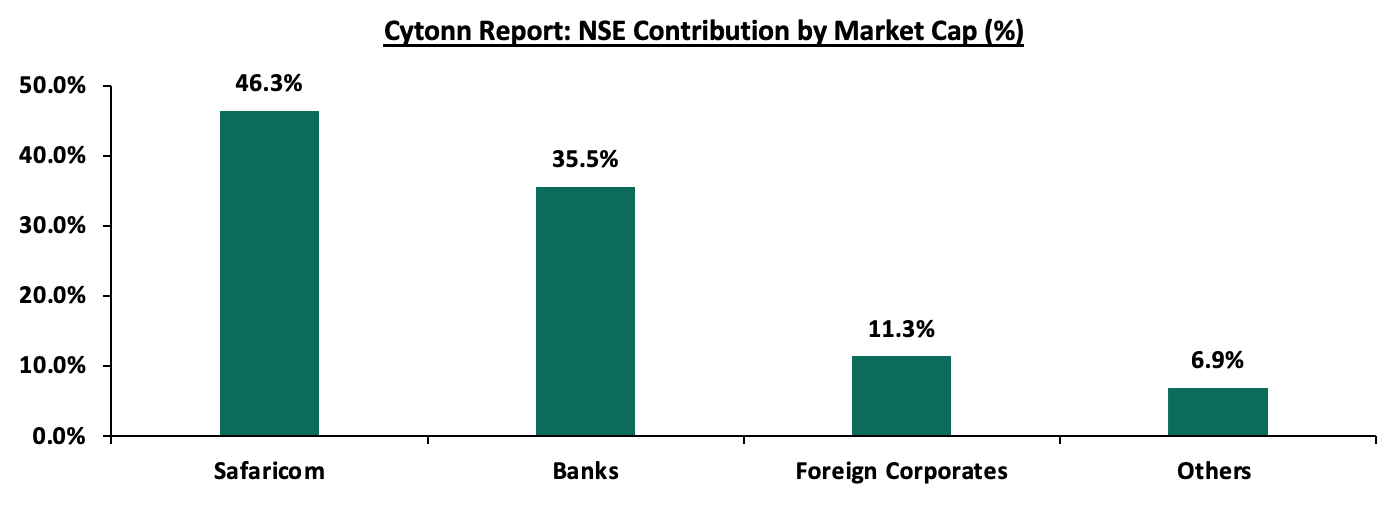

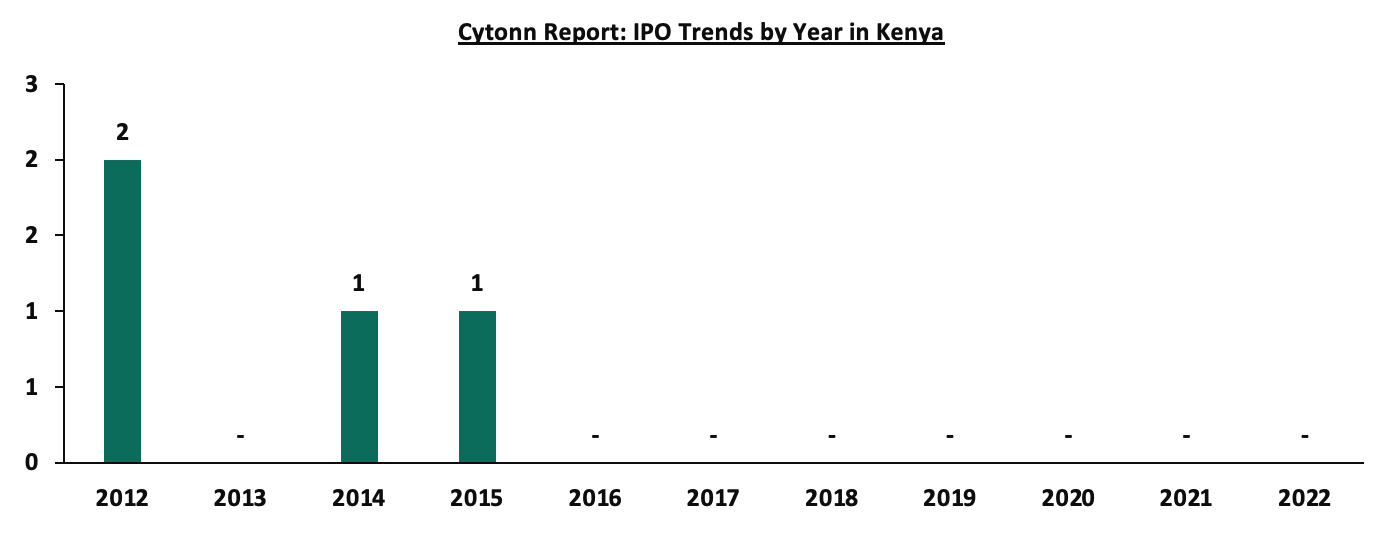

The Nairobi Securities Exchange (NSE) last recorded an Initial Public Offers (IPOs) in 2015, when Stanlib Investments issued an IPO of the first Real Estate Investment Trust (Fahari-Ireit) at the bourse, managing to raise Kshs 3.6 bn against the target of Kshs 12.5 bn, 28.8% success rate. This translates to an eight year IPO drought, with the most recent activity at the bourse being the listing by introduction (meaning no money was raise) of the Local Authority Pension Trust (LAPTRUST) Imara Income Real Estate Investment Trust (I-REIT)) under the Restricted Sub-Segment in 2022. LAPTRUST will hold 100.0% of the Imara I-REIT shares with no initial offer to the public. Currently the bourse has 66 listed securities with a total market capitalization of Kshs 1.9 tn as at 13th January 2023. The bourse continues to be Safaricom dominated, with Safaricom’s market capitalization of Kshs 881.4 bn equivalent to 46.3% of the entire market capitalization. Additionally, between Safaricom (46.3%), Banks (35.5%) and Foreign Corporates (11.3%) make up a total 93.1% of the bourse, leaving all other local sectors to share 6.9% of the bourse. The President in September 2022 also set a target of 10 listings in one year. The Capital Markets Authority (CMA) has also raised concerns that Kenya has been unable to achieve its projected listings targets as articulated in its Capital Markets Master Plan released in 30th April, 2016 which envisions at least four listings on the NSE every year; by its own masterplan CMA is now behind by 28 listings. The chart below highlights the composition of stocks at the Nairobi Securities Exchange;

Given that a few large cap stocks, namely Safaricom PLC, Equity Group Holdings, KCB Group Ltd and East African Breweries Ltd hold almost 75.0% of the total market capitalization, the market remains volatile, which presents a risk of a market collapse due to concentration risk. To remedy the listing drought, the regulator has been on a journey of reviewing a number of regulatory provisions to align them to current and the ever-evolving capital raising and listing realm. In this week’s focus, we take a view on the reasons behind the low number of new listings, as well as recommendations on what should be done in order to attract IPO’s. To cover this topic, we shall address the following;

- The structure of the Nairobi Securities Exchange,

- Types of Listings,

- Requirements for listing,

- Reasons for the low number of new listings in the Nairobi Securities Exchange,

- Case study of the Johannesburg Securities Exchange,

- Recommendation and Conclusion.

- The structure of the Nairobi Securities Exchange (NSE)

