Kenya’s Real Estate sector has been one of the fastest-growing sectors of the economy over the past years, growing at a compound annual growth rate of 6.4% in the past 6 years. With the onset of the COVID-19 pandemic, the sector realized a slowdown in activities with the most affected investment classes being the hospitality sector brought about by a decline in tourism arrivals and the commercial office sector, which saw people adopting the working-from-home initiative coupled with an oversupply of 6.7 mn SQFT as of 2021. As the real estate sector recovers from the pandemic effects, key challenges such as inadequate access to development financing still persist as most developers rely on bank loans as their main source of funding despite lower lending levels witnessed in Q4’2021. The gross loans advanced to the Real Estate sector decreased by 1.5% to Kshs 456.0 bn in FY’2021, from Kshs 463.0 bn in Q3’2021 according to the Quarterly Economic Review Report October-December 2021, by the Central Bank of Kenya. The over-reliance on traditional sources of financing real estate projects such as debt financing continues to be a challenge mainly due to difficulty in accessing credit loans, coupled with the burden of being in debt. To address the funding gap, Real Estate industry players have been focusing on exploring alternative ways of financing Real Estate Developments such as Real Estate Investment Trusts.

In light of this, the Capital Markets Authority (CMA) in 2013 put in place REITs regulations that developers can use to raise capital and paving the way for registration of the three active REITs in the market – ILAM Fahari REIT, Acorn D-REIT and Acorn I-REIT. In an aim to establish a clear understanding of REITS, we have previously done two topicals namely Real Estate Investment Trusts, REITs, as an Investment Alternative in 2019, and, Real Estate Investment Trusts in Kenya in 2021. However, activity by local REITs remains low given two recent foreign transactions- i) Grit Real Estate Income Group REIT acquired a 20.0% stake in Gateway Real Estate Africa Ltd (GREA) which invested Kshs 5.5bn to build a diplomatic housing estate Rosslyn, and, Ii) Grit Real Estate Income Group REIT invested Kshs 6.1 bn to acquire Orbits Products Africa, a warehousing complex in March 2022. We therefore look into the REIT market to understand why the development of REITs continues to be slow. This week, we update our topicals and provide an update on the performance of the established REITs by covering the following topics;

- Overview of REITs,

- Types of REITs,

- Benefits of investing in REITs,

- Challenges investors have encountered investing in REITs and suggested solutions,

- REITs performance in Kenya,

- Case Study of Singapore and lessons learnt, and,

- Conclusion.

- Overview of REITs

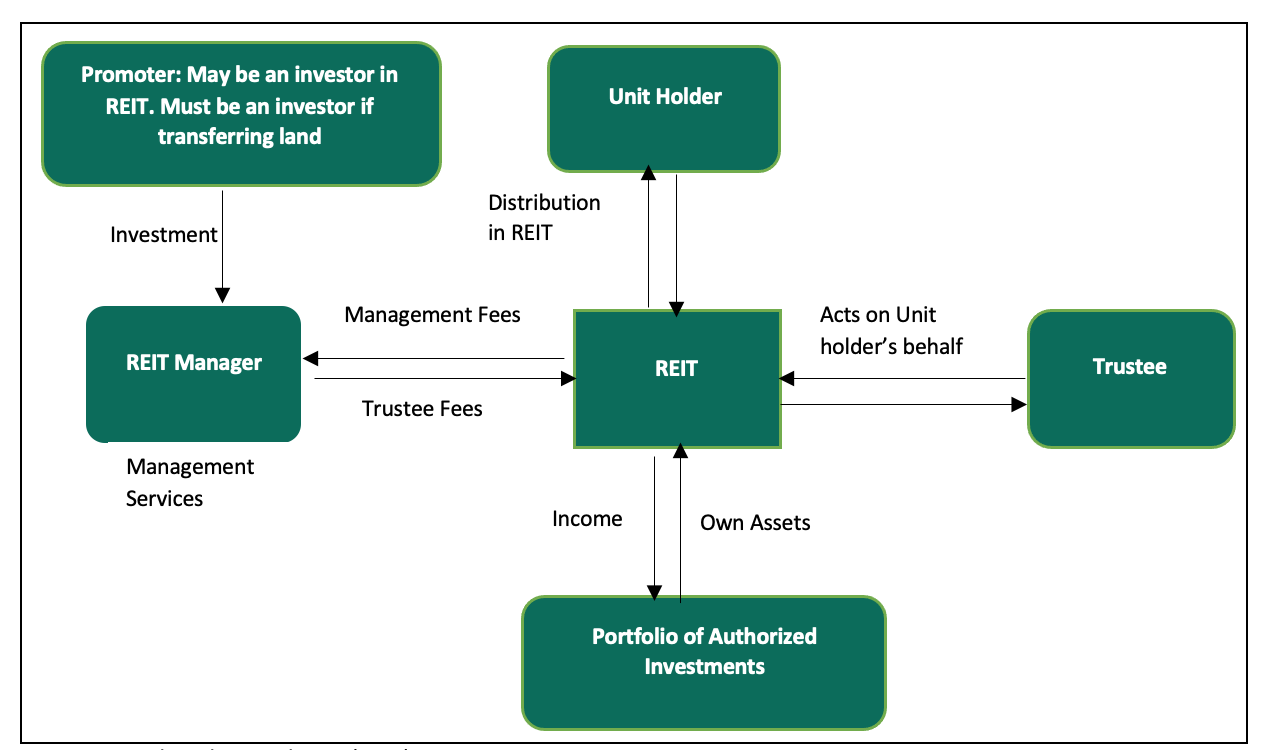

Real Estate Investment Trusts (REITS) are regulated collective investment vehicles which invest in Real Estate. REITs promoters source funds to build or acquire Real Estate assets, such as residential, commercial, retail, mixed-use developments among others which they sell or rent to generate income. The income generated is then distributed to the investors as returns. The Real Estate assets are held by a trustee on behalf of unit holders and professionally managed by a REIT manager. To help improve accountability and transparency within the REIT structure, there are four key parties who work together to ensure that the interests of REITS investors fully protected. These parties include:

- The Promoter: This is an individual or a company involved in setting up a Real Estate Investment Trust (REIT) scheme. The promoter is regarded as the initial issuer of REIT securities and is involved in making a submission to the regulatory authorities to seek for approval of a draft trust deed, draft prospectus or an offering memorandum. In the existing Acorn D-REIT, Acorn Investment Management is the promoter. For the attempted D-REITs, Fusion Investment Management Limited was the Promoter in Fusion D-REIT, and Cytonn Asset Managers Limited (CAML) was the Promoter in Cytonn D-REIT,

- The REIT Manager: This is a company that has been incorporated in Kenya and has been issued a license by the authority (CMA) to provide Real Estate management and fund management services for a REIT scheme on behalf of investors,

- The Trustee: This is a corporation or a company appointed under a trust deed and licensed by the regulatory authorities to hold the real estate assets on behalf of investors. The Trustee’s main role is to act on behalf of beneficiaries, usually the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed, and,

- Project/Property Manager: The role of the project manager is to oversee the planning and delivery of the construction projects under a REIT and ensuring that they bring value to the REIT’s investors. The property manager on the other hand plays the role of managing the completed real estate development that has been acquired by a REIT.

The figure below shows the relationships between the key parties in a typical REITs structure;

Source: Capital Markets Authority (CMA)

- Types of REITs

There are three main types of REITs which include

- Income Real Estate Investment Trusts (I-REITs): This is a Real Estate trust that primarily derives its revenues from rental properties. These properties may be in any Real Estate asset class such as the residential, hospitality, retail, student housing among others. The investors gain through rental income and capital appreciation form the investments undertaken,

- Development Real Estate Investment Trust (D-REITs): This is a type of Real Estate trust where resources are pooled together for purposes of developing of Real Estate projects. Once a development has been completed, a D-REIT may be converted to an I-REIT and here the investors may choose to either re-invest their funds to another development by the same REIT manager, sell, or, lease their shares, and,

- Islamic Real Estate Investment Trusts: This is a unique type of a Real Estate Investment Trust, which only undertakes Shari’ah compliant activities. A fund manager is required to do a compliance test before making an investment in this type of REIT to ensure it is Shari’ah compliant.

- Benefits of Investing in Real Estate Investment Trusts (REITs)

Some of the benefits of investing in Real Estate Investment Trusts include;

- Competitive Long-term returns: The performance of the REITs are derived from the Real Estate investments and we have seen that Real Estate has outperformed other asset classes, in the last 5-years, generating returns of over 25.0% p.a., compared to 5- year average returns of the 91-day T-bills at 7.3%, NASI at 6.4%, the 10 Year treasury bond at 12.4% and Bank deposits return at 7.0%,

- Diversification: REITs, fixed income securities, and equities have different investment characteristics creating diversification when combined within a single portfolio. Diversification helps to reduce the risks taken when the investments are spread across various asset classes, industries and geographies,

- Flexible Asset Class: REITs are regarded as a flexible payment option where investors are able to customize their REITs portfolio based on the fund characteristics, the various real estate sectors and geographic exposures,

- Liquidity: A physical property takes time and money (in terms of commissions, fees and taxes) to sell. A REIT, on the other hand, offers high liquidity since an investor can buy and sell units/shares in the REITs any time and especially if they are listed. The advantage of liquidity also extends to Real Estate developers as well since they may not need to completely sell their entire assets if they are seeking for some little liquidity,

- Stable and Consistent Income Stream: Investors especially those who take the I-REIT option have the advantage of getting rental income thus guaranteeing a stable and consistent income stream, I-REITs are required by the law to pay off at least 80.0% of their income to unit holders in the form of dividends,

- Taxation Benefits: REITs general have a number of tax benefits which include; i) REITs registered by the Commissioner of Income Tax are exempted from income tax except for the payment of withholding tax on interest income and dividends, ii) transfer of properties to a REIT also attracts a stamp duty exemption, as per Section 96A (1) (b) of the Stamp Duty Act, iii) REITs’ investee companies are exempted from income tax as stated in the Finance Bill 2019, section 20 of the Income Tax Act, and, withholding tax constitutes final tax on that income,

- Transparency: REITs provides operating transparency mainly because of how they are structured and operated. REITs, particularly, the listed ones are regulated by the securities markets regulators who adhere to high standards of corporate governance, financial reporting and information disclosure, and,

- Affordability: REITs offer the benefit of investing in large Real Estate developments at affordable prices particularly through the security exchange platform, as opposed to purchasing an entire unit or development, which may be expensive sometimes. For instance, instead of purchasing a Kshs 5.0 mn 1-bedroom house in order to enjoy the relatively high real estate returns, an investor may require only Kshs 975.0 to purchase 100 shares of the listed ILAM Fahari I-REIT and enjoy the same benefits as any real estate investor. The affordability opens up real estate investment and returns to retail investors.

- Challenges facing the adaptation of REITs in Kenya & Suggested Solutions

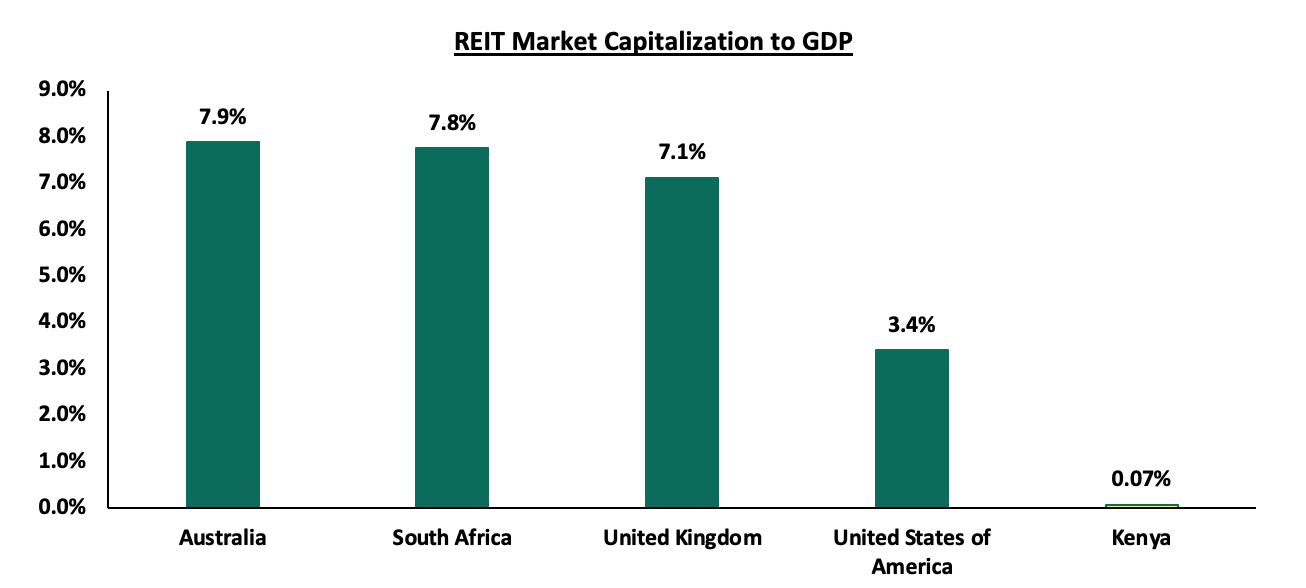

The REITS market in Kenya has continued to face numerous challenges evidenced by the low REIT market Cap to GDP at less than 0.1% compared to more developed countries such as South Africa and Australia at 7.8% and 7.9% respectively. The graph below shows the REIT market Capitalization to GDP for various countries.

Source: World Bank, online research

The dismal performance of the REIT market in Kenya is attributed to various factors which include;

- High Minimum Capital Requirements for a Trustee of Kshs 100.0 mn: This essentially limits the eligible trustees to only banks, efficiently eliminating corporate trustees and other fund managers. When compared to the minimums for a REIT Fund Manager and a pension scheme Corporate Trustee at Kshs 10.0 mn, the Kshs 100.0 mn for a REIT Trustee is 10x higher. This exacerbates the problem of overreliance on banks as only banking institutions qualify with such high minimum requirement. Case in point, Kenya currently has only three licensed REITs trustees who are all banks. The Solution is to drop the minimum capital requirement to match what is required of a fund manager, that is Kshs. 10.0 mn, allowing for inclusion of corporate and non-bank trustees,

- High Minimum Investment Amounts Set at Kshs 5.0 mn: Based on the current regulations, the minimum investment amounts for a D-REIT is 5.0 mn, which is 100x higher than the gross median income of Kshs 50,000 in Kenya. This discriminates against many investors who need the benefit of regulated structures to protect their investments, especially in alternative asset classes markets. The Solution is to bring down the minimum required investment amount for a REIT to Kshs 100,000, which is the amount required by regulations for a private offer,

- Lengthy Approval Process: The approval process can take time particularly to get the necessary documentations, and meet all the required regulatory requirements. This might discourage promoters from perusing their interests in focusing on REITs and look for other more efficient ways to raise capital. The Solution is to have a defined approval time within which an application must be processed and either approval or reasons for failure to approve clearly communicated to the applicant,

- Inherent conflicts of interests with Trustees: Due to the high minimum capital amounts, there are only 3 Trustees who are all banks. There have been instances where banks have asked for deposits in order to undertake the REIT Trustee work, this would be cured by enabling Corporate Trustees as is the case with Pensions.

- Inadequate Investor Knowledge: Despite the fact that REITs have been existence in the Kenyan market for the past 9 years, the popularity of the instrument has remained low mainly. The low popularity of the instrument is a major contributor to the low subscription rates and the consequent poor performance of the FAHARI I-REIT and the failed issuance of the Fusion D-REIT in 2016. The Solution is to have broader investor education on the benefits of REITs, through seminars, workshops or advertisements but this will only make sense after several REITS have come to market,

- Subdued Performance of the Real Estate Market: Despite the fact that the Real Estate sector has demonstrates pockets of recovery as per the Cytonn Q1’2022 Markets Review, oversupply in various sectors such as the Nairobi Metropolitan Area commercial office and the Kenyan retail sector of 1.7 mn SQFT and 6.7 mn SQFT continues to affect performance. This directly affects the occupancies and the rental returns. The solution is that REIT managers should focus on ensuring continued sector monitoring in order to ensure that they take advantage of the performing subsectors and nodes in order to boost returns to unit holders and help in the industry growth, and,

- Economic Uncertainty: There is much uncertainty surrounding not just the REIT market, but the overall economy due to COVID-19 which had a major impact on the real estate sector particularly on the commercial office and hospitality sector and the upcoming general elections since investors are anticipated to reduce their investments as they adopt a wait and see approach. The hospitality industry is yet to recover and this will have repercussions on the economic outlook of REITs.

- REITs performance in Kenya

In 2013, Kenya became the third African country to establish REITS as an investments vehicle after Ghana and Nigeria who launched their REIT frameworks in 1994 and 2007, respectively. The fourth African country to establish REITs was South Africa South in 2013, and after Kenya. In the Nairobi stock Exchange (NSE), there are currently three REITs namely the ILAM Fahari I-REIT which was listed and started trading in November 2015, and, the Acorn Student Accommodation I-REIT and D-REIT which were launched in February 2021. The two Acorn REITs are not listed but investors can trade their shares over the counter through the NSE Unquoted Securities Platform (USP). The total of only three REITs in Kenya is low compared to countries like South Africa which has 33 listed REITs despite REITs regulations becoming operation in 2013 and after Kenya. Below we look at the REITs industry’s performance in Kenya through different metrics – licensing, notable activities in the market, foreign REITS transactions, and, financial performance of the operational REITs:

- Licensing

In the nine years since REITs became operationalized in Kenya, the REITs market has remained underdeveloped and has been marked with some notable failures along the way in terms of licensing. The Fusion Capital D-REIT, which was launched in 2016, failed due to low subscription rates and the Cytonn D-REIT launched in 2019 failed due to conflicts of interest by the prospective bank Trustee who requested for significant deposits in order to accept the Trustee role and a slow approval process. Kenya currently has 10 licensed REITs managers with the latest one being Acorn Investment Management Limited which was licensed in late 2020. Other REIT managers in Kenya are; Cytonn Asset Managers Limited (CAML), Stanlib Kenya Limited Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited. However, Kenya has only three licensed REITs trustees, Kenya Commercial Bank (KCB), Housing Finance Bank (HF), and, Cooperative Bank of Kenya Limited (Coop Bank) mainly attributable to the high minimum capital requirement of Kshs 100.0 mn.

- Notable Market Activities

In August 2019, the Capital Markets Authority of Kenya approved the issuance of Acorn Holdings’ Medium-Term green bond worth Kshs 5.0 bn, the first green bond in Kenya. In the issuance a total of Kshs 4.3 bn was raised with the funds allocated to six Purpose Built Student Accommodation (PBSA) projects with a capacity of 4,503 beds. In July 2021, Acorn Green Bond programme was re-opened after, the company received approval from the Capital Markets Authority to raise the ceiling of its bond programme to Kshs 5.7 bn from the previous Kshs 5.0 bn. Its final tranche which closed on 16th July 2021, aiming to raise Kshs 1.4 bn recorded an oversubscription rate of 146.0%, through which Acorn Holdings managed to raise Kshs 2.1 bn. The firm managed to raise a total of Kshs 6.4 bn from the medium term green bond.

- Foreign REITs Transactions

There have been notable activities related to REIT transactions being done by foreign companies notably from GRIT Real Estate Income Group. These include:

- In January 2022, Grit Real Estate Income group REIT acquired a 20.0% stake in Gateway Real Estate Africa Ltd (GREA) which invested Kshs 5.5bn to build a diplomatic housing estate in Rosslyn which will be leased to the staff of the United States embassy in Nairobi for 8 years. Rosslyn is an attractive investment area that is likely to provide high returns to investors supported by: i) the categorization of the area as a Blue Diplomatic Zone, ii) close proximity to social amenities such as the Rosslyn Riviera Mall, Two Rivers Mall, and Village Market, and, iii) ease of accessibility as the area is served by the Limuru Road and Kiambu Road. It was also the best perforing node in the high end segment in Q1’2022 recording total returns of 6.2%, 0.5% points higher than the market average of 5.7% according to the Cytonn Q1’2022 Markets Review, and,

- Grit Real Estate Income group REIT also invested Kshs 6.1bn to acquire Orbits Products Africa, a warehousing complex in March 2022. This comes after the investment firm entered a Kshs 2.9 bn loan agreement with the International Finance Corporation (IFC) in July 2021, with an aim of acquiring and developing the warehousing and manufacturing facility. Grit’s decision to invest in Orbit factory signifies a rising demand for warehouse facilities in the country amidst the continuing expansion of the manufacturing guaranteeing returns. This was also driven by i) Strategic location with high concentration of industries, as the area is mainly deemed as an industrial area,, ii) adequate infrastructural network with the area being served by roads such as the ongoing Nairobi Expressway, and, iii) presence of a Standard Gauge Railway terminus that serves as an offloading point for Nairobi for goods coming from Mombasa.

GRIT Real Estate Income Group, which is a multi-listed income group has also invested into other properties in Kenya namely i) 50.0% stake in Naivasha Buffalo Mall, and, ii) a pharmaceutical warehouse along Mombasa Road that it leases out to South Africa’s Imperial Health Sciences Logistics. The Company has investments in retail, office, light industrial and corporate accommodation sectors. Mauritius continues to provide a favourable investment platform for firms both local and international and this allows for companies to make offshore investments in other countries. This is coupled with taxation benefits for both local and foreign firms coupled with clear operational guidelines as stipulated in the securities (Real Estate Investment Trusts) rules 2021.

The local REIT market activities have remained low due to the challenges surrounding the establishment of REITS in Kenya as mentioned above. Given the two recent successful REITS transactions in Kenya in the first quarter of the year, by GRIT Real Estate Income Group, we expect more foreign nationals to show their interest in Kenyan developments with the worst case scenario being dominating the REITS market in Kenya.

- Financial performance

In terms of financial performance, Acorn D-REIT recorded profits of Kshs 775.9 mn in FY’2021 while the I-REIT profits came in at Kshs 387.5 mn – both in their first year of operations. The D-REIT performance was mainly driven by a positive adjustment in the fair value of its investment Property to Kshs 1.1 bn from Kshs 339.0 mn in H1’2021. On the other hand, the listed Fahari I-REIT saw a 183.7% decline in its earnings per unit to Kshs (0.7) in FY’2021, from Kshs 0.8 in FY’2020 as it recorded a loss of Kshs 124.0 mn in FY’2021 compared to a profit of Kshs 148.0 mn in FY’2020. The performance was mainly attributable to revaluation losses recorded by the property portfolio in the context of the COVID-19 pandemic, whose impact continues to be a material valuation uncertainty in the short to medium term, particularly in the retail space. This was coupled by an 18.2% decline in total operating income to Kshs 299.6 mn, from Kshs 324.5 mn in FY’2020.

The table below includes a summary of the three REIT’s performance in FY’2021:

|

Balance Sheet Items (Kshs bn) |

Acorn I-REIT FY’2021 |

Acorn D-REIT FY’2021 |

ILAM Fahari I-REIT FY’2021 |

ILAM Fahari I-REIT FY’2020 |

ILAM Y/Y Change (%) |

|

Total Assets |

3.8 |

8.4 |

3.7 |

3.9 |

(4.4%) |

|

Total Liabilities |

0.2 |

3.2 |

0.2 |

0.1 |

56.8% |

|

Total Unitholders’ Funds |

3.6 |

5.2 |

3.5 |

3.8 |

(6.2%) |

|

Income Statement Items (Kshs bn) |

|||||

|

Rental Income |

0.3 |

0.1 |

0.30 |

0.34 |

(12.8%) |

|

Total Operating Income |

0.4 |

0.1 |

0.30 |

0.35 |

(13.8%) |

|

Total Operating Expenses |

(0.2) |

(0.4) |

(0.2) |

(0.2) |

0.0% |

|

Investments Property Revaluation Gain/(Loss) |

0.1 |

1.1 |

(0.2) |

0.01 |

(1,760.7%) |

|

Profit/ (Loss) |

0.4 |

0.8 |

0.2 |

(0.1) |

(183.7%) |

|

Basic EPS |

2.3 |

3.5 |

(0.7) |

0.8 |

(183.7%) |

|

Ratios Summary (%) |

|||||

|

ROA |

10.3% |

9.9% |

(3.3%) |

3.8% |

(7.2%) points |

|

ROE |

10.8% |

14.8 |

(3.5%) |

3.9% |

(7.4% points |

|

Debt Ratio |

4.7% |

37.9% |

4.6% |

3.9% |

1.8% points |

|

PBT Margin |

87.6% |

67.7% |

(41.4%) |

42.6% |

84.0% points |

|

Rental Yield |

11.4% |

10.0% |

9.1% |

9.8% |

(0.7%) points |

|

Distribution Per Unit -Kshs (Subject to Approval) |

1.02 |

- |

0.5 |

0.6 |

0.1 |

|

Distribution Yield |

4.9% |

- |

8.5% |

10.2% |

(1.7%) points |

|

Distribution Pay-out Ratio |

93.5% |

- |

88.7% |

80.8% |

7.9% points |

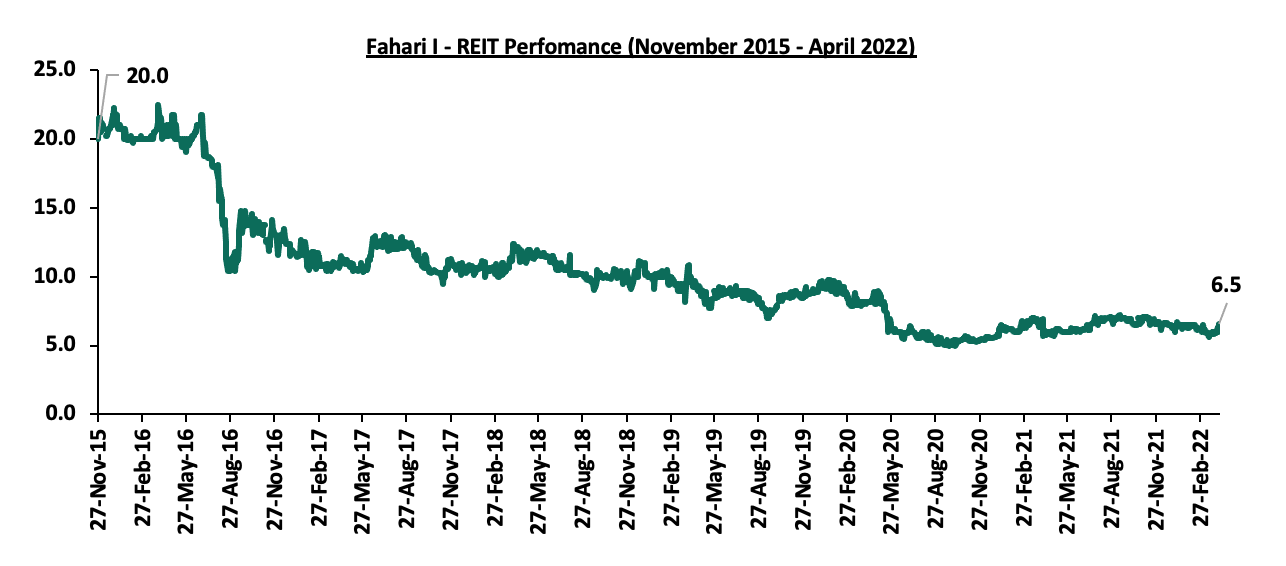

Fahari I-REIT is currently trading at an average price of Kshs 6.5 per share, which is a 67.5% decline from the inception to date price of Kshs 20.0. The poor performance of the Fahari I-REIT is an indication of the dwindling interest of the instrument by investors. The graph below shows Fahari I-REIT’s performance since inception:

- Case Study of Singapore

Singapore is presently considered the largest Real Estate Investment Trust (REIT) market in the Asia-Pacific region. Singapore Real Estate Investment Trusts (S-REITs) are regulated as Collective Investment Schemes under the Monetary Authority of Singapore's Code on Collective Investment Schemes or alternatively as Business Trusts. The first REIT to be listed in the Singapore Exchange (SGX) was CapitaLand Mall Trust (CMT), which made its debut in 2002. Since the listing of the first REIT in the Singapore Exchange, notable growth has been witnessed in the instrument particularly among the retail investors. As of 31st December 2021, there were 19 S-REITS whose Real Estate portfolio is entirely comprised of overseas properties. As of 31st December 2021, there were 44-REITS and property trusts listed in the Singapore Stock exchange made up a market capitalisation of S$115 billion (Kshs 9.7 tn) and 13.0% of the entire Singapore stock market. S-REITs’ (Singapore-Real Estate Investment Trust) market capitalisation has grown at a compounded annual growth rate of 13.0% over the last 10 years. More than 85.0% of S-REITS and property trusts have overseas properties across Asia Pacific, South Asia, Europe and USA in their portfolios. The table below shows the REIT market capitalization for various countries as of June 2021, Singapore data is as at 31 December 2021 while Kenya’s data is as at 1st April 2022;

|

NO. |

COUNTRY |

REIT MARKET CAP ($US Bn) |

% OF STOCK MARKET CAP |

|

1 |

Singapore |

86 |

13% |

|

2 |

Australia |

105 |

6% |

|

3 |

USA |

1,492 |

3% |

|

4 |

UK |

92 |

3% |

|

5 |

Canada |

72 |

3% |

|

6 |

Japan |

158 |

2% |

|

7 |

France |

55 |

2% |

|

8 |

Malaysia |

9 |

2% |

|

9 |

Hong Kong |

29 |

0.4% |

|

10 |

India |

8 |

0.3% |

|

11 |

Kenya |

0.072 |

0.3% |

Source: Online Research, SGX, REITAS Singapore 2021

The government of Singapore has provided a conducive regulatory environment for REITS transactions. Other key factors supporting the growth of the REIT market in Singapore include:

- High Earnings Distribution Requirement - S-REITs that own Singapore Real Estate properties are required to distribute at least 90.0% of their specified taxable income (generally income derived from the Singapore Real Estate properties) to unitholders as dividends in order to qualify for tax transparency treatment. This has proven to be an attractive proposition for individuals in favor of the “income investing” distributions to unit holders. The dividends are exempt from taxes and may be distributed semiannually or quarterly,

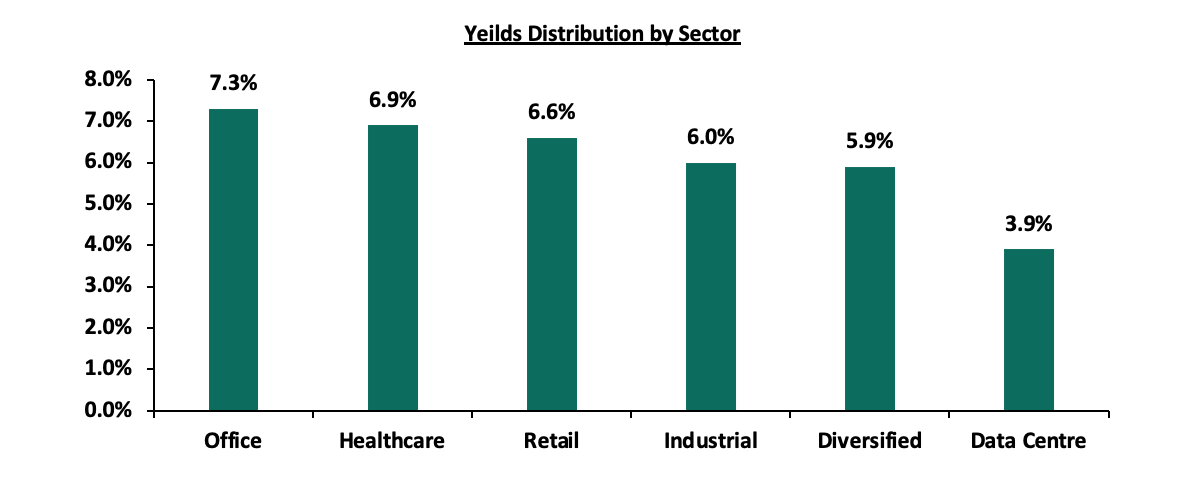

- Attractive Returns - S-REITS have proven offer attractive returns with an average dividend yield of between 5.0%-6.0% higher than the country’s 10 year government bond providing returns of 2.6% as at 8th April 2022. The attractive returns have continued to prove that S-REITS are a good investment option. The returns are mainly driven by the performance of the commercial office which recorded high distribution yields of 7.3% compared to the retail and industrial sector at 6.6% and 6.0% respectively, as at August 2021

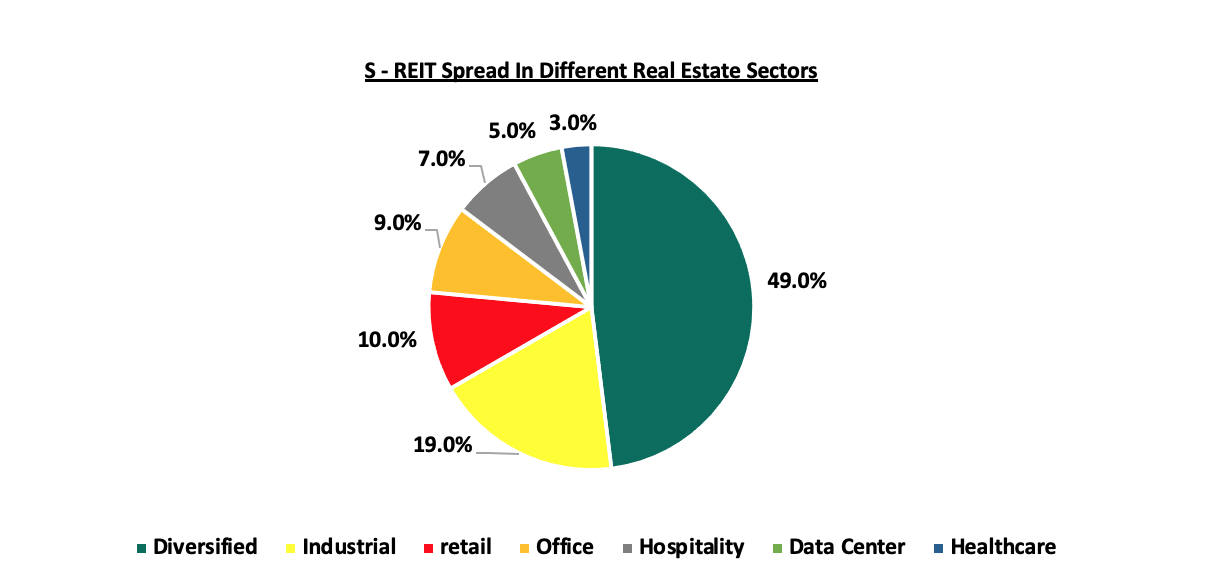

- Diversified Investment Options - In Singapore, the REITS market is well diversified across various sub sectors which includes retail, hospitality, industrial, land, and health care among others. There are some REITS in Singapore that have invested in more than one Real estate sub-sector and this accounts for more than half of the S-REITS in the Market. The diverse offering of the REITS in various investment classes creates a safe investment space especially for risk averse clients. The chart below shows the percentage spread of the S-REITS in different Real Estate sectors as at 2021;

Source: Source: REITAS Singapore, 2021

Source: Source: REITAS Singapore, 2021 - Good Corporate Governance - The main regulatory body of the S-REITS, the Monetary Authority of Singapore has made major efforts to strengthen the corporate governance in the S-REIT market. These includes a requirement by REIT managers to prioritize the interest of investors over the managers and other sponsors when there is a conflict of interest. These policies have helped to facilitate the growth of the REIT market in Singapore. Additionally in light of this, the Monetary Authority of Singapore alongside the Island Revenue authority of Singapore (IRAS) and Ministry of Finance in 2020 put in place measures aimed at ensuring that the listed REITS in Singapore have greater flexibility when managing their cash flows and raising funds in a challenging environment during COVID-19. Some of these measures included: i) Higher Leverage Limit and Deferral of Interest Coverage Requirement, and, ii) Extension of Permissible Period for Distribution of Taxable Income. These strategies were aimed at ensuring that the REITs market is well governed, and,

- Increased Investor Knowledge of the REITS instrument - The Monetary Authority of Singapore has made efforts to ensure that there is increased investor knowledge of REITS in the market. This has been achieved through publishing relevant information aimed at increasing investor knowledge, and creating an environment where REIT managers can compete freely thereby expanding investor knowledge. As a result, investors are able to explore the various REITS investments options in Singapore, making it the largest REITS market within Asia

Lessons learnt from the case of Singapore

The Kenyan REITs market has the potential to grow and this is possible if there is a supportive framework set up just like the case of Singapore, supporting both local and foreign investments. Based on the case study of Singapore the following measures can be implemented to rejuvenate the REIT Market;

- Working on increasing the awareness of the REITS instrument through organizing conferences, advertisements, workshops among others for investors to boost their confidence, this however may be possible if several REITS have come into the market,

- Continuous Improvement on the Regulation and Government Support for REITs e.g. providing regulations that assist in Real Estate uptake to help increase cash flows into the property market especially during challenging times of the economy,

- Key industry players in the Real Estate market can work on developing institutional grade Real Estate assets which will guarantee higher returns as seen in the case of Singapore since REITS are able to yield high returns to investors,

- Prioritize the needs of the investors first through providing a limit on the amount that can be distributed to clients in form of dividends within a specific period either quarterly, semi-annually or annually just like the case of Singapore where the S-REITS are required to distribute at least 90.0% of their specified taxable income in form of dividends, and,

- REIT managers in Kenya can diversify their investments and returns by establishing trusts for a variety of properties not just limited to residential, student housing and retail sector. They can explore Real Estate asset classes such as the hospitality sector, industrial sector, mixed-use/lifestyle developments etc. just like the case of Singapore.

- Conclusion

Real Estate Investment Trusts (REITS) have proven to be a viable investment option for investors as they have proven to be effective in encouraging people to tap into the Real Estate market. REIT as an alternative means for financing Real Estate projects can help plug the existing housing deficit and reduce overreliance on the expensive debt financing for developments while boosting returns for investors & developers. In Kenya, despite the REITS being in existence for more than nine years, the instrument remains subdued due to various factors among them being lack of investor knowledge. There is potential for growth of the instrument if reforms are made to favour the needs of investors, if the approval processes are aligned with well-defined timelines, and, if the public is sensitized in an aim to improve investor knowledge.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.