As highlighted in our 2022 Annual Markets Outlook, elections generally pose the risk of destabilizing an economy should the resultant period be chaotic and unstable politically. This leads to a ripple effect whereby production decreases in the country due to decreased business activities. This also leads to low investor confidence in the country and leads to negative capital net flows. Investor sentiments are generally expected to be poorer with the more apprehensive and risk averse expected to sell off their investment holdings while moderate risk-appetite investors hold off on new investments.

We have previously covered topicals on the “Effects of Elections on the Investments Environment in Kenya” and “Effects of Elections on the Real Estate Environment in Kenya” in 2017 where our expectations were that the 2017 elections would largely have a neutral effect on the markets. This week we tackle the historical effects of general elections on different factors and indicators within the investments environment, as well as give our expectations ahead of the upcoming 9th August 2022 general elections. We shall do this by taking a look into the following;

- Effects of Elections on the Investment Environment where shall analyse the performance of the Fixed Income market, Equities market and the Real Estate market,

- Outlook given the Historical Performance and the Current Macro-economic Environment, and,

- Conclusion and our view going forward

Section 1: Effects of Elections on the Investment Environment

The investment performance is largely affected by the market sentiments on the macro-economic indicators of an economy as they drive demand and supply which in turn leads to price movements. In our 2022 market outlook, We expected 2022 to register lower investor sentiments mainly due to; i) A cautious stance by investors as they monitor the election proceedings, ii) expected increase in Eurobond yields as concerns over Kenya’s high debt-to-GDP ratio persists, and, iii) Expected depreciation of the Kenyan currency as a result of increased oil prices globally and high debt servicing costs. Below, we discuss the performance of the fixed income, equities and real estate markets in the previous electioneering periods as we review the key macro-economic indicators:

- Fixed Income Market

Historically, the fixed income market has acted as a safe haven for investors during periods of economic uncertainties as the market is usually highly volatile. The performance of the fixed income market is partly determined by the macro-economic environment, which in turn inform the market sentiment. The macro-economic indicators include:

- Gross Domestic Product (GDP)

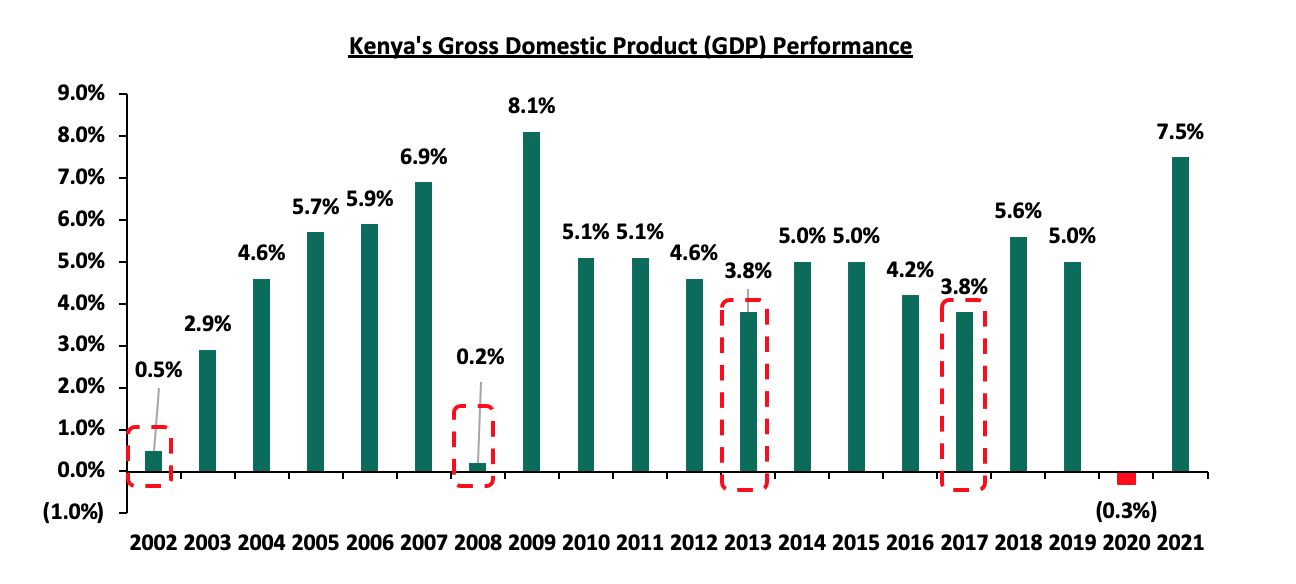

The Kenyan economy continues to register robust recovery from the adverse effects of the pandemic having recorded a 7.5% growth in 2021. In 2022, the economy is expected to grow at an average rate of 5.1% with the National Treasury projecting a 6.0% growth rate supported by the global recovery and the easing of COVID-19 containment measures following an increase in vaccination rates and reduced infections. However, in the past, elections have had a negative effect on the economic growth given the disruptions that come along with the cycle. The chart below shows the GDP growth over the last four electioneering periods:

Source: Kenya National Bureau of Statistics (KNBS)

In the past twenty years, save for 2020, the lowest GDP growth was recorded in 2008 following the political instability that was occasioned by the post-election crisis. In the other three periods, the GDP declined in the election cycles and increased in the preceding years reflecting the economic disruptions that are brought about by the elections. As such, we expect the 2022 electioneering period to weigh down the projected average growth of 5.1%.

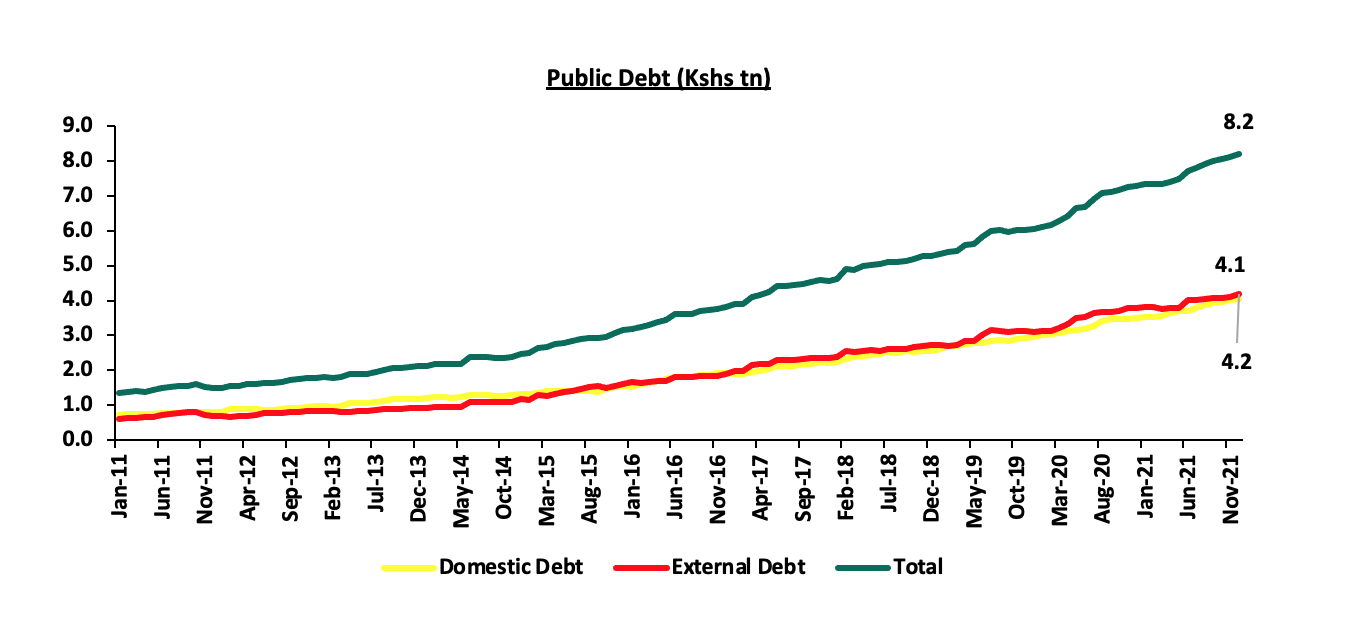

- Government Borrowing

The election period is typically characterized by increased infrastructure development expenditure, as elected leaders seek re-election by selling a track record to endear themselves to the electorate. Key to note, the current electioneering period coincides with the closure of the FY’2021/2022 which further aggravates the borrowing appetite as the government attempts to narrow the fiscal gap. As of March 2022, Kenya’s total public debt stood at Kshs 8.4 tn. The chart below shows the evolution of Kenya’s public debt;

Source: Central Bank of Kenya (CBK)