The Nairobi Securities Exchange is one of the leading securities exchange in Africa, based in Kenya. It was founded in 1954 in order to facilitate the trading of financial product through provision of trading platform for listed securities. NSE was demutualized and listed in 2014 and it operates under the jurisdiction of the Capital Markets Authority of Kenya and charged with the responsibility of developing the securities market and regulating trading activities, with the most recent key developments being:

- In July 2019, NSE launched NEXT derivatives markets, which made it the second African exchange to launch a derivative market after Johannesburg Stock Exchange. The derivative market was to enhance investors’ portfolio performance through availing risk management tools,

- In May 2021, NSE officially launched its Unquoted Securities Platform (USP) which facilitated the trading, clearing and settlement of securities of unquoted companies in Kenya. The platform provided access to capital and introduced capital market transactions easing the possible transition of the issuers into the primary quoted market. The USP also helped to reduce settlement delays as well as allowing surveillance by the bourse and the regulator, thereby protecting investors in the market. Acorn Holdings Limited became the first company to tap into the market infrastructure to trade shares by quoting its Income and Development Real Estate Investments Trusts on the USP,

- In June 2021, the NSE launched the mini NSE 25 share index futures contracts which was meant to appeal to retail investors due to its low initial margin cost. The segment was to help increase liquidity as well as promote exposure of the Kenya equities market through the equity index future contracts,

- Launch of Environmental, Social and Governance (ESG) disclosure governance manual. In November 2021, the NSE published ESG manual for Kenya listed companies meant to provide detailed guidelines on implementation of ESG metrics in organizational strategy, as well as collection, analysis and reporting of ESG performance. The move was to raise standards on ESG practices by companies thereby enhancing competiveness of Kenya capital markets in the global market space,

- The launch of day trading. The NSE launched day trading in December 2021 as part of its strategy to enhance market liquidity following the approval by the Capital Markets Authority (CMA) of Kenya. The move made Kenya the first frontier market to implement day trading. Day trading which refers to the practice of purchasing or selling a security within a single day or trading session or multiple times over the course of the day. To complement the initiative, NSE approved an incentive structure whereby investors who participates in day trading received a 5.0% discount on subsequent trades,

