The Kenya Mortgage Refinance Company (KMRC) is a treasury backed financial institution in Kenya that specializes in lending to Primary Mortgage Lenders (PMLs) such as banks, microfinance institutions and Savings and Credit Cooperatives (SACCOs) for onward lending to potential home owners. It was established in August 2018 and began its operations in September 2020 after licensing by the Central Bank of Kenya (CBK), in an aim to increase home ownership through issuance of affordable mortgages. This week, we seek to do a follow up of the company and provide an update a year since operationalization, as well as benchmark with a more established refinance company;

We have in the past written three topical on KMRC namely;

- Kenya Mortgage Refinance Company in April 2018,

- Kenya Mortgage Refinance Company Update in April 2019, and,

- The latest being the Kenya Mortgage Refinance Recap in November2020.

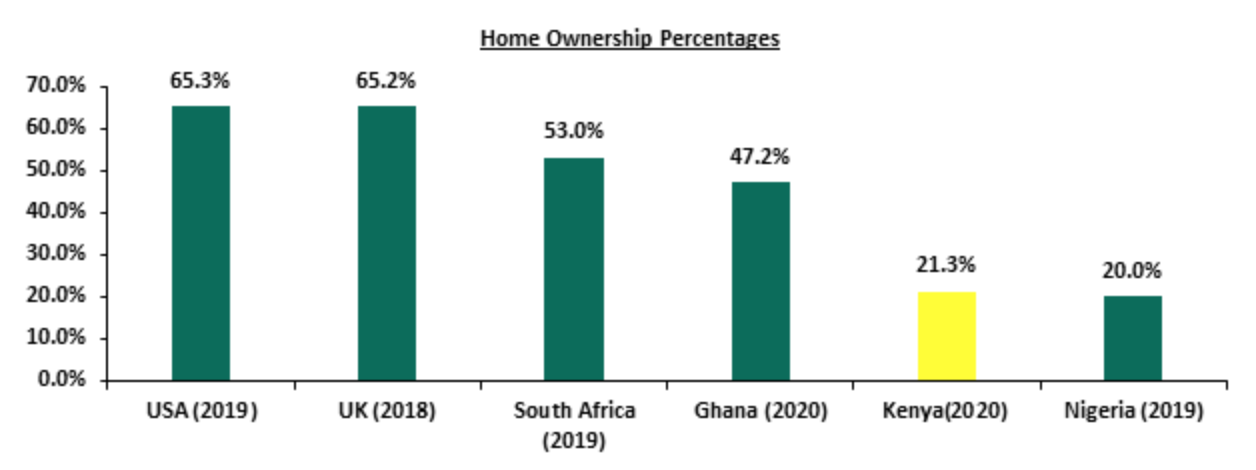

Homeownership is an important aspiration, hence affordable mortgages are essential to increasing homeownership, currently at 21.3% compared to Ghana at 47.2% and South Africa at 53.0%, hence the need for acceleration. Consequently, we again seek to offer more insights into the progress, with an aim of offering solutions to challenges faced so far and giving recommendations to those challenges by benchmarking with a well-established refinance company, and observing existing gaps in the Kenyan set up. We shall therefore cover the following topics;

- Overview of the Housing Sector in Kenya,

- Home Financing in Kenya,

- Overview of Kenya Mortgage Refinance Company (KMRC),

- KMRC Objectives, Achievements and Challenges,

- Case Study and Lessons Learnt, and,

- Conclusion

- Overview of the Housing Sector in Kenya

The housing sector in Kenya remains constrained by high demand and low supply. According to the Centre for Affordable Housing, the yearly new supply of housing units in Kenya stands at approximately 50,000, with only 2.0% percent of this incoming supply targeted for the low income earners. Considering the housing deficit of 2.0 mn units which continues to grow annually by 200,000 units, and the low annual supply rate, it might not be easy to meet the targeted to 500,000 affordable housing units by 2022 under the Affordable Housing Initiative, since we are yet to see a significant part of that delivered. Current hurdles constraining supply of affordable houses in the country include; i) high construction costs, ii) the pending operationalization of the Integrated Project Delivery Unit under the Ministry of Housing as a single point of regulatory approval for developments, infrastructure provision and developer incentive, iii) lack of development finance as investors hold back monies during the tough economic times and a non-supportive capital markets regulatory framework, and, iv) reduced revenue inflows and disruption of supply chains due to the pandemic.

Home ownership in Kenya has remained low at 21.3% in urban areas as at 2020, implying that 78.7% of the urban population are renters, which is low compared to other African countries such as Ghana with a 47.2% urban home ownership rate. The low home ownership rate is attributed to; i) the increasing number of Non-Performing Loans (NPLS) in the real estate sector, which increased by 14.8 % to Kshs 70.5 bn in Q1’2021 from Kshs 61.4 bn recorded in Q4’2020 leading to tighter underwriting standards, ii) exclusion of self-employed citizens due to lack of the credit information on criteria threshold for mortgage products, iii) the tough economic times reducing savings and disposable income, iv) high property costs, and, v) the high initial deposits required to access mortgages.

The graph below shows the home ownership percentages of different countries compared to Kenya;

Source: Center for Affordable Housing Africa, Federal Reserve Bank

To address the low home ownership rate, the government established the Affordable Housing Initiative under Big 4 Agenda aimed at providing affordable housing for the low and middle income earners ranging from government and institutional housing, slum upgrading and private affordable homes. This led to the establishment of the Boma Yangu online platform, which facilitates the registration for housing allocations and has so far attracted at least 321,284 applications. The government, however, has only been able to hand over 716 units under the Pangani and Ngara Park Road Affordable Housing Projects. Other projects in the pipeline in the Nairobi Metropolitan Area (NMA) are Shauri Moyo, Starehe and River Estate.

- Housing Finance in Kenya

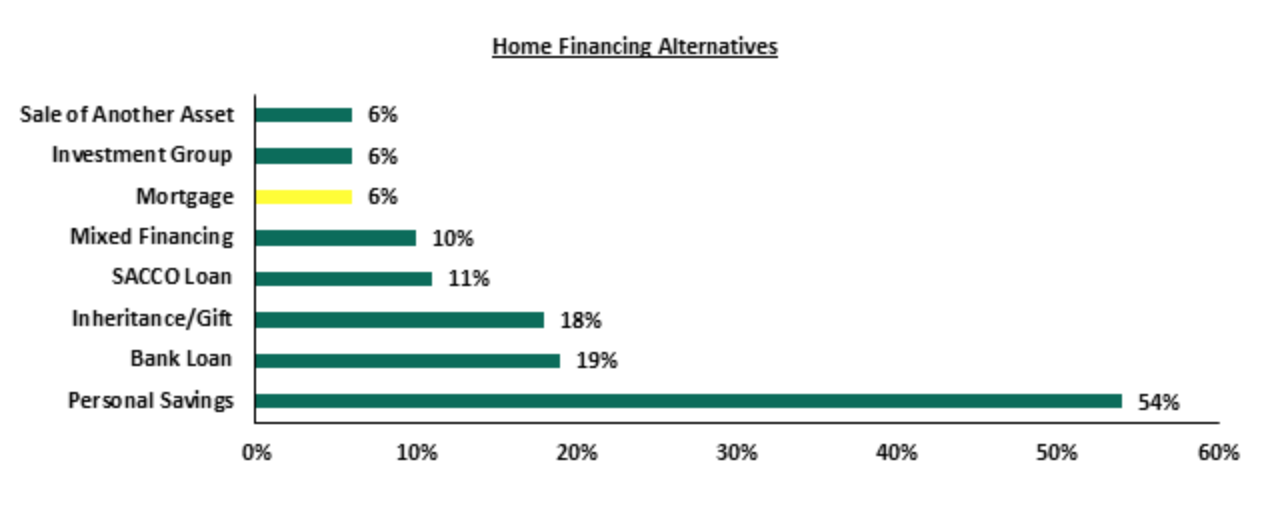

The main form of housing finance in the country is personal savings accounting for 54.0% of all housing financing alternatives while bank loans come in second at 19.0% according to the Kenya Bankers Association-Home Ownership Survey. The survey also shows that mortgages have continued to lag behind as a home financing alternative, accounting for only 6.0% and being the least sort option of the home financing.

The graph below shows home financing alternatives in Kenya;

Source: Kenya Bankers Association (KBA)

