Kenya's Real Estate sector contribution to GDP has grown exponentially in recent years, expanding at a CAGR of 6.2% over the past five years. Some of the factors that have driven the upward performance of the Real Estate sector include; i) Rapid population growth and urbanization, ii) rapid expansion drive by both local and international retailers which boosts the performance of the retail sector, iii) reopening and expansion of the hospitality sector on the back of economic recovery, coupled with the improved investor confidence in the sector, iv) high investor appetite for Mixed Use Developments (MUDs) owing to their convenience, and, v) efforts to improve infrastructure across the country which further opening up various locations for investment.

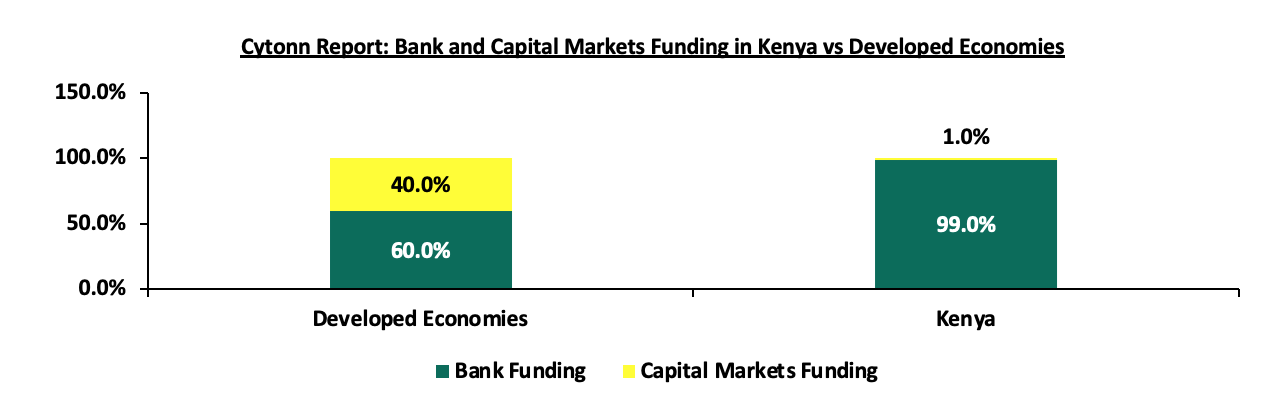

Despite this, the sector’s performance has been weighed down by a couple of challenges over the recent years such as the onset of the COVID-19 pandemic which caused the sector to experience a slowdown in activity, with the two investment classes most negatively impacted being the hospitality and commercial office sectors. Other factors that have negatively impacted the performance of the sector include: i) an oversupply of 6.7 mn SQFT in the Nairobi Metropolitan Area (NMA) commercial office market, 3.0 mn SQFT in the NMA retail market, and 1.7 mn SQFT oversupply in the overall Kenyan retail market as at 2022, and, ii) difficulty in the access of funding. The financing challenge is fuelled by Kenya’s under developed capital markets given that there exists only one listed REIT in the country since inception of the investment regime in 2013. Due to this, most property developers rely on conventional sources of funding such as banks, compared to other developed countries. The table below shows the comparison of development funding in Kenya against developed economies;

Source: World Bank

The REITs to market capitalization for Kenya remains very low compared to other jurisdictions. To curb the funding gap, Real Estate stakeholders have been focusing on exploring alternative ways of financing Real Estate Developments such as Real Estate Investment Trusts (REITs) which are regulated by the Capital Markets Authority (CMA). In 2013, CMA put in place a REITs framework and regulations that developers can utilize to raise capital. This paved the way for the authorization of four REITs in the Kenyan market, all of which are structured as closed-ended funds but with only one – ILAM Fahari I-REIT, listed and traded on the NSE’s Main Investment Market. On the other hand, Acorn I-REIT and D-REIT are not listed, but trade on the Unquoted Securities Platform (USP), an over-the-counter market segment of the NSE. In addition, LAPTrust Imara I-REIT is currently pursuing listing after it was granted approval by the CMA to list on the NSE’s Main Investment Market, under the Restricted Sub-segment. The table below highlights the REITs authorized by the CMA in Kenya;

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

October 2015 |

Main Investment Market |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

November 2022 |

Main Investment Market: Restricted Sub-segment |

Restricted |

Source: Nairobi Securities Exchange, CMA

Further, according to the Capital Markets Authority (CMA)’s Q4’2020 Capital Markets Soundness Report, the financing for construction in Kenya was majorly sourced from the banking sector at 95.0% while capital markets contributed only 5.0%; further highlighting the overreliance on banks. We believe the REITS are crucial to closing the funding gap for real estate, hence the focus note on REITs.

To have a comprehensive understanding of REITs and the Kenyan REIT market, we have previously done three topicals namely; i) Real Estate Investment Trusts (REITs) as an Investment Alternative in 2019, ii) Real Estate Investment Trusts in Kenya in 2021, and, iii) Real Estate Investment Trusts Performance in Kenya in 2022. Due to their exclusivity as an investment segment allowing access to capital markets, REITs could offer a means to complement the delivery of various projects in the country such as the affordable housing initiative that has been gaining momentum in the country. However, since the adoption of REIT structures in 2013, their activity has remained low, and, hence their performance remains below optimum. This week, we update our topical by shading light on the progress of REITs in Kenya by covering what could be done to improve the uptake and performance of REITs by covering the following topics;

- Overview of REITs,

- Types of REITs,

- Benefits and challenges associated with investing in REITs,

- REITS progress and performance in Kenya,

- Case studies of REITs in other countries,

- Recommendations, and,

- Conclusion

Section I: Overview of REITs

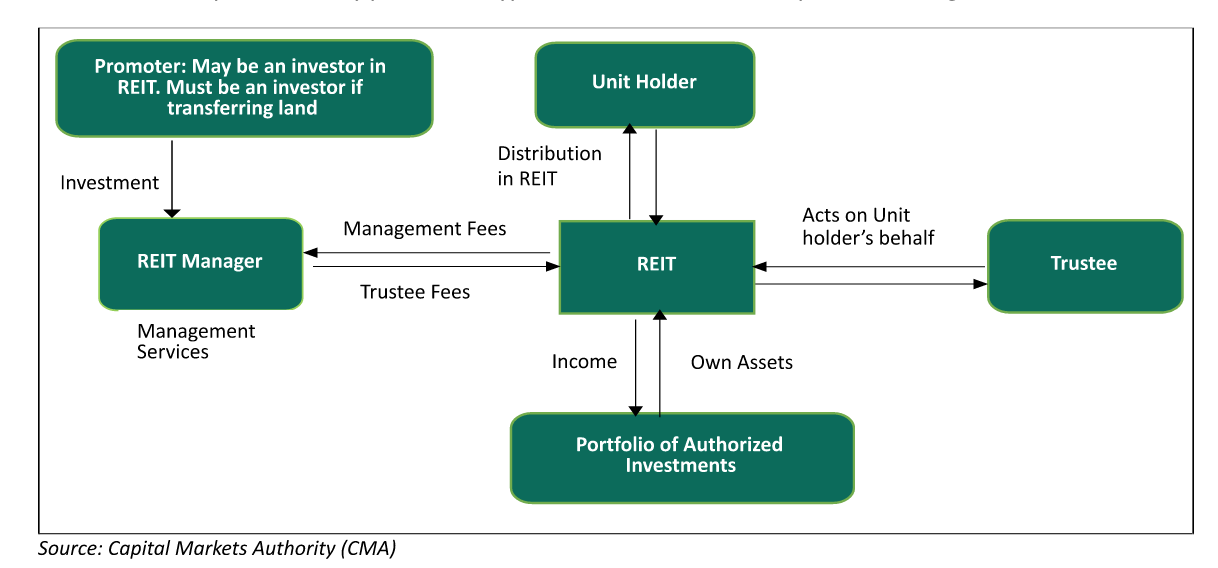

REITs are essentially regulated collective investment vehicles that allow investors to contribute money’s worth as consideration for the acquisition of rights or interests in a trust that is divided into units with the intention of earning profits or income from Real Estate as beneficiaries of the trust. Investors can purchase and sell shares of REITs on the stock market. REITs source funds to build or acquire Real Estate assets, which they sell or rent to generate income. At the end of a fiscal year, the generated income is then dispersed as returns (dividends) on investment to the shareholders. There are four important parties who collaborate to guarantee the protection of REITs interests and to help promote accountability and transparency inside the REIT structure. These parties include:

- The Promoter: This party is involved in setting up a REIT scheme. The promoter is regarded as the initial issuer of REIT securities and is involved in making submissions to the regulatory authorities to seek relevant approvals of a draft trust deed, draft prospectus or an offering memorandum. Some of the REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust,

- The REIT Manager: This is a company that has been incorporated in Kenya and has been issued a license by the authority (CMA) to provide Real Estate and fund management services for a REIT scheme on behalf of investors. Currently, there are 10 REIT Managers in Kenya namely; Cytonn Asset Managers Limited (CAML), Acorn Investment Management, Stanlib Kenya Limited, Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited,

- The Trustee: This is a corporation or a company that has been appointed under a trust deed and is licensed by the authority (CMA) to hold the Real Estate assets on behalf of investors. The Trustee’s main role is to act on behalf of the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed. REIT trustees in Kenya include; Kenya Commercial Bank (KCB), Co-operative Bank (Coop) and Housing Finance Bank and,

- Project/Property Manager: The role of the project manager is to oversee the planning and delivery of the construction projects in the REITs. The property manager on the other hand plays the role of managing the completed Real Estate development that has been acquired by a REIT with his main goal being profit generation.

The relationship between key parties in a typical REITs structure is as depicted in the figure below;

Section II: Types of REITs

There are three main types of REITs in Kenya and they include;

- Income Real Estate Investment Trust (I-REITs): This’ a type of REIT in which investors pool their capital for purposes of acquiring long term income generating Real Estate including residential, commercial, and other Real Estate asset types. In I-REITs, investors gain through capital appreciation and rental income,

- Development Real Estate Investment Trusts (D-REITs): A D-REIT is a type of REIT in which investors pool together their capital together for purposes of acquiring Real Estate with a view of undertaking development and construction projects. A D-REIT can be converted into an I-REIT once development is complete where the investors can choose to sell, reinvest or lease their shares. D-REIT investors gain from sale profits once an asset is sold in a commercial arm’s length transaction, and,

- Islamic Real Estate Investment Trusts: An Islamic REIT is a unique type of REIT that invests primarily in income-producing Shari’ah-compliant Real Estate developments. A fund manager is required to conduct a compliance test before investing to ensure it is Shari’ah compliant and that non-permissible activities are not conducted in the estate and if so, then on a minimal basis.

Section III: Benefits and challenges associated with investing in REITs

- Benefits of Investing in Real Estate Investment Trusts (REITs);

- Diversification: Investing in a variety of asset classes such as REITs, fixed income securities and equities helps to reduce risk when incorporated into a single investment, as it spreads the investments across diverse locations, sectors, platforms and classes. REIT institutions typically own physical assets such as land and buildings, and frequently enter into lengthy leases with their tenants. This makes REITs some of the most dependable investments on the market. This diversification creates the opportunity for blended portfolio to earn higher returns while reducing the potential for negative or low returns,

- Stable and Consistent Income Stream: Investors who opt for I-REITs gain the benefit of regular rental income, which guarantees a dependable and consistent income source. According to the CMA regulations, I-REITs must distribute at least 80.0% of their earnings to unit holders via dividends,

- Flexible Asset Class: REITs are seen as an adaptable investment tool, allowing investors to tailor their portfolio of REITs to match the characteristics of the fund, the different segments of the Real Estate market, and their desired geographic exposure,

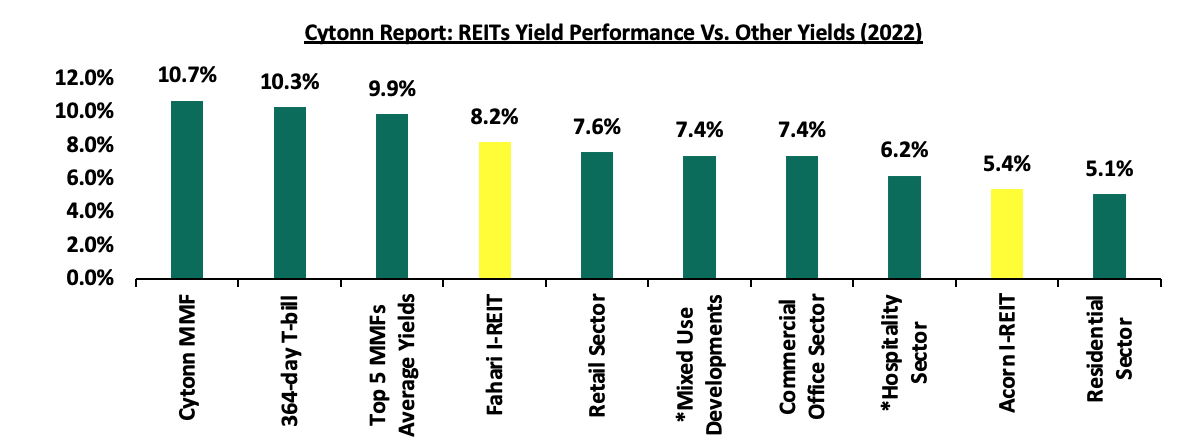

- Competitive Long-Term Returns: REITs provide robust and long-term yields. This makes them an ideal component of a successful and efficient portfolio. The chart below shows the comparison of Kenyan REIT yield performance versus other yields in 2022. It is notable that the promise of competitive yields from REITs is yet to materialize in Kenya;

- Liquidity: Selling a physical property requires investing both time and money in terms of commissions, fees, and taxes. Investing in REITs, on the other hand, offers greater liquidity, as investors can buy and sell units or shares of REITs at any time, particularly if they are publicly listed. This liquidity advantage is also applicable to Real Estate developers who are not in a hurry to completely liquidate their assets if they need some liquidity,

- Beneficial Tax Reliefs: REITs typically benefit from exemptions such as the income tax (except for withholding tax on interest income and dividends). Additionally, the transfer of properties to a REIT is exempt from stamp duty, as per the terms of Section 96A (1) (b) of the Stamp Duty Act. Furthermore, REITs’ investee companies are exempt from income tax as outlined in Section 20 of the Income Tax Act, with withholding tax constituting the final tax on that income,

- Transparency: Listing of REITs ensures that their activities are transparent; also, these REITs are registered and subjected to stringent financial reporting, corporate governance, and information disclosure guidelines by securities market authorities, and,

- Access to new capital: REITs provide a method for pooling cash for investment in capital-intensive long-term income-producing Real Estate projects, supplementing existing capital-raising routes such as debt and equity markets, and raising funds to capitalize on opportunities as they occur.

- Challenges Associated with investing in REITs

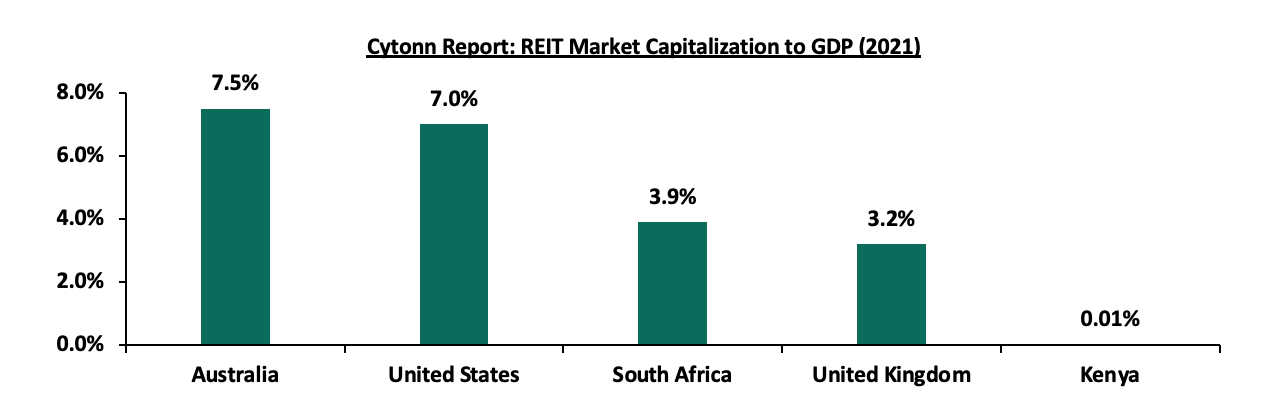

Despite the aforementioned benefits, the Kenyan REIT market has been on a dismal performance since its inception in 2013. This comes at a time when only 4 REITs have been incorporated, with only ILAM Fahari I-REIT listed in the NSE. Consequently, Kenya’s REIT Market Capitalization to GDP has remained significantly low at 0.01%, compared to other countries such as South Africa with 3.9%, as shown below;

Source: European Public Real Estate Association (EPRA), World Bank

This constrained performance is attributed to various factors which include;

- High Minimum Capital Requirement for a Trustee: The minimum capital requirement for a Trustee of Kshs 100.0 mn effectively limits the eligible trustees to only banks, thus eliminating corporate trustees and other fund managers. This is 10x more than the requirement for a REIT Fund Manager and a pension scheme Corporate Trustee, which is Kshs 10.0 mn. As a consequence, the current overdependence on banks is amplified as only banking institutions can meet this criterion. To illustrate, the licensed REITs trustees in Kenya; Kenya Commercial Bank (KCB), Co-operative Bank (Coop) and Housing Finance Group,

- High Minimum Asset Size for Investment Companies: According to CMA regulations, the minimum size of initial assets for I-REITs is Kshs 300.0 mn whereas for the D-REITs is at Kshs 100.0 mn. The limits are very high for most companies in the country to achieve and manage the assets and the only easier way to achieve the initial asset requirements is via huge investments in Real Estate. This wards off medium and small startup that might want to join the REITs market hence very low uptake in the investments,

- High Minimum Investments Amounts: The current regulations set the minimum investment amount for a D-REIT at Kshs 5.0 mn, which is an overwhelming 100x higher than the gross median income of Kshs 50,000 in Kenya. This creates a situation in which many investors who need the safety that regulated structures offer for their investments, particularly in alternative portfolio classes markets, are unable to benefit from it,

- Adverse Conflicts of Interests with Trustees: Due to the large sum of minimum capital required, only three banks serve as Trustees in the REITs market. This has created severe conflicts with institutions in the market with instances where banks have requested deposits from prospective REITs in order to complete their Trustee obligations,

- Insufficient Investment Knowledge and Awareness of the REITs Market: Despite REITs having been available in the Kenyan market for 9 years, the instrument has not gained much popularity and majority of potential investors are not aware of REITS, thus contributing to the low uptake, subscription rates and poor performance,

- Subdued Performance of Select Real Estate Sectors: Despite the recovery of Kenya’s Real Estate sector, oversupply of physical space remains a challenge. As of 2022, there exists an oversupply of 6.7 mn SQFT in the Nairobi Metropolitan Area (NMA) commercial office market, 3.0 mn SQFT in the NMA retail market, and 1.7 mn SQFT oversupply in the overall Kenyan retail market. The dire situation has resulted to subdued occupancy rates and yields,

- Lengthy Licensing and Approval Processes: The licensing and approval process for REITs is laborious and time-consuming due to the need for documentations and compliance with various legal and regulatory requirements. This could put off promoters from investing in REITs, and may encourage them to seek alternative, more efficient means to raise capital, and,

- Continued Economic Slowdown: This has resulted from; i) high operating environment attributable to high interest rates against the rising inflation, depreciation Kenyan currency against the Dollar and high energy prices, ii) interruptions in global supply chains of various commodities especially in the construction sector, iii) geopolitical tensions in regards to conflicts between nations involving major economic superpowers (Russia Ukraine War, China-Taiwan proxy, and tensions in the Middle East), iv) extreme climatic and environment conditions, v) looming debt crisis of the country, and vi) increasing protectionism.

Section IV: REITs Progress and Performance in Kenya

In 2013, Kenya become the third African nation to adopt REITs as an investment vehicle, following in the footsteps of Ghana and Nigeria, who had initiated their REIT frameworks in 1994 and 2007 respectively. Subsequent to that, South Africa became the fourth African country to launch REITs in 2013 after Kenya making the investment milestone. There are currently four authorized REITs in Kenya namely; the ILAM Fahari I-REIT, Acorn Student Accommodation I-REIT, Acorn Student Accommodation D-REIT, and recently, the Local Authorities Pension Trust (LAP Trust) Imara I-REIT. However, only one REIT is listed.

ILAM Fahari I-REIT was listed and began trading in the Nairobi Securities Exchange (NSE) in November 2015. The two Acorn REITs launched in February 2021 are not listed but investors can trade their shares over the counter through NSE’s Unquoted Securities Platform (USP). The Local Authorities Pension Trust (LAP Trust) Imara I-REIT was approved for listing on the Nairobi Securities Exchange (NSE) Main Investment Market in November 2022, a process which is currently underway. However, it sought permission to restrain trade for the following three years due to difficulties in finding the minimum 7 investors in a depressed market, and desired the REIT to create a substantial track record before allowing the units to trade freely.

A total of only three REITs in Kenya is low compared to countries like South Africa which has 33 listed REITs despite REITs regulations becoming operational in 2013 and after Kenya. Below we look at the REITs industry’s performance in Kenya through different metrics; notable activities in the market, and, financial performance of the operational REITs. We will also look at the progress made regarding status of policy proposals made by the Capital Market Authority in efforts to streamline the REIT’s industry in the country an increase its uptake by investors.

Notable Activities

Some of the recent notable activities in the Kenyan REIT’s sector include;

- The REITs Association of Kenya (RAK) announced plans to initiate a 5-phase REIT incubator program during the Capital Market Conference on Real Estate Investment Trusts held at Emara Ole-Sereni on 30th November 2022. The program would be managed by RAK and help REIT promoters to progressively design and launch new REITS in the market. The main aim of the program is to launch 4 new REITs in the market in 18 months. Other objectives of the program will include;

- Provide support to emerging REITs,

- Share learnings in a peer community of REIT promoters & provide support/guidance,

- Leverage engaging and credible professionals to help with REIT strategy or/and implementation,

- Discuss service providers, documentation, processes, and other relevant items, and,

- Provide guidance between REITs in design and already operational,

- In November 2022, the Capital Markets Authority (CMA) approved the listing of the Local Authorities Pension Trust (LAP Trust) Imara I-REIT, on the Nairobi Securities Exchange (NSE) Main Investment Market under the Restricted Sub-segment. It was offered as a close-ended fund capped at Kshs 20.0 per unit, with a total of Kshs 346.2 mn units worth Kshs 6.9 bn. For more information, see our Cytonn Monthly – October 2022,

- In March 2022, Grit Real Estate Income Group invested Kshs 6.1 bn to acquire Orbits Products Africa, a warehousing complex. This came after the investment firm entered a Kshs 2.9 bn loan agreement with the International Finance Corporation (IFC) in July 2021, with an aim of acquiring and developing the warehousing and manufacturing facility. For more information, see our Cytonn Weekly #14/2022,

- In January 2022, Grit Real Estate Income group REIT acquired a 20.0% stake in Gateway Real Estate Africa Ltd (GREA) which invested Kshs 5.5 bn to build a diplomatic housing estate in Rosslyn which will be leased to the staff of the United States embassy in Nairobi for 8 years. For more information, see our Cytonn Q1’2022 Markets Review, and,

- In August 2021, Acorn launched an investment club dubbed Vuka through which retail investors can invest in the property fund with capital starting from Kshs 50,000. The Vuka platform was admitted into the Capital Markets Authority’s Sandbox (a platform for encouraging innovation in the Capital Markets). The fund managed to attract 257 members with total contributions of Kshs 6.4 mn by December 31, 2021.

With the listing of an additional REIT institution in the local market to the public, investors will have a broader opportunity to enjoy REIT benefits. The milestone will also improve investors’ confidence in the industry, create more track records in the industry and play critical roles in the achievement of government’s housing agenda as well as democratization of investment opportunities.

Section V: Case studies of REITs in other countries

In our previous topicals covering the REITs market in Kenya, we highlighted the REITs markets of several countries such as Singapore, Australia, and South Africa. This week, we now take a look at the lessons on the operational and policy framework in the REITs market that we can learn from these aforementioned countries, in addition to those from China and the United Kingdom (UK);

|

Cytonn Report: Summary of Case studies of REITs in Various Countries |

|

|

Country |

Key Take-outs |

|

Singapore |

|

|

Australia |

|

|

South Africa |

|

|

China |

|

|

United Kingdom (UK) |

|

Overall, the REIT market stakeholders of Singapore, Australia, South Africa, China and the UK create an enabling environment for REITs, through various incentives to market participants, which potentially increases their attractiveness compared to other investment instruments. Our analysis of the REITs markets in these countries indicates that we can draw various lessons that could improve REITs market in Kenya. Most of all, the successful growth of REITs in these countries can largely be attributed to the supportive regulatory frameworks and REIT structure. In addition, the REITs have become increasingly popular in these countries as investors have become more comfortable with REITs as a viable investment option.

Section VI: Recommendations

The progress of the Kenyan REIT market is underway, albeit slow, with the potential to experience growth similar to those of other countries that have seen positive REIT market outcomes. With view of this, we recommend the following measures to be taken in order to further spur the Kenyan REIT market;

- Education of Key Stakeholders and Decision Makers: All key stakeholders need to be educated on the REIT structure. For example, a recent market participant experienced difficulty getting a KRA PIN just because the agency did not understand what is a trust structure,

- Allow different legal entities for REIT formation: Just as it’s done in South Africa, different legal entities should be able to incorporate REITs. In Kenya only a trust is allowed to form a REIT. Other entities such as companies, partnerships, in addition to trusts should also be permitted,

- Introduce Hybrid REIT Vehicles: Though promising higher returns, there is a relatively high exposure to development risk for D-REIT investors brought about by the increasing costs of construction. Currently, investors have to subscribe to both of the separate REIT classes, forcing them to pay duplicate costs, due to the nature of exclusivity of the two. A hybrid REIT would provide investors integrated returns, by combining the higher return from development while reducing risk exposure through the relatively stable income component of the I-REIT. In addition, an IPO with such a hybrid REIT vehicle would eliminate the duplicated costs of running two separate REITs, thereby improving subscriptions by investors,

- Efficient approval structure: In order to streamline the approval process for Real Estate Investment Trusts (REITs), the approval structure should be combined into one agency, instead of the current two (CMA and KRA). Combining the approval structure into one approval structure would eliminate the need to go through two separate agencies for REITs approval, which would streamline the process by improving its efficiency, saving on costs, and increasing transparency and accountability,

- Reduce the amount of capital required for a REIT Trustee: Reducing the amount of capital required for a REIT Trustee from Kshs 100.0 mn to match what is required for Pension Trustee, Kshs 10.0 mn, would broaden the pool of trustees by allowing more financial institutions to become eligible to serve as trustees. There are only 3 REITs Trustees compared with 11 for Pension Funds. This would increase competition by providing more choice for REIT Sponsors, allowing them to select a trustee that is more closely aligned with their objectives.,

- Remove the high minimum of Kshs 5.0 mn for D-REITs: The high minimums locks people out of the market. The minimums for more developed markets stand at about Kshs 100,000. It is not clear why Kenya’s minimum is 50 times the amount of developed markets, and 100 times the average median income of Kshs 50,000,

- Give time before requiring that a REIT must list in the public markets: REITs should be allowed to stay private for a while before listing. Companies are not comfortable listing from day one. For example, in the UK they are given 3 years before they are required to list, and,

- Reduce the bureaucracy required for REIT formation: It can take anywhere from 1 to 2 years to form a REIT due to the bureaucracy process. The CMA should make the REIT formation process more efficient thereby reducing time spent.

Section VII: Conclusion

The REITs market in Kenya presents opportunity to boost the Real Estate sector, allowing for an alternative way to finance real estate away from scarce and expensive debt financing, while providing returns for both developers and investors. With the ongoing drive by the government to provide decent housing to Kenyans, the REIT market could go a long way to boost the Affordable Housing Initiative by increasing the supply of housing units. However, for REITS to take off, we need to consider taking prompt and decisive action to implement some of the above recommendations.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.