- NSE announced in 2022, the introduction of fractional investing which allowed investors to purchase less than a whole share of a security. The move was to help to increase market activity by opening up access to stocks that would be out of reach due to high price,

The NSE equities market segment is the premium listing location for companies seeking to raise equity capital to support their growth needs by offering issuers a deep and liquid market that enables them to access a wide range of domestic and international retail and institutional investors. The NSE equities market is comprised of four listing segments, each specifically designed to meet capital, liquidity as well as regulatory requirements for issuers of all sizes. Namely; Main Investment Segment, Alternative Investment segment, Growth Enterprise Segment and Fixed Income Securities Segment. Below is a list of market segments and the requirements to list on each of the segments.

- Main Investment Market Segment: This is the premium platform for large and well established companies in Kenya and the region. The segment currently has 50 listed stocks with a total market capitalization of Kshs 1.9 tn, as at 13th January 2023, equivalent to 99.6% of the total NSE market capitalization. It is suitable for bigger companies that have been around for a longer period of time. For a company to be listed in this segment, it must submit at least 5-years of audited financials, 3 of which should be profitable years, and must have at least Kshs 50.0 mn worth of fully paid ordinary share capital and at least, at least Kshs 100.0 mn in assets. At least 25.0% of share to be held by not less than 1000 shareholders excluding employees of the issuer,

- Alternative Investment Market Segment: This market segment is better suited for medium-sized companies that have at least Kshs 20.0 mn in assets and Kshs 20.0 mn of fully paid up share capital at the time of listing. The company must also have been in existence in the same line of business for a minimum of two-years and demonstrate good growth potential. This segment currently has 9 listed companies with a market cap of Kshs 6.6 bn as at 13th January 2023, equivalent to 0.4% of the total NSE market cap. Listing fees for this segment are 0.06% of securities value to be listed, subject to a minimum of Kshs 100,000 and a maximum of Kshs 1.0 mn,

- Growth Enterprise Market Segments: It is a market segment introduced to facilitate trading of securities of start-ups, small and medium sized companies. The requirements of listing in this segment are designed to be less stringent in order to enable firms in their growth phase to raise substantial capital and accelerate their growth within a regulatory environment. In this segment there is no minimum firm asset value and profitability record requirement, a minimum of Kshs 10.0 mn in paid up share capital. This segment currently has 5 listed stocks, with a total market capitalization of Kshs 0.9 bn as at 13th January 2023 equivalent to 0.05% of the total NSE market capitalization, and,

- Fixed Income Securities Market Segment: This segment was designed to incorporate listing and secondary market trading of fixed income securities, mainly corporate and government bonds.

Other companies listed in the bourse are under the Exchange Traded Funds and the Unquoted Securities Platform namely; the New Gold Kenya ETF and the Acorn Holdings LTD respectively.

- Types of Listings

Securities may be admitted to listing at the exchange through the following methods;

- Initial Public Offer (IPO): This is the most common type of listing. It involves a company issuing new shares while listing on the selected stock exchange that will result in a new set of shareholders from the public buying the shares at a specified share price, and hence the company raising capital from the exercise,

- Listing by Introduction: This type of listing occurs when a company takes its existing shares and lists them on an exchange. Since only existing shares are listed by introduction, it follows that no new shares will be issued and no additional funds will be raised. This type of listing only provides the company with a regulated environment within which to operate and a platform to trade shares with the public investors in the capital markets. The recent listing by introductions at the bourse, was the listing of the Local Authority Pension Trust (LAPTRUST) Imara Income Real Estate Investment Trust (I-REIT)) under the Restricted Sub-Segment in 2022. LAPTRUST held 100.0% of the Imara I-REIT shares with no initial offer to the public,

- Cross Listing: This occurs when a company that is already listed on one stock exchange decides to list on another stock exchange other than its primary or original exchange. Cross listing is advantageous in that it gives the listed company a larger scope of access to capital from different jurisdictions and different investors. No new shares are issued. Atlas managed the first cross listing between the London Stock Exchange and the NSE raising Kshs 450.0 mn, by offering 10% of its 393.9 mn total issued shares for cross-listing on the NSE with price per share set at Kshs 11.5 with a minimum subscription of Kshs 1.0 mn per investor, and,

- Reverse Listing: This is a rare kind of listing strategy also referred to as back door listing where a company that is not listed on any exchange purchases a listed company and becomes automatically listed by virtue of this transaction. It is common when a company that wants to have access to the capital markets also wants to avoid the time and cost spent in a regular listing. The listing of I&M bank for instance, was through reverse acquisition of City Trust Limited (CTL) in 2013.