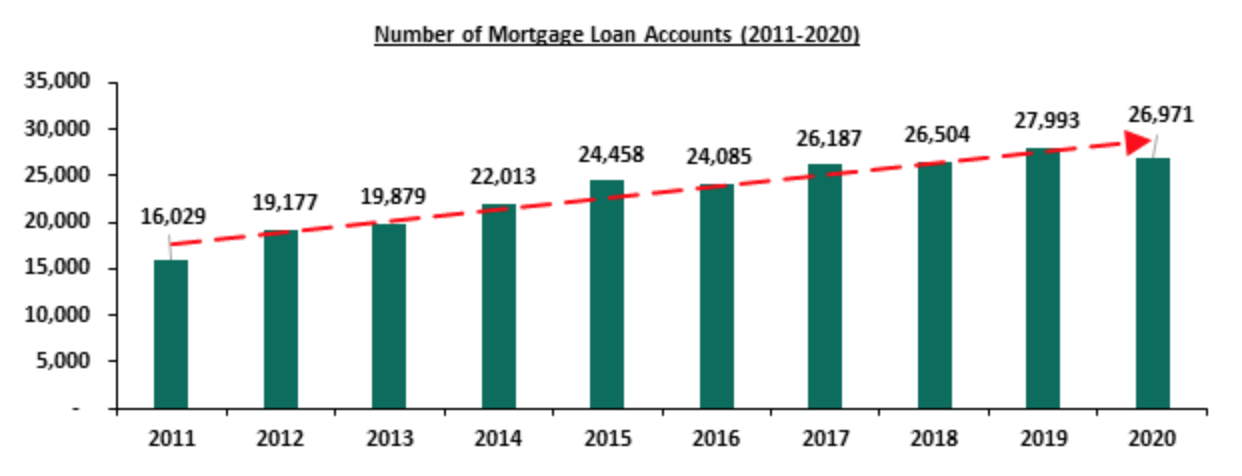

According to the Central Bank of Kenya- Bank Supervision Annual Report 2020, the residential mortgage market recorded a 3.7% decline in the number of mortgage loans accounts, to 26,971 in December 2020 from 27,993 in December 2019. The overall value of mortgage loans outstanding therefore registered a 2.1% decline from Kshs 237.7 bn in December 2019 to Kshs 232.7 bn in December 2020. The performance decline of the mortgage market was mainly attributed to fewer mortgage loans advanced by banks, due to the effect of the Covid-19, depressed economy that caused an increase in mortgage defaults as well as a reduction in savings and disposable income. According to the same report, about 74.5% of lending to the mortgage market was by 6 institutions that is, one medium sized bank at 11.2% and five banks from the large peer group at 63.3% in FY’2020, compared to 76.1% of lending by 6 institutions in FY’2019, that is one medium sized bank at 16.9% and five banks from the large peer group at 59.2%. The interest rate charged on mortgages on average was 10.9% in 2020, compared to an average of 11.3% in 2019 reflecting a 0.4% reduction in average rates. The average loan maturity was 11.0 years with minimum of 4 years in 2020, compared to average loan maturity of 11.2 years with a minimum of 5 years in 2019. These reductions in average interest rates and minimum loan maturity periods are expected to accommodate more mortgage clients.

The graph below shows the number of mortgage loan accounts in Kenya over the last 10 years;

Source: Central Bank of Kenya (CBK)

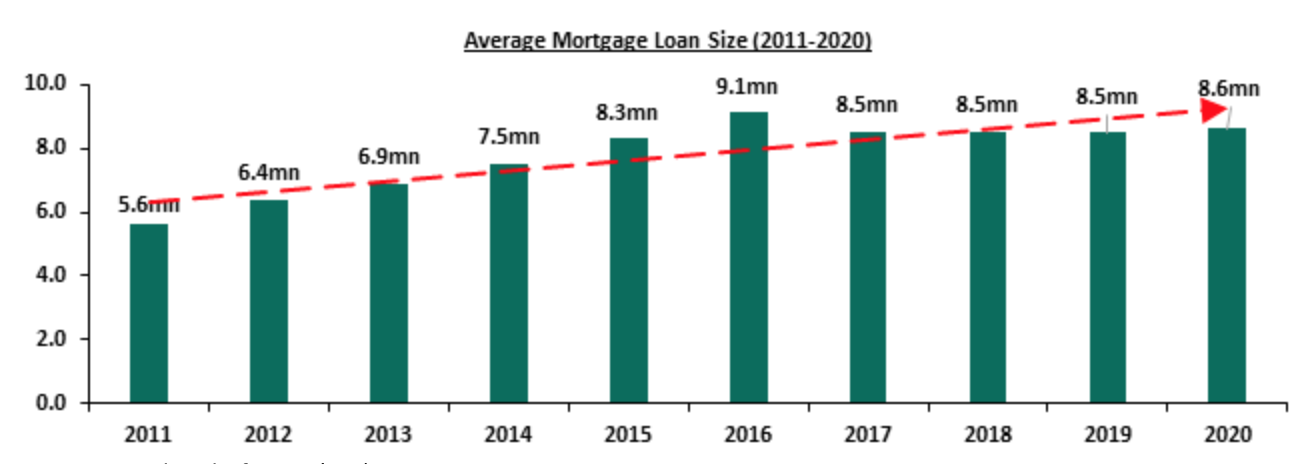

However, according to the CBK’s report, the average mortgage loan size increased from Kshs 8.5 mn in 2019 to Kshs 8.6 mn in 2020, with the government making efforts to avail relatively affordable mortgage facilities through the Kenya Mortgage and Refinance Company (KMRC) as banks tighten credit standards to the mortgage market in the midst of high loan default rates.

The graph below shows the average mortgage loan size from 2011 to 2020;

Source: Central Bank of Kenya (CBK)

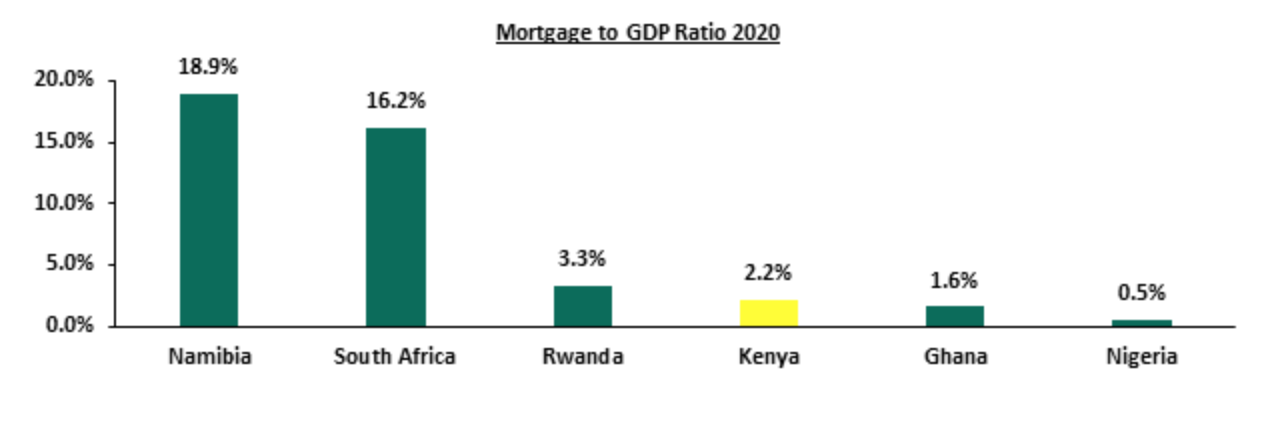

With an average mortgage size of Kshs 8.6 mn and interest rates at 10.9% and a maximum tenor of 20 years, one is required to make monthly repayments of approximately Kshs 88,000 per month, which is unaffordable assuming a gross salary of Kshs 50,000 per month and that is the median household income in Kenya for the employed population. Given the above, the Kenya mortgage to GDP ratio has continued to lag behind at 2.2% as of 2020, compared to countries such as Namibia and South Africa at 18.9% and 16.2%, respectively as shown in the graph below;

Source: Center for Affordable Housing Africa

The average mortgage loan size has increased by a 10-year CAGR of 4.4% while the average loan accounts have increased by a 10-year CAGR of 5.3% which is a positive trend. The increase in loan accounts over the ten years is attributable to the combined efforts by the government and the private sector players to avail affordable mortgages with flexible terms in order to accommodate more clients especially in the low and middle income bands thereby boosting home ownership rates.

- Overview of Kenya Mortgage Refinance Company

The Kenya Mortgage Refinance Company is a treasury backed lender, established in August 2018 and licensed for operations in September 2020, to provide long term funds to primary mortgage lenders such as banks, microfinance institutions and SACCOs in order to increase the availability and affordability of home loans to Kenyans. KMRC was established in a partnership between the Government of Kenya through the National Treasury, and World Bank with majority ownership by the private sector at 75.0% and the Government at 25.0%. Its current shareholders include;

|

KMRC Shareholders (As at 2020) |

|||

|

# |

Umbrella Body |

Individual Shareholders |

Estimated Stake (%) |

|

1 |

The Government of Kenya |

The Ministry of National Treasury and Planning |

25.0% |

|

2 |

Pan African Housing Developer |

Shelter Afrique |

8.4% |

|

3 |

World Bank |

International Finance Corporation (IFC) |

8.4% |

|

4 |

Commercial Banks |

Kenya Commercial Bank (KCB) Group, Cooperative Bank, Diamond Trust Bank (DTB), Housing Finance (HF) Group, NCBA, Absa Kenya, Stanbic and Credit Bank

|

43.3% |

|

5 |

Savings and Credit Co-operatives (SACCOs) |

Kenya Police, Mwalimu National, Safaricom, Ukulima, Bingwa, Imarisha, Unaitas, Imarika, Tower, Stima and Harambee SACCOs |

14.9% |

|

6 |

Microfinance Bank |

Kenya Women Microfinance Bank (KWFT).

|

|

Source: Online Research

KMRC provides concessional fixed rate long term loans to primary mortgage lenders so that they can transfer the benefits to individual borrowers, making home loans accessible and affordable to majority of Kenyans especially the low and middle income earners. In terms of products, KMRC offers two key loan products which include;

- Affordable housing loans: These are loans extended to Primary Mortgage Lenders (PMLs) to re-finance mortgage loans capped at Kshs 4.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) and Kshs 3.0 mn in other parts of the country to individual borrowers whose monthly household income is not more than Kshs 150,000. The loans are issued at a fixed rate of 5.0%, and,

- Marketing housing loans: These are loans extended to Primary Mortgage Lenders to re-finance mortgage loans above the Affordable Housing loans threshold of Kshs 4.0 mn, and income greater than 150,000.

KMRC refinances participating financial institutions (primary mortgage lenders) subject to refinancing eligibility criteria outlined below;

- Eligible property for refinancing must be a residential unit for owner occupation or occupation by immediate relatives of the owner,

- Eligible loans should be for purchase of a residential house for Kenyan citizens, salaried and self-employed, for a term up to 25 years,

- Interest rate is fixed at 5.0% and the currency must be in Kenyan Shillings with a mortgage loan limit of up to Kshs 4.0 mn for affordable housing loans within the Nairobi Metropolitan Area (NMA) and Kshs 3.0 mn elsewhere,

- Loan to Value Ratio (LVR) must be up to 90.0% of the value of the property implying a minimum deposit rate of 10.0% to be eligible for the loan,

- All loans submitted for refinance must be current and have no delinquencies, i.e. must not have history of default, and,

- The nominal value of pledged mortgage loans should exceed the aggregate outstanding balance of the loans to the financial institution by 120.0 % for example, for a mortgage loan Kshs 4.0 mn the value of the collateral should be at least Kshs 4.8 mn.

- KMRC Objectives, Achievements and Challenges

- Objectives of the Kenya Mortgage Refinance Company

Some of the key objectives of KMRC include;

- Provision of secure long-term funding at attractive rates to member institutions to enable them scale up their mortgage lending operations,

- Contributing to the growth of Kenyan capital markets through the issuance of KMRC bonds as a source of sustainable long-term fund,

- Standardization of mortgage practices in Kenya through enhancing capacity building to primary mortgage lenders,

- Facilitating the entry of new mortgage lenders in the market in order to broaden the scope of mortgage issuance and as a result increase competition among the primary lenders,

- Support lowering the cost of funds to primary mortgage lenders, which lead to a lowering of onward mortgage rates, thereby improving affordability and extending the range of potential borrowers, and,

- Facilitating member institutions to extend the mortgage maturity in line with the objective of long-term finance.

- KMRC Achievements

- Boosted Liquidity to Primary Mortgage Lenders: In December 2020, KMRC made its debut lending of Kshs 2.8 bn to primary mortgage lenders out of the total Kshs 4.5 bn that was available for refinancing. KCB Bank was the largest beneficiary of the KMRC funding at Kshs 2.1 bn, while Housing Finance (HF), Stima Sacco and Tower Sacco received an allocation of Kshs 515.0 mn, 69.0 mn and 30.0 mn, respectively. This lending was provided at a fixed rate of 5.0% for onward lending at single digit rates. In the for FY’2021/22 that began in July 2021, KMRC has tripled the lending allocation to Kshs 7.0 bn representing a 153.5% increase,

- Increased Mortgage Uptake in the Country: The lending to primary mortgage lenders at December 2020 refinanced a portfolio of 1,427 mortgages, at single digit interest rates to make them affordable to more clients and increase mortgage uptake. The boost in mortgage accounts came at an ideal time when mortgage accounts had declined by 1,022 accounts to 26,971 in December 2020 from 27,993 in December 2019, thus reducing further hemorrhage in the sector which was negatively impacted by the effects of Covid-19 pandemic,

- Encouraged Mortgage Market Competition for the Benefit of Borrowers: KMRC lending at 5.0% to primary mortgage lenders for onward lending at single digit rates has spurred competition among lending institutions particularly those offering higher interest rates. This has prompted them to revise their terms in order to remain competitive, thereby benefitting mortgage loan borrowers,

- Increased Capital for Refinancing: KMRC has since been able to receive debt financing of Kshs 25.0 bn from the World Bank and Kshs 10.0 bn from the African Development Bank. Equity from shareholder members accounts for Kshs 2.2 bn of the total Kshs 40.0 bn under management by the firm as at June 2021. Moreover, in the FY’2021/22 budget, KMRC received a Kshs 3.5 bn allocation from the government to refinance affordable housing in the country. In the company’s Annual General Meeting (AGM) held in June 2020, KMRC voted for International Finance Corporation (IFC), World Banks Private Investment arm, and Shelter Afrique, a Pan-African housing developer and financier, as the part of the Company’s shareholders with more equity injections expected in the company in the near future, and,

- Solving the Balance Sheet Mismatch PMLs to Encourage Long Tenor Mortgages: Due to the short term nature of deposits for many financial institutions, and the long term nature of mortgage loans at an average of 11 years and a maximum of 20 years in 2020, most of these financial institutions would shy away from mortgage lending to avoid future liquidity challenges and the uncertainty of variable interest rates to their cash flows. However, KMRC is now offering the institutions long term financing at a fixed rate of 5.0% which will enable them offer long tenor mortgages with minimal liquidity or interest rate risk concerns to reduce over dependence on deposits while offering loans.

- Challenges facing KMRC

- High Property Prices: Given the property price cap for affordable housing at the Nairobi Metropolitan Area, clients may run out of options for houses due to the high prices recorded in the area. During H1’2021, prices for detached units averaged at Kshs 12.3 mn while that of apartments averaged at Kshs 8.9 mn which are both higher than the affordable housing limits of Kshs 4.0 mn in the NMA region and Kshs 3.0 mn elsewhere.

The table below shows the performance of both apartments and detached units in the Nairobi Metropolitan Area (NMA) in H1’2021;

(All Values in Kshs unless stated otherwise)

|

Detached Units Performance H1’2021 |

|||||

|

Area |

Average Unit Size (SQM) |

Average of Price per SQM H1'2021 |

Price |

Average of Price Appreciation |

Average Total Returns H1'2021 |

|

High-End |

90 |

193,010 |

17.4 mn |

1.1% |

4.8% |

|

Upper Mid-End |

90 |

142,934 |

12.9 mn |

1.2% |

5.8% |

|

Lower Mid-End |

90 |

73,803 |

6.6 mn |

1.1% |

5.5% |

|

Average |

90 |

136,582 |

12.3 mn |

1.1% |

5.4% |

|

Apartments Performance H1’2021 |

|||||

|

Area |

Average Unit Size (SQM) |

Average of Price Per SQM H1'2021 |

Price |

Average of Price Appreciation |

Average Total Returns H1'2021 |

|

Upper Mid-End |

90 |

124,559 |

11.2 mn |

0.3% |

5.7% |

|

Suburbs |

90 |

95,611 |

8.6 mn |

0.9% |

6.2% |

|

Satellite Towns |

90 |

77,272 |

7.0 mn |

(0.9%) |

4.7% |

|

Average |

90 |

99,147 |

8.9 mn |

0.1% |

5.6% |

Source: Cytonn Research 2021

- High Default Rates Leading to a High Number of Non-Performing Loans (NPLs): According to Central Bank of Kenya-Quarterly Economic Review the residential gross NPLs in the real estate sector increased by 14.8 % to Kshs 70.5 bn in Q1’2021 from Kshs 61.4 bn recorded in Q4’2020, accounting for 15.9% of the total real estate loan book. The increase was attributed economic disruptions by the Covid-19 pandemic reducing cash flows and the ability to service debt. The high number of non-performing loans is expected to reduce loan advances as lenders will cushion themselves from credit risk that would expose them to possible collapse,

- Constrained and Unsustainable Funding Model: In an aim to consolidate more funds for onward lending, KMRC is likely to attract fewer investors as it seeks to both borrow and maintain lending at low rates, and as result face competition from government instruments which are offering higher rates. Some of the government bonds such as the 20-year bond are attracting a return of 13.2% and would seem more attractive to investors. It is therefore not clear how the firm will borrow and maintain lending at a 5.0% rate with the latest postponement of the green bond issue attributed to challenges surrounding rates, quantum and bond guarantee negotiations, and,

- Inability to Meet Criteria Threshold for Mortgage Products: The primary lending institutions have a set of eligibility criteria to meet before they can receive funding from KMRC mostly set under the World Bank and African Development Bank (AfDB) standards as discussed. Most of these requirements have not been met thus limiting the number of primary mortgage lenders for the loans.

- Case Study: Jordan Mortgage Refinance Company (JMRC)

- Introduction

Jordan Mortgage Refinance Company (JMRC) is a public shareholding company established in 1996 and headquartered in Amman Jordan, whose main purpose is providing medium and long-term financing for the Jordanian housing sector by extending loans to banks and financial institutions in the country. JMRC gets the necessary funding for its operations through member equity and issuing bonds in the local capital market through private or public subscription in accordance with the Jordan Securities Commission regulations.

- Ownership

The Central Bank of Jordan (CBJ) is the major shareholder of JMRC with an 18.0% shareholding while the private sector owns 82.0% as indicated in the table below;

|

JMRC Shareholding |

|||

|

# |

The Investors |

Value/No of shares |

Percentage |

|

1. |

The Central Bank of Jordan (CBJ) |

900 |

18.0% |

|

2. |

Social Security Corporation |

500 |

10.0% |

|

3. |

Housing & Urban Development Corporation |

500 |

10.0% |

|

4. |

Housing Bank for Trade and Finance |

500 |

10.0% |

|

5. |

Arab Bank |

500 |

10.0% |

|

6. |

Jordan Loan Guarantee Company |

300 |

6.0% |

|

9. |

Jordan Commercial Bank |

250 |

5.0% |

|

7. |

Jordan Ahli Bank |

245 |

4.9% |

|

8 |

Cairo Amman Bank |

245 |

4.9% |

|

10 |

Others |

1,045 |

21.2% |

|

Total |

100.0% |

||

Source: JMRC

- Eligibility Criteria

JMRC provides medium and long-term finance for banks and financial institutions. A refinance loan is granted to a financial institution that;

- Is privately owned, duly established and operating under the laws of the Hashemite Kingdom of Jordan provided that the JMRC shall have determined that such financial institution,

- Is in compliance with the legal and regulatory requirements applicable to its operations, including all applicable banking or financial or company laws, capital adequacy requirements, and monetary regulations,

- Has had its audited financial statements by independent auditors for its fiscal year, preceding the year within which its respective refinance loan agreement is to been entered into,

- Has a sound financial structure and satisfactory financial performance, in addition to having the management, staff, and other required resources for carrying out its operation efficiently, and,

- Has adequate technical and administrative capacity and satisfactory operating policies and procedures for appraisal and monitoring of a mortgage loan portfolio, and for carrying out its activities under the Housing finance and Urban Reform Project Agreement signed between the International Bank for Reconstruction and Development (IBRD) and JMRC.

- Achievements

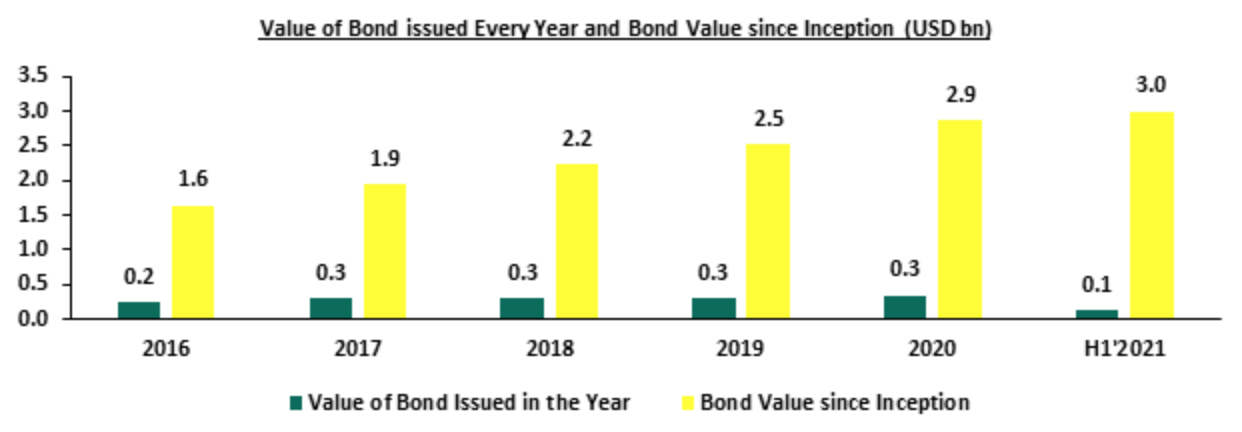

- Successful Bond Issuance for Mortgage Funding: During H1’2021 JMRC issued 12 bonds with a nominal value of USD 0.125 bn (Kshs 13.7bn). The total amount of corporate bonds issued by JMRC since inception in 1996 is USD 3.0 bn (Kshs 325.8 bn). JMRC has issued its corporate bonds through private subscription and are collateralized by the company’s assets. The interest rate on latest JMRC 7-year bond issue in August 2021 at 4.4% reflects the low risk associated with the company, given that the government’s risk free rate for a 7-year bond is 4.1%. The funds raised through bond issue are incorporated in capital for refinancing to primary mortgage lenders.

The graph below show the value of bonds issued every year and since inception from 2016 to 2021;

Source: JMRC

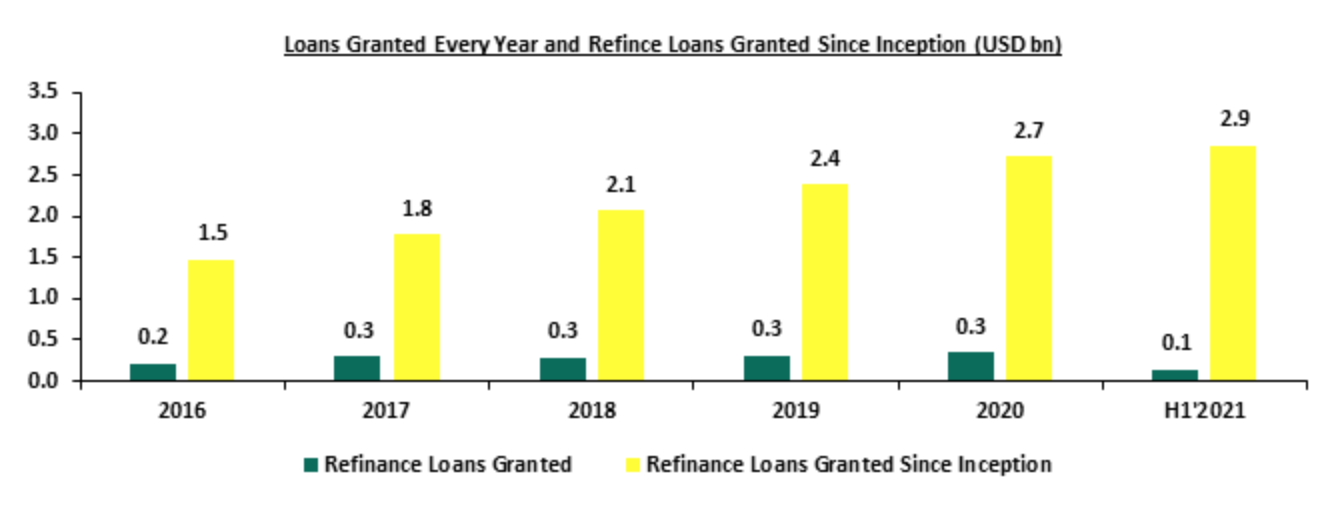

- Increased Capital to Primary Mortgage Lenders: In H1’2021, JMRC signed 12 refinance loan agreements with 8 financial institutions for an amount of USD 0.132 bn (Kshs 14.5 bn). The refinance loans agreements with primary lenders signed since JMRC’s inception are 338 with a total amount of USD 2.8 bn (Kshs 305.3 bn). This has continued to boost mortgage accounts by lenders and increasing the home ownership rates in the country.

The graph below shows the value of refinance loans granted every year and since inception from 2016 to H1’2021;

Source: JMRC

- Low Market Interest Rates to Mortgage Clients: In 2001, mortgage rates for major banks in Jordan ranged from 9.0%-11.0% but 20 years down the line, the rates have declined to between 5.6%-7.6% in the market and this can be partly attributable to the Kshs 305.3 bn in loans that KMRC has issued since inception. Primary mortgage lenders in Jordan are able to do onward lending at interest rates as low as 5.6% with a good example being the Bank of Jordan which offers up to 80.0% financing at such a low rate for tenures of up to 25 years. The Bank of Jordan is a shareholder of the JMRC with a 4.0% shareholding and thus is able to maintain capital liquidity from borrowing from the JMRC and lending at low rates, and,

- Low Risk Weighted Capital for Housing Loans: In Jordan the required risk weighted capital for housing loans is at 20.0% compared to Kenya’s recently lowered to 35.0% effective 1st July 2021, from the initial 50.0%. This has boosted liquidity and freed more funds available for refinancing and Jordan has therefore been able to reach to a larger number of primary mortgage lenders with 12 refinance agreements in H1’2021 and 338 since inception.

- Challenges facing JMRC

- Biased Mindset of the Banking Sector: The banking sector is reluctant to extend long term loans and consider JMRC as a competitor than a partner. They are contented with the short term variable rate lending they operate in and fear that that JMRC will aid other primary lenders into bringing stiff competition through reduced rates thus bringing down interest rates paid by their clients,

- Narrow Primary Mortgage Market: In Jordan, three Banks handle over 50.0% of the mortgage loan business which are often inclined to selling certificates of deposit as opposed to obtaining funds from JMRC. Even with much liquidity, banks have limits on how much they can borrow from JMRC. This limits the number of mortgage clients that can be reached at any particular point by the JMRC funding, and,

- Lack of Action in Fostering Regulatory Reform to Attract the Private Sector: Low political will has slowed the implementation of key reforms to catalyze housing supply by the private sector related to i) land availability in terms of restrictions on plot size and density, ii) the slow procedures and high costs in construction permits, iii) territorial planning, and, iv) zoning constraints. Despite that most of the proposed reforms have included specific deadlines, oversight committees, work-plans there is no clear coordination mechanisms to work this out.

- Recommendations from The Case Study

- KMRC Should Look to Boost Funding through issuance of bonds: JMRC has managed to raise funds through issuing of bonds which has enabled the company maintain cash flows for lending. In H1’2021 JMRC issued 12 bonds with a nominal value of USD 0.125 bn (Kshs 14.5 bn) and the total amount of corporate bonds issued by JMRC since inception till H1’2021 are USD 3.0 bn (Kshs 305.3 bn). The Kenya Mortgage Refinance Company (KMRC) bond issue that was scheduled for September 2021 was postponed pending stakeholder consultations leading to delayed funding for potential refinancing. We recommend that KMRC pursue the credit guarantee agreement with African Development Bank as planned, and leverage on their high credit score at AAA with a prospect status to reduce risk exposure and increase in investor appetite,

- Increase Capital and Investor Confidence through Listing in the Stock Exchange: JMRC was listed in the Amman Stock Exchange in 2011. After the listing, the net revenue has increased at an 8-year CAGR of 16.2% from USD 13.3 mn (Kshs 1.5 bn) in 2012 to an estimated USD 44.4 mn (Kshs 4.9 bn) as at FY’2020. Listing not only helps improve capital by raising funds from the general public, it also helps build confidence from investors since financials are publicly available and listed companies are viewed to have stronger regulation and scrutiny. KMRC should in its long term plans look to list on the Nairobi Stock Exchange (NSE) in order to increase funding and grow investor confidence,

- In the Long Run and in Consultation with CBK, KMRC Should Look to Lower the Risk Weighted Capital Further to Improve Liquidity: Since one of the criteria for mortgage loan refinancing by KMRC is an over collateralization by 120.0% of the balance of the loan, KMRC in consultation with CBK should look to improve liquidity with the primary mortgage lenders even further, by reducing the risk weighted capital for individual housing loans to lower than the current 35.0%. This will free more funds for onward lending thereby boosting mortgage uptake in the country, and,

- Growing Public Awareness is Key: KMRC should look to grow its public awareness by innovating ways to market its affordable mortgage products and expound on the eligibility criteria for loans with primary mortgage lenders. JMRC has participated in conferences such as the Jordan Leasing Conference, awareness campaigns and fostered cooperation with Central Bank of Jordan (CBJ) and commercial banks, to bring together employees, borrowers and mortgage lenders. This has provided them with the relevant training through enrollment in structured courses with benchmarks in international markets. For Kenya, public awareness is timely given that formal housing finance through banks accounts for less than 10.0% of the total housing finance alternatives.

- Conclusion

In our view, KMRC has so far performed well, one year after operationalization in terms of improving liquidity with lending institutions and contributing towards the increase in mortgage uptake in the country, with the debut Kshs 2.8 bn loan issue so far servicing 1,427 mortgage loans. However, in order to achieve its 5-year objective of financing over 50,000 homes, KMRC needs to increase its fund base by fast tracking its green bond issue and fostering worldwide partnerships to not only learn, but also acquire more funding. To complement KMRCs efforts to achieve higher home ownership rates, the government needs to take a number of steps in supporting affordable housing including: i) encouraging the use of alternative building materials to lower construction costs, ii) reviewing the public private partnership framework to enhance effectiveness iii) fast-tracking incentives, and, iv) allocating more funds into the refinance company to boost liquidity and subsequent mortgage uptake.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor