joint Venture was announced to be 60:40, Sanlam Limited to Allianz respectively, with the effective date of the proposed transaction being within 12-15 months of the announcement, subject to relevant approvals. However, given the length of the Agreement we expect that the Joint Venture will provide for Sanlam Kenya Plc, Allianz General Insurance Kenya and Jubilee General Insurance (which Allianz owns the majority stake in – 66.0%), to combine operations to grow their market share, asset base and bottom lines.

Section III: Industry Highlights and Challenges

Following the stable growth achieved by the insurance sector over the last decade, we expect the sector to experience sustained gradual growth on the back of an improving economy and subsequent growth in insurance premiums, which will enhance the capacity of the sector to sustain profitability.

In H1’2022, the Insurance Regulatory Authority (IRA), in line with their mandate of regulating and promoting development of the insurance sector approved 12 new or repackaged insurance products filed by various insurance companies. In the new products, 2 or 16.7% of the 12 products were bundled products, 3 or 25.0% of the 12 products were medical plans, 1 or 8.3% of the 12 products was micro insurance, 1 or 8.3% of the 12 products was non-linked insurance, 2 or 16.7% of the 12 products were life products, while miscellaneous accounted for 3 or 25.0% of the total new/repackaged products.

Industry Challenges:

- Cut throat competition: The local insurance sector is served by 56 insurance companies offering the same products, despite the low insurance penetration in the country. The battle for market share has seen some insurers resort to underhand methods of gaining competitive advantage, such as premium undercutting which involves secretly offering clients unrealistic low premiums in order to gain competitive advantage and to protect their market share. This is a major driver of underwriting losses suffered by the industry. The regulator retaliated plans to engage a consultant to relook at the industry pricing in March 2021, and the plans are still underway. This however comes on the back drop of muted insurance penetration that could be worsened by increased premiums pricing. Some industry players have argued price fixing will kill innovation and that the industry players should be left free to set their own prices,

- Fraud: Insurance fraud is an intentional deception committed by an applicant or policy holder for financial gain. Recent years have seen an increase in fraudulent claims especially in medical and motor insurance, with estimates indicating that one in every five medical claims are fraudulent mainly through inflated medical bills and hospitals making patients take unnecessary tests. In H1’2022, 74 fraud cases were reported, with fraudulent motor accident injury claims accounting for 25.7%, followed by forgery at 13.5%. The sector has been adopting the use of block chain and artificial intelligence to curb fraud within the sector. Key to note, most companies are also setting up their own assessment centres across the country so as to better determine the actual compensation,

- Increased loss ratios: Core insurance business performance has been dwindling, mainly attributable to the high loss ratios, which have deteriorated further, following the increase in claims outpacing increase in premiums. In H1’2022, general insurance claims increased by 14.5% to Kshs 37.1 bn from Kshs 32.4 bn in H1’2021. On the other hand, premiums for general insurance business grew by a slower 8.2% to Kshs 92.4 bn in H1’2022, from Kshs 85.4 bn in H1’2021. As a result, loss ratio for general insurers increased by 1.3% points to 68.1% in H1’2022, from 66.8% in H1’2021. Motor classes of insurance business incurred claims contributed 48.3% of total claims incurred compared to their business contribution of 28.1% of the total premium under general insurance business. However, the loss ratios under the long term business eased, to 64.2% from 72.2% in H1’2021, attributable to the 17.8% increase in premiums to Kshs 64.3 bn from Kshs 54.6 bn in H1’2021 that outpaced the 4.7% growth in net claims and policyholder’s benefits to Kshs 41.3 bn from Kshs 39.4 bn in H1’2021,

- Dwindling trust from insurance consumers: During H1’2022, IRA received 933 complaints, lodged against insurers by policyholders and beneficiaries, with general insurance accounting for a lion’s share of the complaints at 82.3%, while long term insurers recorded 17.7% complaints against them. The complaints range from insurance companies failing to settle claims and constant haggling over terms of insurance contracts, fueling the public mistrust against insurers and increasing insurance apathy in the country, and,

- Compliance with regulations: Regulation on capital requirements has made it difficult for smaller insurance companies to continue operating without increasing their capital or merging in order to raise their capital base. Additionally, some of global regulatory requirements such as implementation of IFRS 17 are costly due to the need to revamping and realigning accounting and actuarial systems.

Section IV: Performance of the Listed Insurance Sector in H1’2022

The table below highlights the performance of the listed insurance sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Cytonn Report: Listed Insurance Companies H1’2022 Earnings and Growth Metrics |

||||||||

|

Insurance |

Core EPS Growth |

Net Premium growth |

Claims growth |

Loss Ratio |

Expense Ratio |

Combined Ratio |

ROaE |

ROaA |

|

Britam |

77.4% |

5.1% |

(1.5%) |

73.5% |

48.6% |

122.1% |

2.0% |

0.3% |

|

CIC |

45.0% |

20.5% |

2.0% |

68.8% |

49.6% |

118.4% |

4.7% |

0.8% |

|

Sanlam |

(1.4%) |

5.5% |

(9.1%) |

91.4% |

36.7% |

128.2% |

(34.4%) |

(0.8%) |

|

Jubilee Insurance |

(25.3%) |

(7.6%) |

(16.2%) |

99.4% |

33.7% |

133.0% |

8.0% |

2.2% |

|

Liberty |

(99.4%) |

6.1% |

(20.0%) |

60.6% |

66.9% |

127.5% |

0.02% |

0.004% |

|

*H1'2022 Weighted Average |

16.0% |

1.7% |

(8.7%) |

83.4% |

43.4% |

126.8% |

3.4% |

1.1% |

|

H1'2021 Weighted Average |

127.6% |

6.3% |

29.1% |

92.8% |

53.8% |

146.6% |

6.2% |

1.6% |

|

*Market cap weighted as at 14/10/2022 **Market cap weighted as at 30/09/2021 |

|

|||||||

The key take-outs from the above table include;

- Core EPS growth recorded a weighted growth of 16.0%, compared to a weighted growth of 127.6% in H1’2021. The decline in earnings was attributable to a slower premium growth during the period following a slower economic growth and deteriorated business environment, coupled with declines recorded in investment income,

- The premiums grew at a slower pace of 1.7% in H1’2022, compared to growth of 6.3% in H1’2021, while claims declined significantly at a rate of 8.7% in H1’2022, from the 29.1% growth recorded in H1’2021 on a weighted average basis,

- The loss ratio across the sector eased to 83.4% in H1’2022, from 92.8% in H1’2021,

- The expense ratio eased to 43.4% in H1’2022, from 53.8% in H1’2021, owing to a decline in operating expenses, a sign of increased efficiency,

- The insurance core business still remains unprofitable, despite the combined ratio improving to 126.8% in H1’2022, compared to 146.6% in H1’2021, and,

- On average, the insurance sector delivered a Return on Average Equity (ROaE) of 3.4%, a decline from a weighted Return on Average Equity of 6.2% in H1’2021.

Based on the Cytonn H1’2022 Insurance Report, we ranked insurance firms from a franchise value and from a future growth opportunity perspective with the former getting a weight of 40.0% and the latter a weight of 60.0%.

For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics shown in the table below in order to carry out a comprehensive review:

|

Cytonn Report: Listed Insurance Companies H1’2022 Franchise Value Score |

|||||||

|

Insurance Company |

Loss Ratio |

Expense Ratio |

Combined Ratio |

Return on Average Capital Employed |

Tangible Common Ratio |

Franchise Value Score |

Ranking |

|

CIC Group |

68.8% |

49.6% |

118.4% |

5.9% |

17.1% |

16 |

1 |

|

Liberty Holdings |

60.6% |

66.9% |

127.5% |

1.2% |

18.0% |

20 |

2 |

|

Jubilee Holdings |

99.4% |

33.7% |

133.0% |

9.7% |

26.1% |

21 |

3 |

|

Britam Holdings |

73.5% |

48.6% |

122.1% |

5.2% |

11.6% |

23 |

4 |

|

Sanlam Kenya |

91.4% |

36.7% |

128.2% |

(81.7%) |

1.0% |

25 |

5 |

|

Weighted Average H1'2022 |

83.4% |

43.4% |

126.8% |

3.9% |

18.3% |

|

|

The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation. The overall FY’2020 ranking is as shown in the table below:

|

Cytonn Report: Listed Insurance Companies H1’2022 Comprehensive Ranking |

|||||

|

Insurance |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

H1’2022 Ranking |

FY'2021 Ranking |

|

Jubilee Holdings |

3 |

1 |

1.8 |

1 |

1 |

|

Liberty Holdings |

2 |

2 |

2.0 |

2 |

2 |

|

CIC Group |

1 |

4 |

2.8 |

3 |

5 |

|

Britam |

4 |

3 |

3.4 |

4 |

3 |

|

Sanlam Kenya |

5 |

5 |

5.0 |

5 |

4 |

Major Changes from the FY’2021 Ranking are;

- Jubilee Holdings maintained position 1 in H1’2022 as was in FY’2021 mainly due to the strong the franchise and intrinsic scores in H1’2022, driven by reduction in expense ratio to 33.7% in H1’2022, from 41.3% in FY’2021. As a result, the combined ratio also improved to 133.0% in H1’2022, from 149.7% in FY’2021,

- Liberty also maintained position 2 in H1’2022 as was in FY’2021 mainly due to improvement in the franchise score in H1’2022, driven by the improvement in the loss ratio to 60.6%, from 78.3% in FY’2021. The expense ratio also improved to 66.9%, from 79.3% in FY’2021,

- CIC Group improved to position 3 in H1’2022, from position 5 in FY’2021, on the back of improved franchise and intrinsic scores driven by improvement of its loss ratio to 68.8% in H1’2022, from 71.6% in FY’2021, and combined ratio to 118.4% in H1’2022, from 123.8% in FY’2021,

- Britam Holdings declined to position 4 in H1’2022 from position 3 in FY’2021 driven by a weak franchise score attributable to the deterioration in the loss ratio to 73.5%, from 66.9%. However, the combined ratio improved to 151.5% from the 164.2% in FY’2021, and,

- Sanlam declined to position 5 in H1’2022 from position 4 in FY’2021 mainly due to deterioration in both the franchise score and intrinsic value score.

Section V: Conclusion & Outlook of the Insurance Sector

In H1’2022, the insurance sector continued to suffer from low penetration rates which has been worsened by deteriorated business environment emanating from rising interest rates, increased inflationary pressures arising from geopolitical instability caused by Russian-Ukrainian conflict. As such, the level of disposable income has reduced amongst the citizens. However, the sector continues to undergo transition where traditional models have been disrupted, mainly on the digital transformation, innovation and regulation front, which have positively impacted the outlook. Going forward, we expect a steady growth in premiums as underwriters come up with products suited to the planning for unforeseen events like COVID-19 and global conflicts interfering with business operations. Key to note, the insurance sector should maintain the culture of innovation achieved during the pandemic period while maintaining the customer centricity as the main focus of the sector’s operating model. Insurance companies should also widen their historical focus from risk and cost minimization to venture into high levels of risk taking and experimentation which will consequently optimize the ongoing innovation, lead to differentiation among competitors and improve profit. As such, we are of the opinion that the insurance sector will have to perform delicate balancing acts to ensure that they remain profitable. The industry has a lot it can do in order to register considerable growth and improve the level of penetration in the country to the 2021 world average of 7.2%, some of this include:

- Improve efficiency – The underwriters should develop strategies to further lower the high expense ratios which are deteriorating the growth of premiums. In H1’2022, the weighted average expense ratio remained elevated despite easing to 43.4%, from 53.8% in H1’2021, owing to a decline in operating expenses, a sign of increased efficiency. This can be achieved through the optimization of operating models and leverage on digitalization to fast-track operations and minimize costs,

- Portfolio optimization – It is prudent for insurance firms to optimize their portfolio by re-evaluating their products and services to sustain the sector’s recovery and realize profitability. Insurers should focus on their core and profitable offerings and dispose non-core offerings, this is achievable through sale of business units considered unprofitable. An example of such is Jubilee which recently received Kshs 270.0 mn from the sale of a 52.4% stake in its Mauritian subsidiary to insurance firm Allianz SE. Going forward, the portfolio optimization will extend to lowering stake in non-profitable subsidiaries and associates and affect underwriters’ products as insurers extend concentration to profitable products,

- Investment diversification – The underwriters should focus more on investment diversification through avenues such as pension schemes, unit trusts, fund management and investment advisories to improve profits and minimize losses. This shift is necessary as evidenced by the increasing combined ratios that have seen insurers suffer losses in their core business, with increase in underwriting expenses and claims outpacing the increase in premiums. Additionally, we expect insurers to continue to look into non-traditional asset classes such as infrastructure. An example is Jubilee Holdings investment in associates such as Bujagali hydropower plant in Uganda, PDM Holdings Ltd and IPS Cable Systems Ltd whose share of profits has been boosting its bottom-line,

- Insurance awareness campaigns – Knowledge deficit on insurance products and its importance continues to persist, massively contributing to the low insurance penetration. Insurance is still largely assumed as regulatory compliance, rather than a necessity. The regulators, insurers and other stakeholders should enhance insurance awareness campaigns to increase understanding of insurance products. According to a survey commissioned by the Association of Kenya insurers (AKI), the 2nd largest contributor to low insurance uptake at 27.0%, is lack of knowledge of the various insurance products and their benefits. As such, there is a lot of headroom for insurers, to educate, repackage, and tailor their products to different potential clients,

- Partnerships and alternative distribution channels – Going forward, we expect underwriters to continue with partnerships and offering alternative distribution channels. This can be realized by linking with other financial services players including Fund managers who have ventured into offering insurance linked products as well as the current bancassurance relationship with Banks. Insurance industry can also take advantage of the penetration of bank products to also push their products. Integration of mobile money payments to allow for policy payments is also expected to continue because of convenience which it provides and also mobile phone penetration in the country is high therefore insurance companies will want to leverage this to improve penetration,

- Technology and innovation – The sector will continue experiencing enhanced technological tools and innovations such as Artificial Intelligence and real time data in hyper personalization of insurance marketing so as to use customer information to tailor content, products and services in line with customer preferences. With such tools, insurers will effectively respond to changes in buying behaviours and tailoring products and services to the needs of the customers to ensure their loyalty hence high retention. Firms will also adopt increased inclusion of advancements like smart contracts through block chain that would help eliminate processing costs, reduce insurance fraud and fictitious claims and improve customer satisfaction through efficient claims processing, and,

- Regulations - We also anticipate increased regulation in the sector from the regulatory body and other international players to ensure its solvency and sustainability. Insurers have to adjust their insurance contract recognition methods in preparation to the coming into effect of IFRS 9 and IFRS 17 in January of 2023 or earlier. The push by the regulator to have the desired capital adequacy levels will likely see more consolidations as insurers try to meet the capital requirements, especially for the small firms. Additionally, there are increased efforts by regulators, governments and policymakers to ensure that Environmental, Social and Governance (ESG) regulations become a necessity in the insurance sector. As such, insurers will have no option but to incorporate ESG and as such, services and products offered by insurers should ensure environmental sustainability, ethics and regulatory compliance and data privacy, and ensuring social responsibility.

To read the H1’2022 Insurance Report, please download it here

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.