- Requirements for Listings

As previously mentioned, the NSE is categorized into different market segments approved by CMA. The segments as stipulated have different eligibility, trading restrictions and disclosure requirements, prescribed by CMA that companies planning to publicly offer shares through listing have to abide to. Below is a summary of those requirements:

|

Cytonn Report: Requirements for Public offering of shares and listing |

|||

|

Requirement |

Criteria for the Main Investment Market Segment(MIMS) |

Criteria for The Alternative Investment Market Segment (AIMS) |

Criteria for the Growth Enterprise Market Segment(GEMS) |

|

Incorporation status |

It should be a public company limited by shares and registered under the Companies Act |

||

|

Share Capital |

he issuer should have a minimum of Kshs 50.0 mn of authorized issued and fully paid up ordinary share capital |

The issuer should have a minimum of Kshs 20.0 mn of authorized issued and fully paid up ordinary share capital |

The issuer should have a minimum authorized and fully paid up ordinary share capital of Kshs 10.0 mn and must have not less than 100,000 shares in issue |

|

Net Assets |

Net assets immediately before the public offering or listing of shares should not be less than Kshs 100.0 mn. |

Net assets immediately before the public offering or listing of shares should not be less than Kshs 20.0 mn |

N/A |

|

Free Transferability of Shares |

Shares to be listed should be freely transferable and not subject to any restrictions on marketability or any pre-emptive rights |

||

|

Availability and Reliability of Financial records |

The issuer should have audited financial statements complying with IFRS for an accounting period ending on a date not more than 4-months prior to the proposed date of the offer or listing for issuers whose securities are not listed at the securities exchange, and 6-months for issuers whose securities are listed at the securities exchange. The Issuer must have prepared financial statements for the latest accounting period on a going concern basis and the audit report must not contain any emphasis of matter or qualification in this regard |

N/A |

|

|

Solvency and adequacy of working capital |

The issuer should not be insolvent and should have adequate working capital |

The issuer should not be insolvent and should have adequate Working capital. The Directors of the Issuer shall also give an opinion on the adequacy of working capital for at least 12 months immediately following the share offering, and the auditors of the issuer shall confirm in writing the adequacy of that capital. |

|

|

Share Ownership Structure |

Following the public share offering or immediately prior to listing in the case of an introduction at least 25.0% of the shares must be held by not less than 1,000 shareholders excluding employees of the issuer. In the case of a listing by introduction, the issuer shall ensure that the existing shareholders, associated persons or such other group of controlling shareholders who have influence over management shall give an undertaking not to sell their shareholding before the expiry of a period of 24 months following listing and such undertaking shall be disclosed in the Information Memorandum |

Following the public share offering or immediately prior to listing in the case of an introduction, at least 20.0% of the shares must be held by not less than 100 shareholders excluding employees of the issuer or family members of the controlling shareholders. No investor shall also hold more than 3.0% of the 20.0% shareholding. The issuer must ensure that the existing shareholders, associated persons or such other group of controlling shareholders who have influence over management shall give an undertaking to the Authority not to sell their shareholding before the expiry of a period of 24 months following listing and such undertaking shall be disclosed in the Information Memorandum. |

The Issuer must ensure at least 15.0% of the issued shares, (excluding those held by a controlling shareholder or people associated or acting in concert with him; or the Company's Senior Managers) are available for trade by the public. An issuer shall cease to be eligible for listing upon the expiry of 3 months of the listing date, if the securities available for trade by the public are held by less than 25 shareholders (excluding those held by a controlling shareholder or people associated or acting in concert with him, or the Company's Senior Managers) The issuer must ensure that the existing shareholders, associated persons or such other group of controlling shareholders, who have influence over management, shall give an undertaking in terms agreeable to the Authority, and the Securities Exchange restricting the sale of part or the whole of their shareholding before the expiry of a period of twenty-four months following listing. |

|

Track record, profitability and future prospects |

The issuer must have declared profits after tax attributable to shareholders in at least three of the last five completed accounting periods to the date of the offer |

The issuer must have been in existence in the same line of business for a minimum of two years one of which should reflect a profit with good growth Potential. |

N/A |

|

Dividend policy |

The issuer must have a clear future dividend policy. |

N/A |

|

Source: NSE

- Reasons for the low number of new listings at the Nairobi Securities Exchange

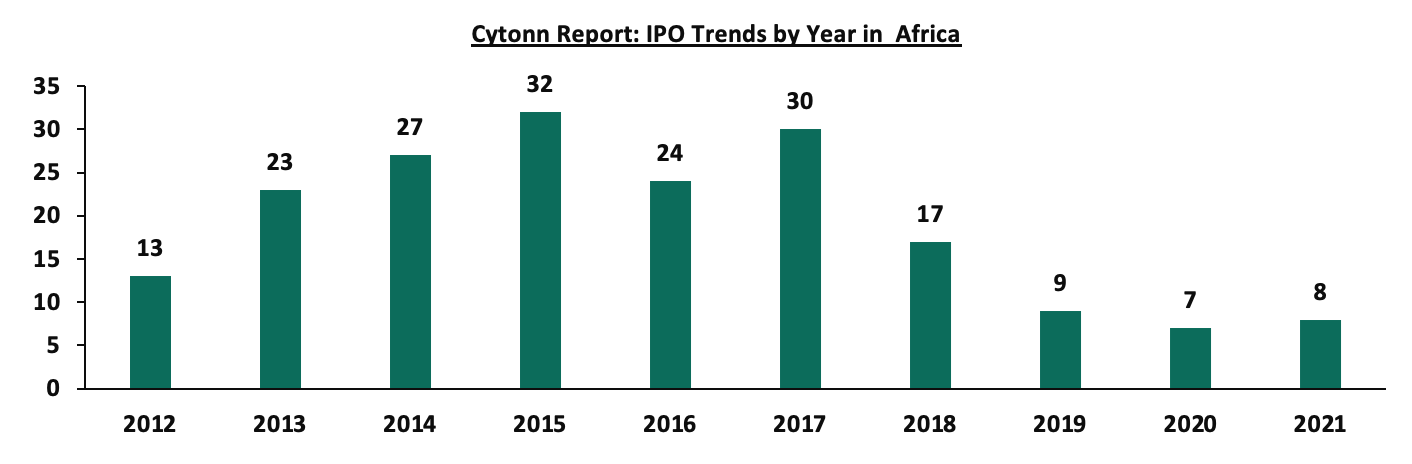

According to PwC’s, 2021 Africa Capital Markets watch, Africa recorded 67 Initial Public Offerings (IPOs) between 2017 and 2021. The continent recorded the highest number of IPOs in 2017, a total of 30 IPOs with value worth USD 3.1 bn. The number of IPO’s has been on a downward trend since 2017 with 2020 recording the lowest number at 7 IPOs, however, 2021 saw a slight increase in value and volume to 8 IPOs with value worth USD 0.9 bn. The charts below highlights IPOs trend in Africa and Kenya respectively, from 2012;

Source: PWC African Capital Watch 2021

Source: PWC African Capital Watch 2021

IPO’s activity in the African region has mainly been dominated by the South African Capital Market, having raised USD 4.1 bn through 16 IPO’s from 2017 to 2021, representing 52.7% of the total capital raised through IPO’s in the region. The Egypt and Tunisia bourses have also been performing well having had 14 and 5 IPOs respectively, raising USD 1.2 bn and USD 67.0 mn USD, respectively. The table below outline the number of IPOs by African exchanges from 2017-2021;

|

Cytonn Report: IPOs by African Exchanges (2017-2021) |

||

|

Country |

Number of IPOs |

Capital raised (USD mn) |

|

South Africa |

16 |

4,139.0 |

|

Egypt |

14 |

1,220.0 |

|

Tunisia |

5 |

67.0 |

|

Namibia |

4 |

232.0 |

|

Morocco |

4 |

216.0 |

|

Botswana |

3 |

72.0 |

|

Mauritius |

3 |

167.0 |

|

BRVM* |

3 |

242.0 |

|

Malawi |

3 |

67.0 |

|

Nigeria |

2 |

690.0 |

|

Ghana |

2 |

240.0 |

|

Uganda |

2 |

195.0 |

|

Tanzania |

1 |

212.0 |

|

Rwanda |

1 |

11.0 |

|

Mozambique |

1 |

53.0 |

|

Zambia |

1 |

23.0 |

|

Egypt-NILEX |

1 |

4.0 |

|

Algeria |

1 |

1.0 |

|

BVMAC |

- |

- |

|

Kenya |

- |

- |

|

Zimbabwe |

- |

- |

|

Total |

67 |

7,851.0 |

BRVM* - regional stock exchange serving the following West African countries: Benin, Burkina Faso, Guinea Bissau, Côte d'Ivoire, Mali, Niger, Senegal and Togo

Source: PwC 2021 Africa Capital Markets Watch

Since 2017, Kenya has failed to attract any IPO’s and the last time it recorded an IPO was in 2015 when Stanlib investments issued an IPO of the first Real Estate Investment Trust (Fahari-Ireit) at the bourse, which raised Kshs 3.6 bn against the target of Kshs 12.5 bn. The most recent activity at the bourse was the listing by introduction, where no money is raised, of the Local Authority Pension Trust (LAPTRUST) Imara Income Real Estate Investment Trust (I-REIT)) under the Restricted Sub-Segment in 2022. LAPTRUST held 100.0% of the Imara I-REIT shares with no initial offer to the public. We believe the reason behind its failure to attract IPO’s is because the measures undertaken have not been able to address the real impediment to listings, focusing mainly on tax exemptions whilst there are a number of deep underlying issues that still need to be remedied, in order to make the country’s capital market robust. Some of the key issues we believe the authority need to undertake in order to attract more IPO’s are as follows;

- Shallow market: The Nairobi Securities Market is regarded as a shallow market since it only offers few instruments and limited liquidity, leaving firms with minimal financing options. The strength of securities markets that make them crucial in growth of an economy, is their capacity to mobilize long term savings for financing long term projects and encourage broader ownership of firms. The intermittent trading of only few stocks held by a small number of investors makes the NSE less efficient. In comparison to other nations like South Africa, which has a total of 350 listed companies, NSE still lags behind having only 66 listed companies. Moreover, the market still lags behind in terms of liquidity due to overreliance on a few stocks thus discouraging listing as companies with the potential to list stay away out of fear of having failed IPOs,

- Rigid regulatory framework: The regulatory structure in Kenya’s capital market has been a key impediment to the penetration of capital market products as well as introduction of new IPO’s. The current regulations governing the capital markets securities, public offers, listing and disclosure is the Capital Markets Regulations Act 2002 and do not meet the needs of the ever evolving market. However, the authority announced that is fast-tracking reforms to update the regulations and have issued the Draft Public Offers, Listing and Disclosures seeking to address emerging issues and market dynamics in order to provide a more enabling environment in Kenya’s Capital Markets that will spur more listings in the Nairobi Securities Exchange. Moreover, costs associated with compliance to the regulatory and corporate governance framework requirements have been a barrier to potential companies going public. Additionally, most potential companies are reluctant to list since compliance with some of the regulations exposes the company to the public realm which they regard as a loss of competitive advantage,

- The rise of Private Equity firms providing easily accessible capital: Kenya’s private equity sector has been thriving, with raising capital through private equity companies is on the upswing, making companies shy from listing due to the readily available capital. According to African Private Equity and Venture Capital Association (APEVCA), Kenya recorded 54 deals with a value of USD 330.0 mn in H1’2022, coming behind only Egypt which recorded 63 deals with a value of USD 352.0 mn in H1’2022. Private equity funding is more appealing than public floatation for many companies primarily because it allows companies to stay private as they continue to finance their businesses for expansion thus preserving the kind of decision making power of its shareholders that is typically lost when business seek public listing,

- Perceived high cost for listing: Most small and medium sized companies shy from listing shares due to the perceived high direct cost in particular the annual listing fees of 0.06% of the market capitalization subject to a minimum of Kshs 200,000.0 and a maximum of Kshs. 1,500,000.0. Additionally, due to lack of awareness, the small and medium sized enterprises which are the dominant in the Kenyan economy, depend mainly on bank loans despite raising capital through the capital markets being cheaper. According to a study by the CMA, the percentage cost of floating securities in the capitals market is comparatively lower than bank lending rates. Moreover, IPO costs have ranged from 1.9% to 10.6% from 2012-2016, with the floatation of Eveready at 10.6% being the highest while Deacons in 2016 at 1.9% being the lowest, compared to bank lending rates averaging at 12.4% as of October 2022 according to CBK monthly economic indicators. Additionally, compared to bank loans, which are annual costs over the tenure of the relevant loans, the cost of floatation is a one-off cost,

- Size of companies: The Kenya economy being dominated by the small and medium sized companies, the perception that mature companies are the ones that are in good position of issuing IPOs make the small and medium sized companies reluctant to list for fear of having unsuccessful IPO’s. This is an indication that startup companies are not growing big enough to the capacity that would make them attractive to investors during IPO’s which is the main reason the informal sector still dominates the economy,

- Loss of control: Many companies particularly that are family owned or closely held are reluctant to list due to fear of dilution of ownership as well as losing their voting control. The companies typically rely on bank finance to raise additional capital when required. Additionally, most companies avoid going public due to constant pressure from public shareholders. Unlike the original owners, public shareholders usually take a short-term position and they are more concerned with seeing constant rises in the stock's price so they can sell their shares for a profit, and,

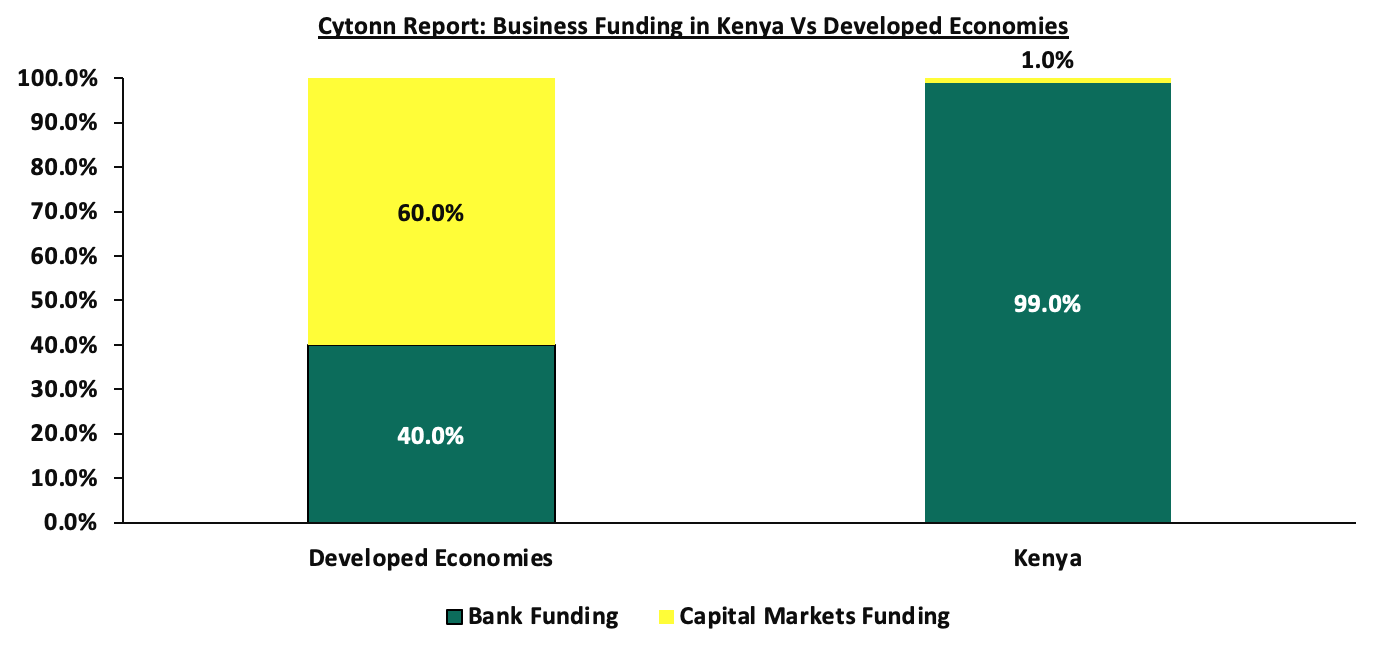

- Overreliance in Banks for funding over capital markets: In developed economies, most businesses are funded through capital markets with capital markets funding accounting for 60.0% compared to funding through banks at 40.0%. However, in Kenya it is the opposite, with capital markets contributing 1.0% while banks accounting for 99.0%. Aside from the statistics, there is a notion that banks rather than the capital markets control the economic agenda, instead of both having equal weights towards the growth of an economy. The chart below shows the comparison of business funding in Kenya against developed economies;

- Improve the Ease of Doing Business: For companies to go public, they need to go through the cycle from formation, to becoming SMEs to being large enough to go public. To get more firms to go public, we have to encourage and support venture formation, growth and ultimately going public. We need a focus on removing obstacles to doing business.

- Case study of Johannesburg Securities Exchange

The Johannesburg Securities Exchange is the principal stock exchange in South Africa founded in 1887 during the first South Africa gold rush, and is currently the largest stock in Africa having a total of 350 listed companies. It is regarded as the engine room for the South Africa economy by facilitating listing of securities as well as provide an orderly market through which investors can increase the value of their capital. The JSE is comprised of three market segments defined by market capitalization; the main Board, Alternative exchange (Altx) and the Debt market.

Main Board: The main board is the JSE primary listing segment designed for well established companies seeking to grow their business exponentially, Altx is the secondary equity market place designed for small and medium sized high growth companies while the Debt market is the largest segment of the JSE and offers a wide range of bond products. The JSE is a vast market offering a wide range of products, in addition to stocks, the market also offers a variety of exchange traded funds (ETFs), Exchange Traded Notes (ETNs) and also Asset Backed Securities which are readily available for trade.

JSE has been keen on revising its regulations as part of key measures undertaken to create an enabling environment for listing on the platform, and in 2022 the bourse announced revised regulations as follows;

- It brought down the free float - trade sharable requirement for a company from 20% to 10%,

- the bourse also amended the special purpose acquisition companies (SPAC) rule to align with international leading markets to ensure the attractiveness and competitiveness of SPACs, and,

- It also eased rules for financial reporting disclosure and debt instrument listing rules.

The bourse has also launched a training academy that is meant to sensitize the public by offering courses that outlines process of listing debt instruments as well as investing in the stock exchange.

JSE also tapped into the capital market tech in order to automate and streamline capital raising process. This follows the launch of the JSE Private Placemats Platform (JPP) meant to connect private companies and issuers directly to investors. This has simplified the hectic process of having to knock different doors for companies looking for capital from private equity firms.

Additionally, given the huge number of listings it has attracted over the years, it is often referred to as one of the most efficient market. Some of the reasons behind the huge number of listings include;

- Liquidity: Due its huge number of participants, meaning there is always a buyer or a seller for every security, the market is more liquid and typically efficient and therefore making it more attractive to investors as well as to potential companies for listing,

- Diversification: The JSE has a wide range of listed companies from different sectors and industries, providing investors with great choice in creating a well-balanced and diversified portfolio, and,

- Transparency: JSE is one of the efficiently regulated securities exchange in the world and provides a high degree of transparency and protection to investors. This makes it more reliable in terms of information available to the public.

- Recommendations to remedy the low number of listings

From the issues identified, we are of the view that the following should be done to facilitate growth in the number of new listings as well as development of the Nairobi Securities Exchange:

- Making changes to regulations that do not meet objectives: The current regulations governing the capital markets securities, public offers, listing and disclosure is the Capital Markets Regulations Act 2002, however, the authority is keen in fast-tracking reforms that will make listing attractive, in order to break the 8 year IPO drought. Therefore, CMA should continuously review, identify and amend restrictive provisions in the capital markets and related Laws that are unattractive to capital raising and listing to ensure the rules in place facilitate rather than deter active participation in the markets. This include rules such as the restrictive regulation inhibiting participation of investors. For example, the minimum amount an investor can put in a DREIT at Kshs 5.0 mn,

- Fast track Privatization of State Owned Enterprises: In October 2022, the new administration announced plans to privatize of 6 to 10 of State Owned Enterprises (SOEs) in the agricultural, energy and financial sectors, within 12 months. However, it is four months down the line, yet there are no actionable results. This also comes on the back of the previous regime’s plans to privatize up to 26 SOEs, yet none was achieved. As such, there is a need by the government to fast-track the process in order to revitalize the capital markets and increase trading activities at the bourse,

- Promote investment in Small and Medium Sized companies with growth potential: Following the increasing number of Small and Medium Sized companies, financing them through the securities exchange is key towards the growth of an economy. However, the challenge usually arises on onboarding investors who are willing to take the risk in these types of companies given some of them have low profit history while others are less liquid. However, some of the ways that can be used to promote and expand the small and medium sized enterprises, include; Introduction of tax incentives for investors willing to invest in small and medium sized companies to facilitate financing and boost liquidity and growth,

- Market Transparency: The degree of to which markets are transparent affects investors decision making. Transparency of trading allows efficient price setting and thus increases confidence in the market. Therefore, it is key for the regulator to enforce measures that raises the level of transparency in the market in order to make it more attractive to investors. This will help to boost its liquidity and consequently attract potential companies who are reluctant from going public due to the inefficiency in the market,

- Creating a culture of participation in the stock market: It is essential to disseminate knowledge of having a candid stock market through listing of more companies in order to broaden the financial markets. This can be implemented through having a specific day in a calendar for financial education where the general public are educated on importance of investment and financial culture,

- Improving tax incentives for new listings: The authority need to develop measures that are favorable to go public that will enable to attract more companies and have a powerful and more developed securities market. In order attract more listings the authority needs to improve its tax treatments for dividends as well as capital gains,

- Training and offer independent and free assessment to companies: In order to attract more listings, the authority need to offer trainings on matters of financial transparency, sustainability and corporate governance to potential companies as well as offering free assessment in order to help them position themselves for transitioning to the public markets, and,

- Simplify regulations and make it easier to access listing at the securities exchange market: The simplification of obtaining listing can encourage companies to go for listing at the stock market and take the advantage of public finance in the market to gain size and boost growth than private financing through risk or venture capital. The general cost of listing should also be reduced in order to make it more favorable and appealing for IPO’s.

We are of the opinion that reforming capital markets will attract IPO’s from mature companies that are in good position to comply with the public market regulations, as well as apply pressure on them to perform well financially. This will help to increase the number of listed companies at the bourse and thus break the dominancy of the few big firms. Additionally, it will help increase the market efficiency and consequently boost investors’ confidence. A vibrant Capital Markets is also key to attract SMEs to the capital markets structure, given that they form the bulk of businesses in Kenya.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor