According to the Kenya National Bureau of Statistics (KNBS) Q2'2025 Quarterly GDP Report, the Kenyan economy recorded a 5.0% growth in Q2’2025, 0.4% points higher from the 4.6% growth rate recorded in Q2’2024. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 4.4% in Q2’2025, lower than the 4.5% expansion recorded in Q2’2024. All sectors in Q2’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q2’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Other services recording growth rate declines of 27.2%, 8.9% and 3.4% points to 7.8%, 1.4% and 1.4% from 35.0%, 10.3% and 4.8% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q2’2024, with Mining and Quarrying, Construction and Electricity and water supply recording the highest growths in rates of 20.8%, 9.4% and 4.5% points, to 15.3%, 5.7% and 5.7% from (5.5%), (3.7%) and 1.2% respectively. Notably, the overall economic performance highlighted modest growth despite a slowdown in several key sectors, reflecting the mixed performance across industries amid a challenging operating environment. In 2025, the Kenyan economy is expected to rebound, returning to its growth path, with the average projected growth estimated at 5.0% by various organizations as outlined below:

|

Cytonn Report: Kenya 2025 Growth Projections |

||

|

No. |

Organization |

2025 GDP Projections |

|

1 |

International Monetary Fund |

4.8% |

|

2 |

National Treasury |

5.2% |

|

3 |

World Bank |

4.5% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.0% |

|

Source: Cytonn Research

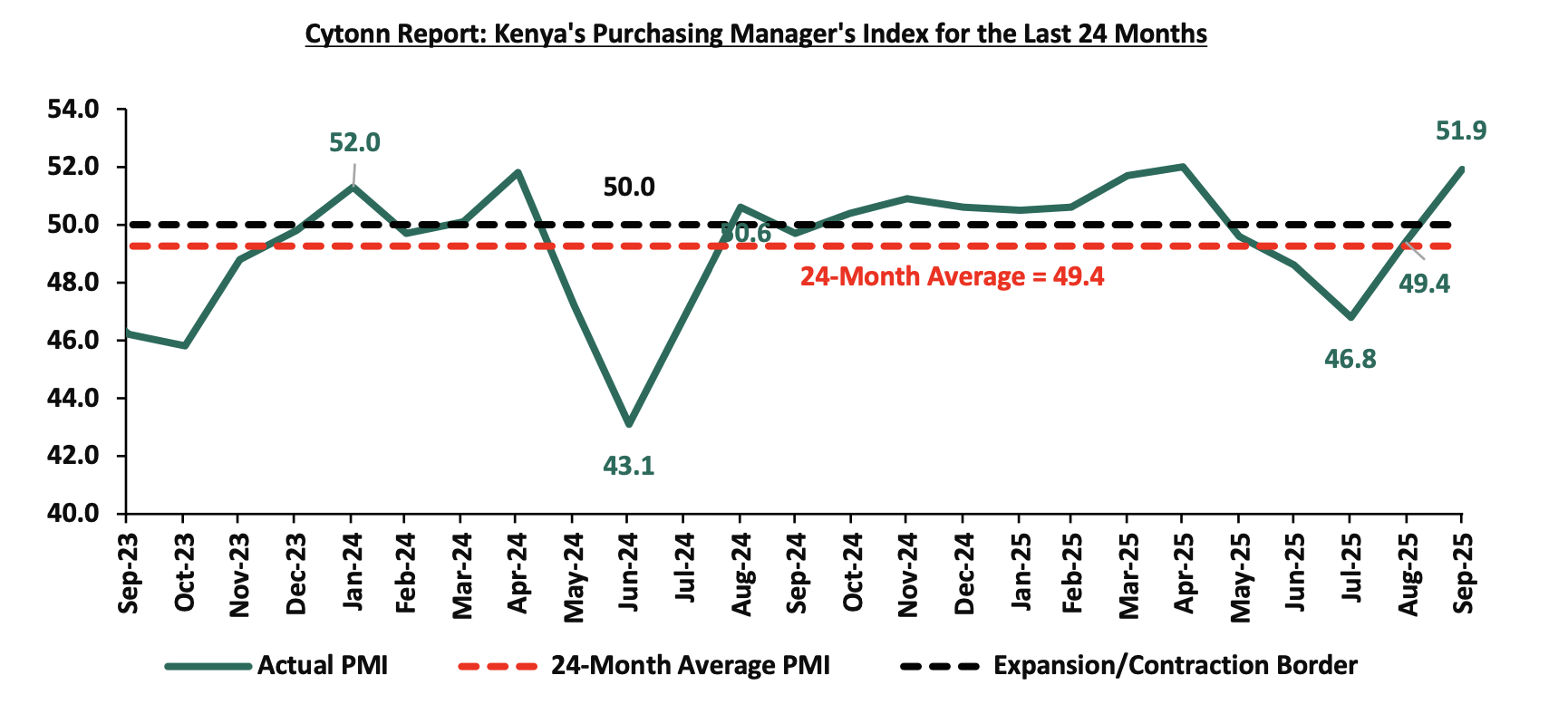

Key to note, Kenya’s general business environment improved slightly in Q3’2025, with the average Purchasing Manager’s Index for the quarter coming at 49.4, compared to 46.9 recorded in a similar period in 2024. The improvement was mainly on the back of a stronger and stable Shilling, despite the slight increase in inflation averaging at 4.4% in Q3’2025, 0.3% points higher than the 4.1% average rate for Q3’2024. Additionally, the easing monetary policy stance is expected to continue to reduce the cost of borrowing and increase spending therefore supporting business activity. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Stanbic Bank’s September 2025 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Managers’ Index (PMI) showing that business conditions in the private sector improved in September 2025, marking the first expansion since April. The headline PMI rose to 51.9 in September, up from 49.4 in August, moving above the neutral 50.0 threshold and signaling a renewed upturn in private sector activity. The improvement followed months of protest-related disruptions and subdued sales, reflecting early signs of demand stabilization. On a year-to-year basis, additionally, the index has recorded a 4.4% increase to 51.9 in September 2025 from the 49.7 posted in September 2024, highlighting relatively stronger conditions compared to the same period last year.

Business output returned to growth, ending a four-month sequence of contraction. The rebound was supported by expansions in manufacturing, wholesale & retail, and services, which outweighed persistent weakness in construction. Similarly, new orders registered solid growth, snapping four consecutive months of decline as improved political stability and marketing efforts boosted demand. Roughly a third of surveyed firms reported higher output, while only 23.0% recorded a decline.

On the employment front, hiring activity strengthened further, with job creation reaching its fastest pace since May 2023. The rise in staffing helped firms reduce backlogs for the fourth consecutive month, pointing to improved capacity. Nevertheless, purchasing activity remained in negative territory, with firms cautious about committing to higher input volumes after months of weak sales. Despite this, inventories increased as some firms resumed procurement in anticipation of stronger demand. Supplier performance also improved markedly, with average delivery times shortening at the fastest pace in four years, reflecting easing supply-side pressures and stronger vendor competition. On prices, Kenyan companies continued to face cost pressures, though the rate of input cost inflation moderated for a second consecutive month. Firms cited higher taxes and commodity prices, especially fuel and food items, as key drivers. Selling prices, meanwhile, rose modestly, partly reflecting cost pass-through but also higher sales volumes.

Overall, while the private sector still faces headwinds from elevated taxes, higher commodity costs, and soft consumer demand, the September PMI reading highlights a tentative recovery in operating conditions. Business confidence remained strong, though below historical averages, as firms pinned hopes on product diversification, marketing strategies, and outlet expansion to sustain growth. The private sector outlook is expected to benefit from easing supply-side pressures, improving political stability, and a more accommodative monetary policy stance, all of which should help anchor a gradual recovery in activity.

Going forward, we expect the private sector to continue experiencing a fragile recovery, supported by easing supply-side bottlenecks, improved political stability, and a more accommodative monetary policy stance by the CBK. However, structural challenges such as elevated fuel prices, rising taxation, and subdued consumer purchasing power will likely constrain the pace of recovery. As such, while short-term improvements are evident, a sustained upturn in business conditions will depend heavily on continued policy support, effective inflation management, and stronger domestic demand.

Inflation:

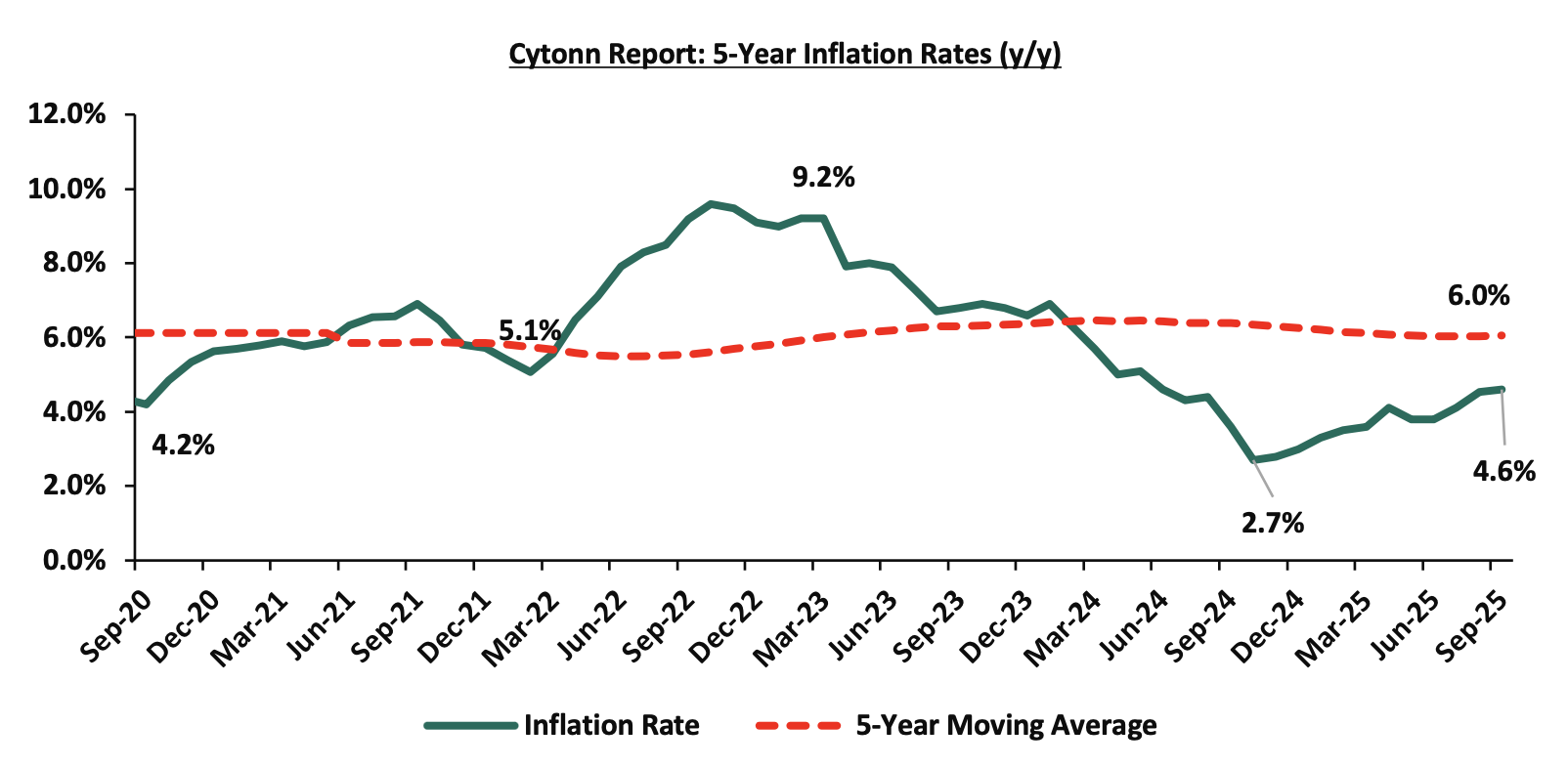

The average inflation rate increased to 4.4% in Q3’2025, compared to 4.1% in Q3’2024, attributable to a stronger and stable Shilling, leading to reduced fuel prices. Notably, fuel prices of Super petrol, Diesel, and Kerosene decreased by 0.4%, 0.1% and 0.5% in September 2025 to Kshs 184.5 Kshs 171.5 and Kshs 154.8, from Kshs 185.3, Kshs 171.6, and Kshs 155.6 per litre in August 2025 respectively. Inflation for the month of September 2025 rose slightly by 0.1% point to 4.6% up from 4.5% recorded in August 2025, mainly driven by an 8.4% increase in the food and non-alcoholic beverages index, a 4.0% increase in transport costs and a 1.4% rise in housing, water, electricity, gas and other fuels. Below is a chart showing the inflation trend for the last five years:

For the last 27 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling, reduced fuel and electricity prices. With the continued easing of monetary policy following the MPC’s observation that its earlier measures had stabilized the Shilling and anchored inflation, the focus has now shifted to lowering borrowing costs, supporting the private sector, and promoting economic growth. As a result, we expect this to exert upward pressure on inflation. The Monetary Policy Committee (MPC) has lowered the Central Bank Rate (CBR) by cumulative of 350 bps since August 2024, to 9.50% in August 2025 from 13.00%, in 2024. Going forward, we still expect the inflationary pressures to remain within the CBK’s preferred target range of 2.5% - 7.5%.

September 2025 Inflation

The year-on-year inflation in September 2025 rose slightly to 4.6%, up from 4.5% recorded in August 2025. This was in line with our projection of an increase to within the range of 4.1%- 4.6% where our decision was mainly driven by the easing in the Central Bank Rate (CBR) to 9.50% in August 2025 and a slight depreciation of the Kenya Shilling against the US Dollar. The headline inflation was primarily driven by price increases in the following categories: Food & Non-Alcoholic Beverages at 8.4%, Transport at 4.0%, and Housing, Water, Electricity, Gas and Other Fuels at 1.4%. The month-on-month inflation rate stood at 0.2% in September 2025. The table below summarizes the performance of commodity indices both on a year-on-year and month-on-month basis:

|

Cytonn Report: Major Inflation Changes – September 2025 |

|||

|

Broad Commodity Group |

Price change m/m (September-2025/ August -2025) |

Price change y/y (September-2025/September-2024) |

Reason |

|

Food and non- alcoholic beverages |

0.5% |

8.4% |

The m/m increase was mainly driven by the increase in prices of fruits and vegetables such as Oranges, Mangoes, Cabbages, potatoes and tomatoes by 5.6%, 3.0%, 2.7%, 2.6% and 1.2% respectively. However, the increase was weighed down by decrease in prices of Sifted Maize flour, Fortified Maize flour, Spinach and Sukuma Wiki of 3.0%, 2.2%, 1.8% and 1.0% respectively |

|

Transport |

(0.3%) |

4.0% |

The transport index recorded a slight m/m decrease mainly due to a decrease in prices of passenger transport costs with the bus/matatu fare for travel between towns dropped by 0.5%. Prices of Diesel and Petrol declined by 0.1% and 0.4%, to retail at Kshs 172.6 and Kshs 185.6 respectively. |

|

Housing, water, electricity, gas and other fuels |

0.5% |

1.4% |

The m/m increase was mainly driven by an increase in prices of 50kWh electricity and 200kWh electricity by 1.1% and 1.0% respectively. while single room house rent recorded an increase of 0.2%. However, the increase was weighed down by the decrease in prices of Kerosene and gas/LPG by 0.5% and 0.2% respectively. |

|

Overall Inflation |

0.2% |

4.6% |

The m/m increase was mainly attributable to the 0.5% increase in food and non-alcoholic beverages. |

In September 2025, overall inflation rose slightly to 4.6% on a y/y basis, up from 4.5% in August 2025, signaling mild upward price pressure in key sectors. Despite this, the inflation rate remained within the Central Bank of Kenya’s preferred range of 2.5%–7.5% for the twenty-seventh consecutive month, underscoring ongoing macroeconomic stability. The increase was primarily driven by an 8.4% y/y rise in food and non-alcoholic beverage prices, a 4.0% increase in transport costs and a 1.4% rise in housing, water, electricity, gas and other fuels. On a month-to-month basis, inflation was marginal at 0.2%, indicating relative price stability. Prices for Super Petrol, Diesel and Kerosene decreased by 0.4%, 0.1% and 0.5% respectively. Despite diesel, super petrol and kerosene prices decreasing, prices are still high, resulting in high production costs and high costs of goods and services. Additionally, the recent reduction in the Central Bank Rate to 9.50% from 9.75% is expected to stimulate credit uptake and increase money supply, which could gradually exert upward pressure on inflation in the coming months as monetary easing transmits through the broader economy. Meanwhile, the Kenya Shilling maintained stability, recording a 0.2 bps month-to-date appreciation as of 30th September 2025 to remain relatively unchanged from the Kshs 129.2 recorded at the end of August and a 5.1 bps year-to-date gain to Kshs 129.2 as of 3rd October, 2025, from the Kshs 129.3 recorded at the beginning of the year. This stabilization in the exchange rate, combined with manageable fuel price increases, continues to anchor inflation expectations within the CBK’s target range.

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a stable currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting stable inflation rates. The risk, however, lies in the fuel prices which despite their stability, still remain elevated compared to historical levels. Additionally, the Monetary Policy Committee cut the Central Bank Rate by 25.0 bps to 9.50% from 9.75% in its August 2025 meeting, with the aim of easing the monetary policy, while maintaining exchange rate stability, and will meet again in October 2025. This cut in the Central Bank Rate is likely to elevate inflationary pressures gradually as consumer spending rises from increased money supply. The committee is expected to adopt a more cautious approach to rate adjustments in the coming meetings in a bid to continue supporting the private sector, while also keeping an eye on the effect on the inflation and exchange rate.

The Kenyan Shilling:

The Kenyan Shilling remained stable against the US Dollar, appreciating slightly by 0.2 bps in Q3’2025, to remain relatively unchanged from the Kshs 129.2 recorded at the beginning of the quarter, mainly attributable to the improved forex reserves during the period which increased by 33.7% to USD 10.7 bn as of 25th September 2025 from USD 8.0 bn recorded in September 2024. Additionally, the Eurobond buyback program of the USD 900.0mn tranche maturing in 2027 in February 2025 alleviated the credit risk on the country, increasing dollar supply in the market. Additionally, during the week, the Kenya Shilling appreciated slightly against the US Dollar by 1.7 bps to close at 129.2 from 129.3 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,078.8 mn in the twelve months to August 2025, 9.4% higher than the USD 4,644.5 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the August 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 60.6% in the period,

- The tourism inflow receipts which came in at Kshs 452.2 bn in 2024, a 19.8% increase from Kshs 377.5 bn inflow receipts recorded in 2023, and owing to tourist arrivals that improved by 9.9% to 2,424,382 in the 12 months to June 2025 from 2,206,469 in the 12 months to June 2024, and,

- Improved forex reserves currently at USD 10.7 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.0-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 1.6% of GDP in the twelve months to June 2025, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 61.4% of Kenya’s external debt is US Dollar-denominated as of March 2025.

Monetary Policy:

The Monetary Policy Committee (MPC) met once in Q3’2025 and lowered the CBR rate by 25.0 bps to 9.50%, from 9.75% in August 2025 against a backdrop of elevated uncertainties to the global outlook for growth, lower but sticky inflation in advanced economies heightened trade tensions as well as persistent geopolitical tensions. Below are some of the key highlights from the August 2025 meeting:

- The overall inflation increased by 0.3% points to 4.1% in July 2025, from 3.8% in June 2025, remaining below the mid-point of the preferred CBK range of 2.5%-7.5%. Core inflation increased to 3.1% in July 2025, from 3.0% in June, reflecting increasing demand pressures in the economy. This increase was largely attributed to higher prices of processed foods, particularly sugar and maize flour. Additionally, non-core inflation rose to 7.2% in July 2025, from 6.2 % in June, driven by higher energy prices. Lower energy and utilities costs, including reduced electricity and fuel prices, continued to help moderate non-core inflation. Overall inflation is expected to stay below the mid-point of the target range in the near term, supported by low food prices, stable energy prices, and a stable exchange rate.

- The recently released Quarterly Gross Domestic Product Report, for Q1’2025 showed a resilience in the performance of the Kenyan economy, with real GDP growing by 4.9%, compared to the similar growth recorded in Q1’2024. This was attributable to expansion in growth in agriculture and industrial sectors of the economy. The economy is expected to continue to strengthen in 2025 with real GDP growth projected at 5.2%, from the 4.7% growth recorded in 2024 supported by resilient services sector and agriculture, expected recovery in the industrial sector. However, this positive outlook is tempered by geopolitical tensions and trade policy uncertainties.

- The Kenya National Bureau of Statistics (KNBS) updated the balance of payments data to better capture cross-border transactions, especially those involving petroleum imports and re-exports under government-to-government deals. The revisions also include the use of alternative data sources to enhance accuracy in reporting international trade in services, notably travel and financial services. These adjustments refine the recording of regional oil product re-exports and international travel earnings.

- Based on the revised balance of payments data goods exports increased by 7.7% in the 12 months to June 2025, compared to 2024, reflecting a rise in exports of agricultural commodities, especially horticulture, coffee, vegetable oil and clothing accessories. Goods imports rose by 9.9% reflecting increases in intermediate and capital goods imports. Additionally, services receipts increased by 12.5%, driven by increased receipts from transport and travel services, while diaspora remittances increased by 12.1%. The current account deficit in 12 months to June 2025 is estimated at 1.6% of GDP, down from 1.8% in similar period in 2024. For 2025, the current account deficit is projected at 1.5% of GDP, up from 1.3% in 2024 and is expected to be fully financed by capital and financial inflows, yielding a balance of payments surplus of USD 673.0 mn.

- The CBK foreign exchange reserves, which currently stand at USD 10,966.0 representing 4.8 months of import cover, which is above the statutory requirement of maintaining at least 4.0-months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans remained unchanged in June 2025 from the 17.6% recorded in April 2025. Decreases in NPLs were noted in the building and construction, personal and household, and manufacturing sectors while increases were recorded in trade and tourism, restaurant and hotel sectors. Banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting in July 2025 revealed sustained optimism about business activity and economic growth prospects for the next 12 months. The optimism was attributed to the stable macroeconomic environment reflected in the low inflation rate and stability in the exchange rate, decline in interest rates, expansion in the digital economy and favorable weather conditions supporting agriculture. Nevertheless, respondents expressed concerns about high cost of doing business, subdued consumer demand and increased global uncertainties due to increased tariffs and geopolitical tensions,

- The Survey of the Agriculture Sector for July 2025 revealed an expectation for decline in food prices, on account of favourable weather conditions and the beginning of the harvest season for key crops, especially maize,

- Global economic growth showed steady recovery in 2024 coming in at 3.3%. However, the outlook for 2025 is projected to decline to 3.0%, an upward revision from 2.8% particularly from revisions in the growth in United States and China, due to lower tariffs on trade and global financial conditions. However, uncertainties from trade policies and tariffs as well as escalating geopolitical risks, particularly ongoing conflicts in the Middle East and the Russia-Ukraine war, continue to threaten global growth prospects,

- Global headline inflation is expected to decline, due to decreased energy prices and reduced global demand. Central banks in advanced economies have continued to cut interest rates, albeit cautiously. International oil prices have declined amid higher production and weak demand, yet volatility risks remain elevated due to trade tensions and ongoing geopolitical conflicts. Food inflation has tightened, largely due to high prices of edible oil prices, although inflation in cereals and sugar remain low.

- The Committee was informed on the proposed revised banking sector Risk-Based Credit Pricing (RBCP) model. The model aims to facilitate monetary policy decisions such as setting interest rates, which will effectively influence the lending rates by commercial banks.

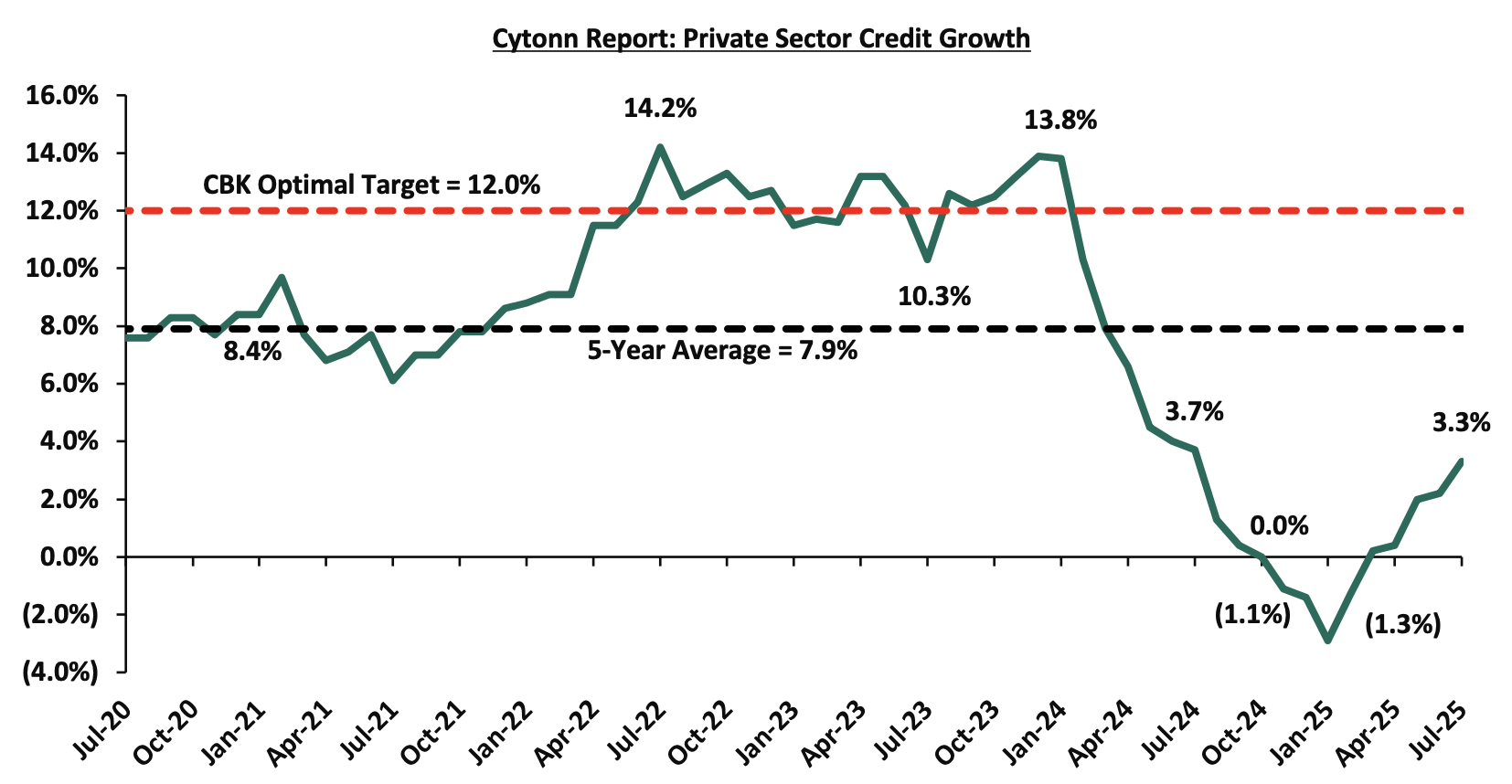

- Growth in private sector credit grew by 3.3% in July 2025 from 2.2% in June and a contraction of 2.9% in January 2025, mainly attributed increased demand attributable to declining lending interest rates. Notably, the growth in credit was recorded in key sectors such as manufacturing, trade, building and construction, and consumer durables since the last MPC meeting in June. Average commercial banks’ lending rates declined to 15.2% in July from 15.3% in June 2025 and 17.2% in November 2024. The chart below shows growth in private sector growth over the last five years:

- The Committee acknowledged the outcome of the implementation of the FY’2024/25 Budget and the Budget for FY’2025/26. These measures are anticipated to further support fiscal consolidation, which should reduce debt vulnerabilities in the medium-term.

The MPC noted that overall inflation is expected to remain below the midpoint of the 2.5%-5.0% target range in the near term, supported by low food prices, stable energy prices, and exchange rate stability. Additionally, central banks in major economies have continued to lower interest rates at a cautious pace. The Committee also noted that the recent economic developments, created room for further easing of monetary policy to support economic activity while maintaining exchange rate stability. The MPC noted that it will continue to monitor the effects of these policy measures, as well as global and domestic economic developments, and will remain ready to take additional action if necessary. Going forward, we expect the MPC to adopt a more cautious approach to rate adjustments in the coming meetings in a bid to continue supporting the private sector, while also keeping an eye on the effect on the inflation and exchange rate. The next MPC meeting is scheduled for 7th October 2025.

Fiscal Policy:

The total Kenyan budget for the FY’2025/2026 National Budget increased by 7.1% to Kshs 4.3 tn from the Kshs 4.0 tn in FY’2024/2025 while the total revenue inclusive of grants increased by 8.0% to Kshs 3.4 tn from the Kshs 3.1 tn in FY’2024/2025. The expenditure will be funded by revenue collections of Kshs 3.4 tn and borrowings amounting to Kshs 923.2 bn. Of the Kshs 923.2 bn total borrowing, Kshs 635.5 bn is estimated to be domestic while Kshs 287.7 bn is estimated to be net foreign borrowing.

The increase in revenues is mainly due to an 6.7% increase in ordinary revenue to Kshs 2.8 tn for FY’2025/2026, from the Kshs 2.6 tn in FY’2024/2025 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as an increase in some of the existing taxes to meet its revenue target. The government’s efforts have seemingly resulted in improved revenue collection as evidenced by 97.4% of the revenue targets in FY’2024/25, and having attained 97.4% of the prorated revenue numbers for FY’2024/25 as of end June 2025. However, there are still concerns about the government's ability to meet its revenue collection targets in FY’2025/2026 mainly on the back of the current operating environment with the high cost of living and heightened political climate.

The table below summarizes the key buckets and the projected changes:

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Cytonn Report: Comparison between FY’2024/2025 and FY’2025/2026 Budgets Estimates |

|||

|

Item |

FY'2024/25 Supplementary Budget II |

FY'2025/26 Estimates |

Change y/y (%) |

|

Ordinary Revenue |

2,580.9 |

2,754.7 |

6.7% |

|

Ministerial Appropriation-in-Aid |

486.8 |

567.0 |

16.5% |

|

Total grants |

52.6 |

46.9 |

(10.8%) |

|

Total Revenue & Grants |

3,120.3 |

3,368.6 |

8.0% |

|

Recurrent expenditure |

1,705.7 |

1,805.0 |

5.8% |

|

Recurrent Consolidated Funds Services (CFS) |

1,242.7 |

1,337.3 |

7.6% |

|

Development expenditure |

624.7 |

693.2 |

13.0% |

|

County Transfer & Contingencies |

445.6 |

474.9 |

6.6% |

|

Total expenditure |

4,007.5 |

4,291.9 |

7.1% |

|

Fiscal deficit inclusive of grants |

(887.2) |

(923.3) |

4.1% |

|

Projected Deficit as % of GDP |

(5.1%) |

(4.8%) |

(0.3%) pts |

|

Net foreign borrowing |

281.5 |

287.4 |

2.2% |

|

Net domestic borrowing |

605.7 |

634.8 |

4.9% |

|

Total borrowing |

887.2 |

923.2 |

4.1% |

Source: National Treasury of Kenya, www.parliament.go.ke

For the FY’2024/2025, the government was not able to meet the revenue collection targets having collected Kshs 2,430.1 bn, equivalent to 97.4% of the revised estimates III of Kshs 2,496.2 bn for FY’2024/2025 and 97.4% of the prorated estimates of Kshs 2,496.2 bn in the twelve months of FY’2024/2025. Notably, the total expenditure amounted to Kshs 3,519.2 bn, equivalent to 78.6% of the revised estimates of Kshs 4,474.9 bn, and 85.8% of the prorated expenditure estimates of Kshs 4,102.0 bn, an indication of modest spending by the government. The total borrowings as at the end of June 2025 amounted to Kshs 1,558.6 bn, equivalent to 91.6% of the revised estimates of Kshs 1,702.2 bn and 91.6% of the prorated estimates of Kshs 1,702.2 bn.

Going forward, we believe that the persistent fiscal deficit owing to lower revenues relative to expenditure will force the government to borrow more. We therefore expect the government to cut on its expenditure, mostly the development expenditure, in order to finance the growing debt maturities and the ballooning recurrent expenditure.