At the beginning of the FY’2021/2022 the government had projected a target borrowing of Kshs 929.7 bn which increased by 11.7% to Kshs 1.0 tn in the FY’2021/2022 supplementary budget that was approved in April 2022. In addition, the government has a total of Kshs 173.3 bn worth of pending domestic maturities in the one month to the end of the fiscal year. Out of this, Kshs 105.3 bn are Treasury bill maturities while Kshs 68.0 bn are Treasury bond maturities. In a bid to meet its obligations, the government has continued to issue bonds more frequently in form of tap-sales as it seeks financial support from the local market. As of 27th May 2022, the government had offered a total of Kshs 431.5 bn worth of bonds in comparison to the Kshs 303.0 bn over the same period in 2021 reflecting the increased borrowing appetite. As such, we expect the government to maintain the elevated borrowing appetite as it seeks to finance the debt repayments as well as funding the budget deficit, which currently stands at 8.1% of GDP. Additionally, we believe that at its current borrowing levels, fiscal consolidation may take longer and the fiscal deficit is likely to exceed the projected figure.

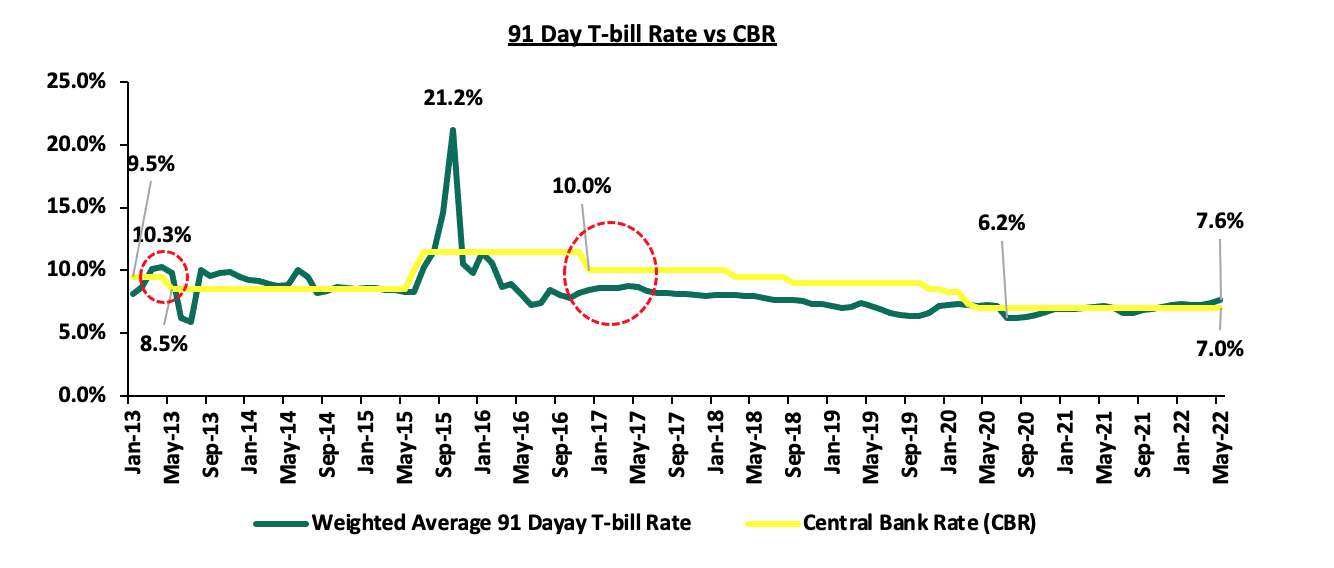

- Interest Rates

Historically, yields on government papers increase during periods of uncertainty mainly due to reduced investor sentiments and the need for the government as the debt issuer to give investors additional premium for the extra risk borne. The last two election cycles have seen an increase in the 91-day T-bill rates just before the election, which can be attributed to the uncertainty of a new government's transition, as well as the likelihood of political unrest as was the case in 2007. In the past, the government has utilized the Central Bank Rate to stimulate economic activity and appeal to the public by decreasing the Central Bank Rate (CBR), having reduced the rate twice to a low of 9.5% in January 2013 from 11.0% in December 2012 and further to a low of 8.5% in March immediately before the elections. Since April 2020, the CBR has remained unchanged at 7.0% in a bid to support the economy recover from the effects of the pandemic. We do not expect the rate to be affected by this election cycle given that the economy has not fully recovered from the effects of the pandemic. Additionally, we expect the yields on the government papers to continue increasing in the short term in a bid to attract investors. The chart below shows the movement of the Central Bank Rate and the yields on the 91-day T-bills:

Source: Central Bank of Kenya (CBK)

- Equities Market

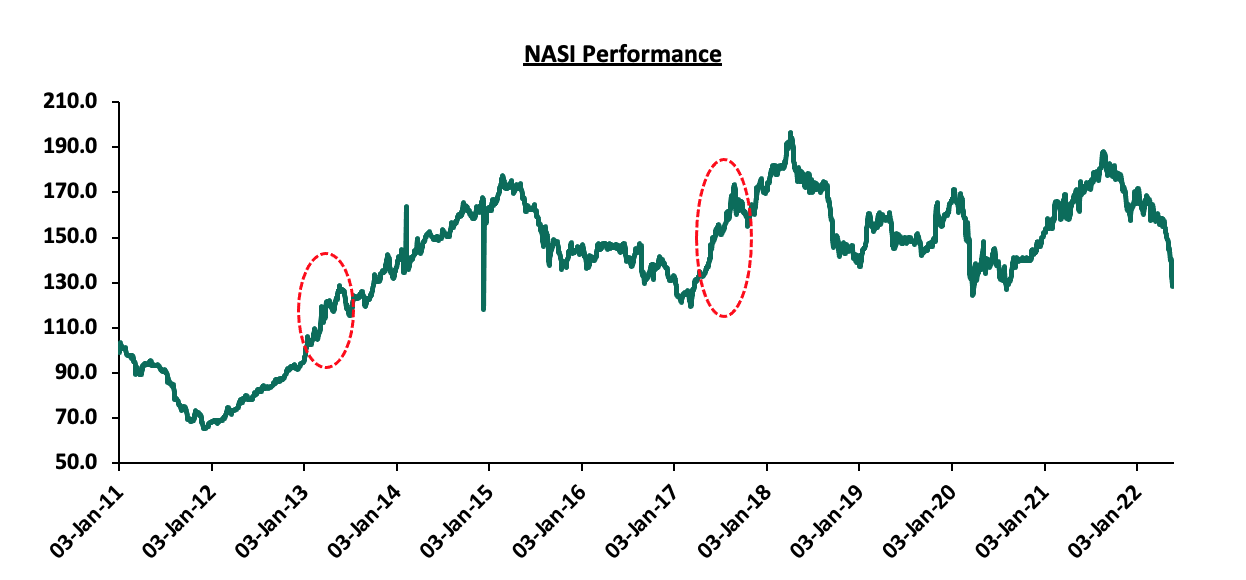

NASI performance has remained independent of the effects of the elections cycle as compared to other external factors such as the COVID-19 pandemic and government interventions such as the interest rate cap. Year to Date, NASI has declined by 22.3%, mostly attributable to foreign capital outflows in the emerging markets as investors seek safer havens due to the uncertainties occasioned by the emergence of new COVID-19 variants and geopolitical pressures. The chart below highlights the performance of NASI since 2011;

Source: Nairobi Securities Exchange (NSE)

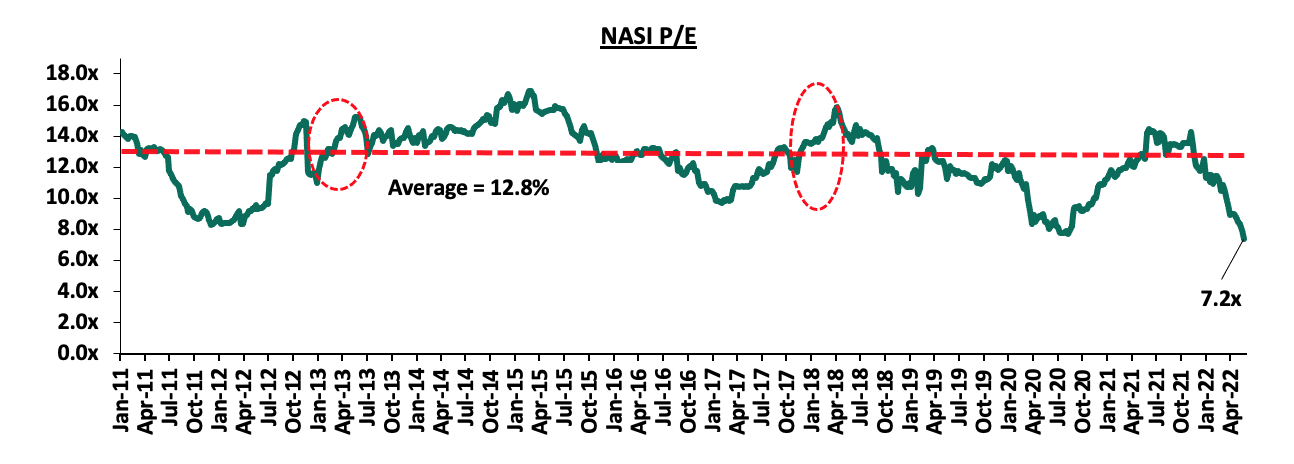

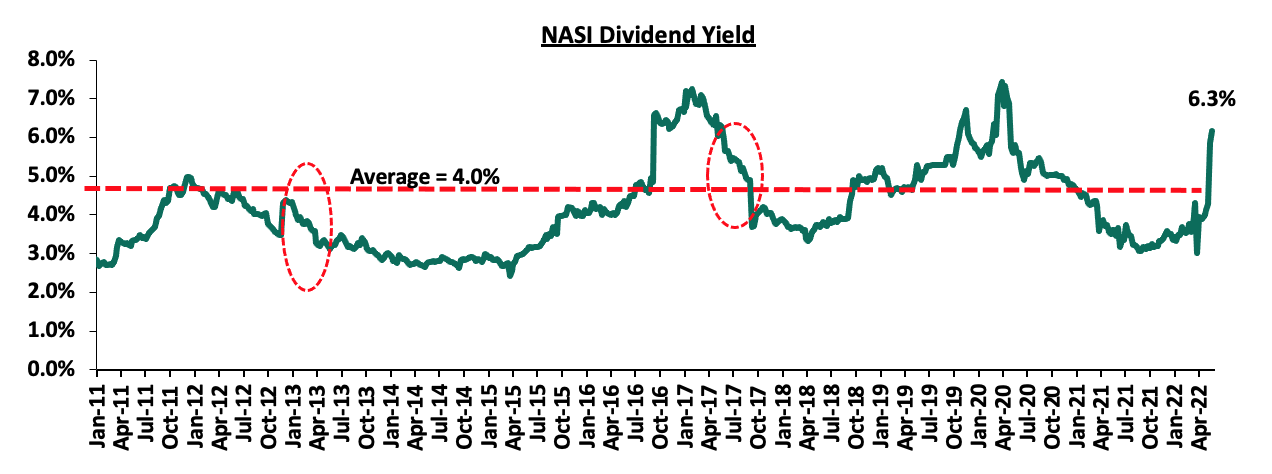

For the listed companies, the market valuation has remained independent of the effects of elections in the past years. In the months surrounding the March 2013 election the NASI P/E ratio was on the rise, on the back of the rising share prices which led to a decline in the NASI dividend yield. The performance was attributable to a general rise in stock prices during the period in majority of the countries globally, which saw NASI gain by 72.4% in the period January 2012 and December 2013 an indication that the market’s confidence during the period was not affected by the electioneering period. Similarly, for the 2017 general elections, the NASI P/E was on an upward trajectory partly due to declining earnings for the banking sector stocks owing to the tough operating environment as a result of the interest rate capping and prolonged political uncertainty in the country after the first round elections were nullified. The environment also affected the market sentiments shortly after the first round elections, as the NASI P/E started declining.

In the current business environment, NASI has been on a downward trajectory and is trading at a price to earnings ratio (P/E) of 7.2x, 44.1% below the historical average of 12.8x, the lowest on record in the last thirteen years. The dividend yield is 6.3%, 2.3% points above the historical average of 4.0% mainly attributable to price declines recorded by most stocks due to increased foreign investor sell-offs as they exit perceived higher risk markets coupled with the rise in interest rates in the US which has seen investors switch to the fixed income market as opposed to the effects of the elections cycle. The charts below indicate the historical P/E and dividend yields of the market:

Source: Bloomberg

Source: Nairobi Securities Exchange (NSE)

- Real Estate Market

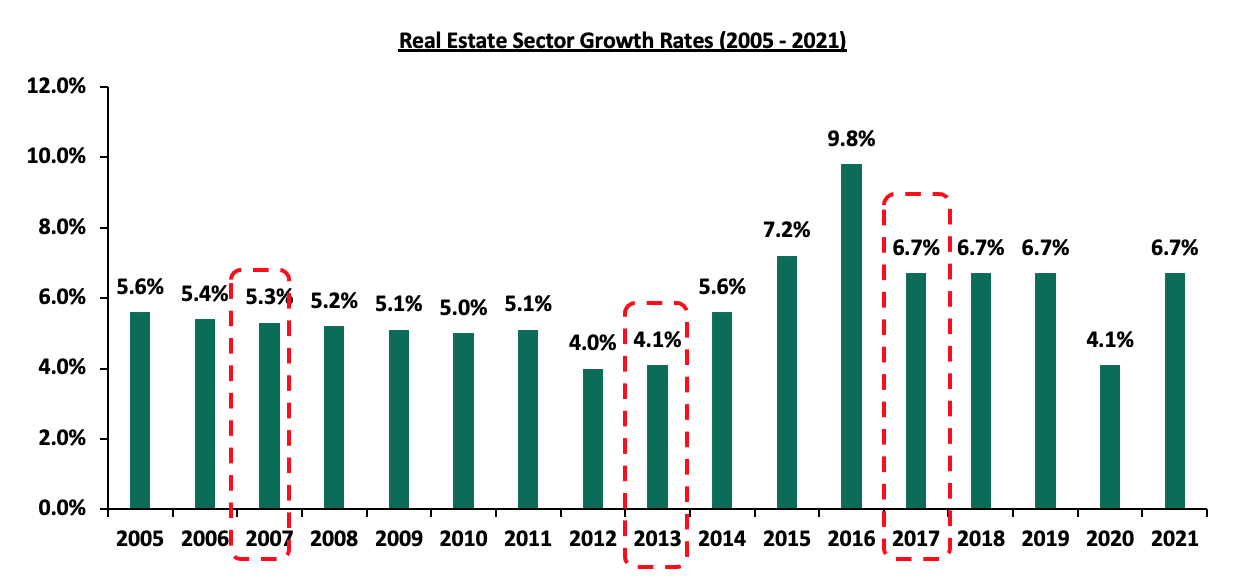

According to the Cytonn Annual Markets Review 2017, the average investor returns softened by 11.3% points to 14.5% in 2017, from 25.8% realized in 2016, due to the shaky general elections effects that resulted to a declined demand in properties. However, the Kenyan real estate sector has been witnessing tremendous growth and developments over the past years having recorded a 6.7% growth in 2021, a 2.6% points increase from 4.1% in 2020, according the Kenya National Bureau of Statistics Economic Survey 2022. The sector’s growth has been influenced by factors such as; i) improved infrastructure developments opening areas for investments, ii) tourism activities boosting the hospitality sector performance, iii) government’s continued focus on the affordable housing initiative, and, iv) aggressive expansion of local and international retailers, among others. Despite this, there are challenges that continue to hinder performance of the sector like financial constraints, and, oversupply in select Real Estate sectors such the commercial office and retail sectors. Also, being that this is an election year, there exist looming qualms that are expected to slightly weigh down the optimum performance and activities of the property sector. This is so because during the election years, the sector has always recorded a correction in performance. The graph below shows performance of Real Estate sector GDP growth rates in the last three election years;

Source: Kenya National Bureau of Statistics

Below are some of the election impacts associated with key property stakeholders;

- Constrained Performance of the General Property Sector

Some property tenants, particularly ones that are based in areas most prone to election ferocities, are expected to streamline or halt their operations amidst the uncertainties. Moreover, property seekers are also expected to avoid hotspot areas or withhold their search plans as they await the outcome of the elections. In turn, both incidences are expected to affect the overall occupancy rates of various properties and lowered returns to property owners.

Additionally, with property tenants and seekers expected to avoid certain areas, coupled with the expected shaky economic environment, some if not most landlords are expected to provide property concessions. This entail provision of rent and price discounts by the landlords to tenants or buyers, in order to attract or retain the existing property occupiers. With this, we expect a correction in property rates with the incoming elections.

- Inadequate Credit Access

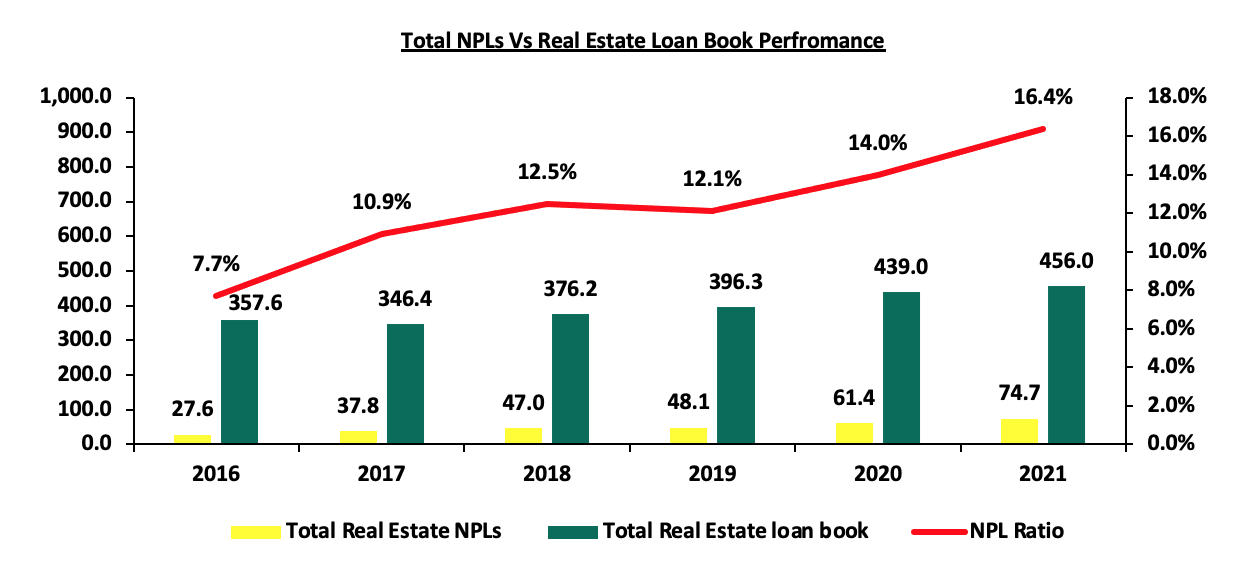

With the expected chanciness brought about by the elections and the unclear impacts on the property sector, developers are expected to slow down their construction plans all through the election period until the high politicking levels die down. Additionally, commercial banks will tighten their lending terms towards developers, due to the economic uncertainties that will result to high loan default rates. In support of this, Central Bank of Kenya’s Quarterly Economic Review Report October-December 2021 highlights that the Gross Non Performing Loans in the Real Estate sector increased by 7.9% to Kshs 74.7 bn in Q4’2021, from Kshs 69.2 bn recorded in Q3’2021. On a YoY basis, the performance represented a 21.6% increase from Kshs 61.4 bn realized in Q4’2020, as a result of high default rates. The graph below shows Real Estate non-performing loans compared to the total Real Estate loan book from 2016-2021;

Source: Central Bank of Kenya

- Roll Out of Social Projects

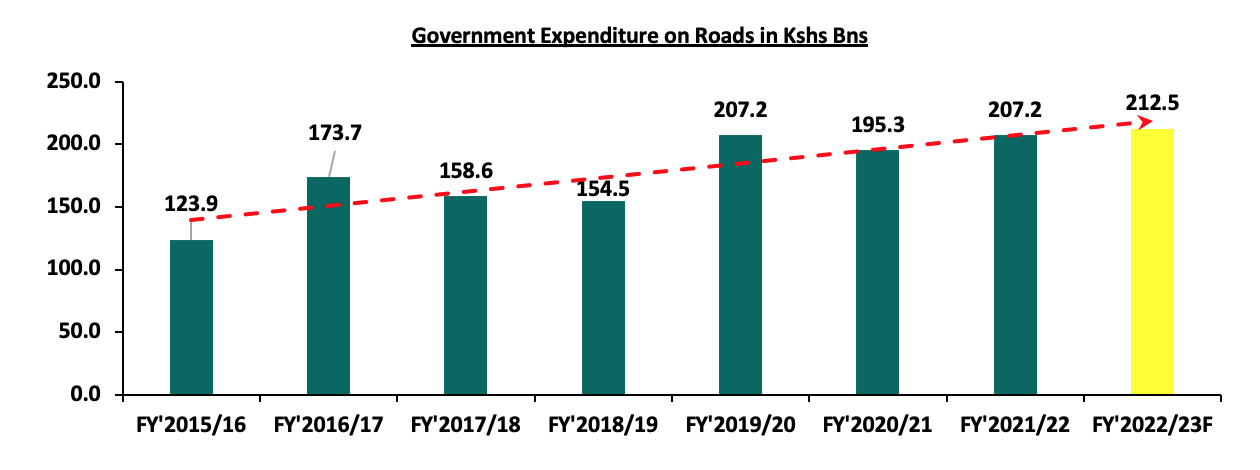

Being that this is an election year, there are various social projects that have been rolled out such as roads, water, and, sewer network projects. This is so because various politicians are known to initiate and implement projects while seeking to get elected or re-elected, by selling their track records. By this, the Real Estate sector gets to benefit through increased investments promoting developments and accessibility in the long term. For example, the total amount of money that was expended towards the development of roads in FY’2016/17 increased by 40.2% to Kshs 173.7 bn, from Kshs 123.9 bn in FY’2015/16, according to the Kenya National Bureau of Statistics. The graph below shows the Kenyan government’s expenditure on roads in the last eight years;

Source: Kenya National Bureau of Statistics

- Increased Employment Rate in the Construction Sector

During the election periods, politicians create employment opportunities, particularly informal employment in various economic sectors aimed at increasing their popularity and winning chances. In turn, employment rates have always increased during these periods, and as such benefiting the various economic sectors such as the Real Estate sector. According to the Kenya National Bureau of Statistics, employment index in the construction sector increased to 277.1 in 2017 from 269.7 recorded in 2016, signaling the increased employment rate in the sector.

Section 3: Outlook given the Historical Performance and the Current Macro-economic Environment

In this section, we shall give our expectations on the effects of elections on the investment environment with regards to the fixed income market, the equities market and the real estate market;

- Fixed Income Market

Rates in the fixed income market have been on an upward trajectory partly on the back of the heightened perceived risk occasioned by the emergence of new COVID-19 variants and the upcoming 2022 elections. In our view, the rise in yields on the government papers is expected to be sustained as the government continues to offer attractive yields on the papers and bonds to facilitate the payment of pending maturities and to meet its borrowing targets for FY’2021/2022. Below is a summary of the expected performance of the key macro-economic indicators;

|

Measure |

Sentiment |

Outlook |

|

GDP |

|

Neutral |

|

Government Borrowing |

|

Negative |

|

Interest Rates |

|

Neutral |

- Equities Market

The Kenyan equities market has been on a downward trajectory in 2022 having declined by 22.3% for NASI on a year to date basis. The decline is mainly attributable to losses recorded by large cap stocks such as Safaricom, of 30.7%, Equity and KCB which have both declined by 16.6% as well as DTB-K and ABSA which have declined by 16.0% and 14.5%, respectively. Below is a summary of the expected performance of the key indicators of the equities market;

|

Measure |

Sentiment |

Outlook |

|

NASI Performance |

|

Neutral |

|

Valuations |

|

Neutral* |

We expect market valuations for most companies to keep declining in the short term and offer great entry points for investors especially to companies with stable and good fundamentals. We have a Neutral outlook on the valuations here as the current and expected decline in prices is not primarily driven by the upcoming general elections, but by foreign capital outflows in the emerging markets as investors seek safer havens on the back of the uncertainties occasioned by the emergence of new COVID-19 variants and the persistent geopolitical pressures. (The average foreign investors’ market participation was 54.9% in Q1’2022).

- Real Estate Markets

The Real Estate sector has registered increased activities so far in 2022 and remains an attractive investment class. However, as 2022 is an election year, we expect a slow-down in market prices and sales volumes since investors and prospective buyers are expected to adopt a wait and see approach. The impact is expected to be temporary and the market is likely to stabilize on the back of relatively strong GDP growth which is expected to grow by 6.1% in 2022. The table below summarizes the expected performance of the key market determinants;

|

Measure |

Sentiment |

Outlook |

|

Performance |

|

Neutral |

|

Credit Access |

|

Negative |

|

Project Developments |

|

Neutral |

|

Employment Rate |

|

Positive |

Section 4: Conclusion and our view Going Forward

Economic development and investments performance is largely depended on continuity and a stable macro-economic environment which significantly determine the investors' sentiments. In our view, a peaceful transition will be key in maintaining the current trend of economic recovery given that the economy is still recovering from the adverse effects of COVID-19. As such, we maintain a general ‘NEUTRAL’ outlook on the effects of elections on the investment environment as we expect the government to fulfil its commitment to a politically stable business environment during and after elections. However, we are of the view that the investment markets are driven by other external factors such as existing geo-political pressures, emergence of new COVID-19 variants, rising inflation rates as well as increasing yields in developed countries as opposed to the effects of the general elections.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.