The Kenyan Economy is projected to grow at an average rate of 4.9% in 2022, from an estimate of 5.6% in 2021, mainly on the back of the global recovery and the easing of COVID-19 containment measures following an increase in vaccination rates and reduced infections. The move is expected to support growth in sectors like tourism, hospitality, manufacturing and trade, which are yet to fully recover from the pandemic. The table below shows the GDP projections according to various organizations;

|

GDP Growth Rate |

|||

|

No. |

Organization |

2021 Estimates |

2022 Projections |

|

1. |

International Monetary Fund |

5.6% |

6.0% |

|

2. |

Cytonn Investments Management PLC |

5.7% |

4.5% |

|

3. |

S&P Global |

6.0% |

4.5% |

|

4. |

World Bank |

5.0% |

4.7% |

|

Average |

5.6% |

4.9% |

|

|

Forecasted in Q4’2021 |

|||

Source: Cytonn Research

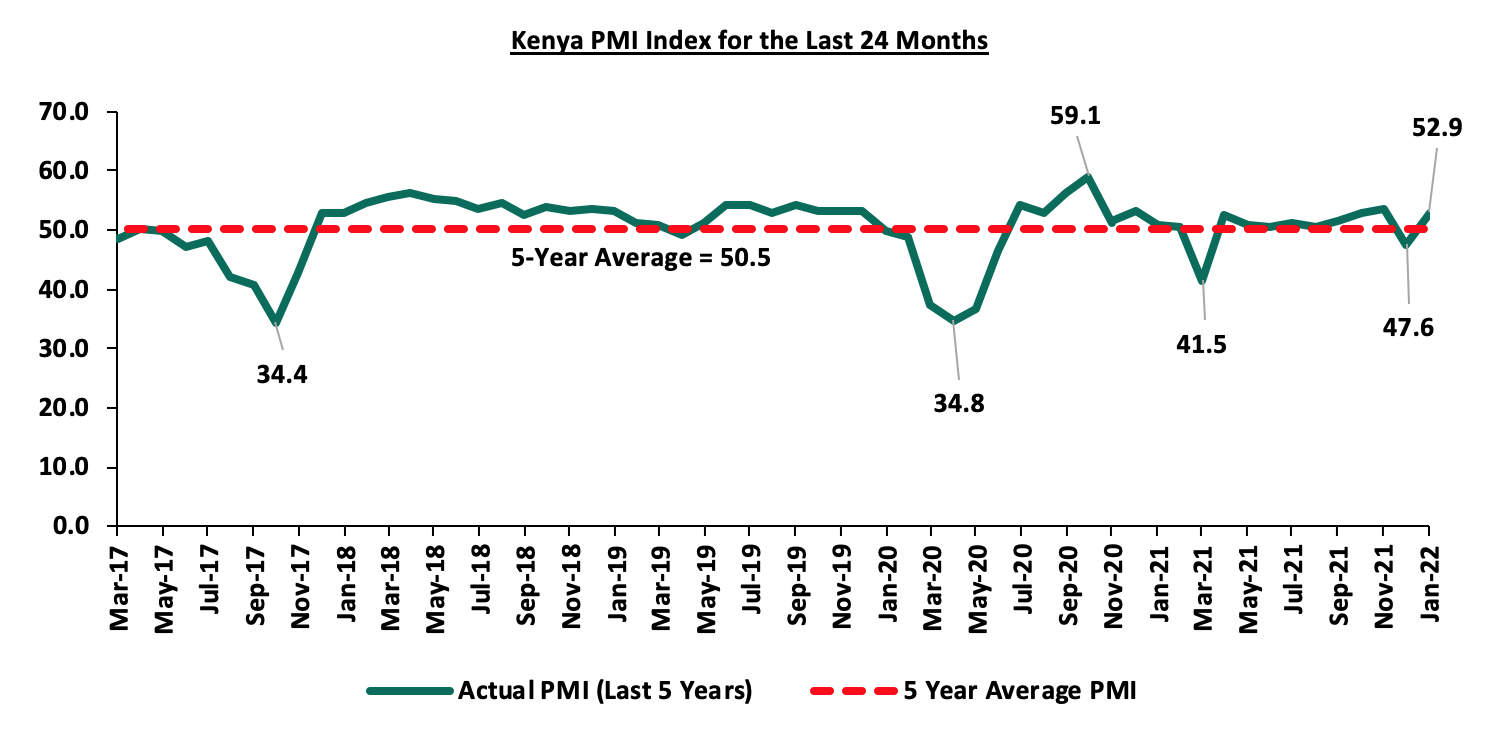

The average PMI for the first two months of Q1’2022 came in at 50.3, lower than the 52.1 recorded during a similar period in 2021 pointing towards a slowdown in the business environment in the private sector. The performance was weighed down by January’s Purchasing Managers’ Index (PMI) which came in at 47.6, marking an 8-month low largely due to lower domestic spending and travel following an uptick in price pressures and persistent COVID-19 cases from the Omicron Variant at the beginning of the year. Below is the PMI chart for the last five years:

Despite this deterioration, the total revenue collected for the two months amounted to Kshs 266.5 bn, 22.3% of the total revenue collected for FY’2021/2022 pointing towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection. Additionally, Fitch Ratings affirmed Kenya’s Long-Term Foreign- Currency Issuer Default Rating (IDR) at ‘B+’ with a Negative Outlook, unchanged from the previous review in March 2021. The B+ rating was on the back of the strong economic growth, with Kenya’s economy having recorded a 9.9% growth in Q3’2021, up from a 2.1% contraction recorded in a similar period in 2020, coupled with the continued macroeconomic stability.

However, risks lie on the downside on the back of;

- Rising fuel prices driven by persistent supply chain constraints coupled with the geopolitical pressures occasioned by the Russian invasion which is expected to put pressure on the inflation basket,

- Resurgence of new and more transmissible variants of the COVID-19 virus in the country’s trading partners is expected to weigh on investment performance, funding and aggravate the country’s debt vulnerabilities,

- The uncertainties surrounding the upcoming 2022 August elections, which are likely to have a negative effect on the business environment,

- Erratic weather conditions which are already causing severe hardship and subdued growth in the agricultural sector. Should the drought intensify, this would weigh on the near-term economic outlook, and,

- External risk such as weaker global growth with the IMF revising down the projected global growth for 2022 to 4.4%, 0.5% points lower than the earlier projection of a 4.9% growth rate, higher than anticipated energy prices and tighter external financing conditions.

Inflation:

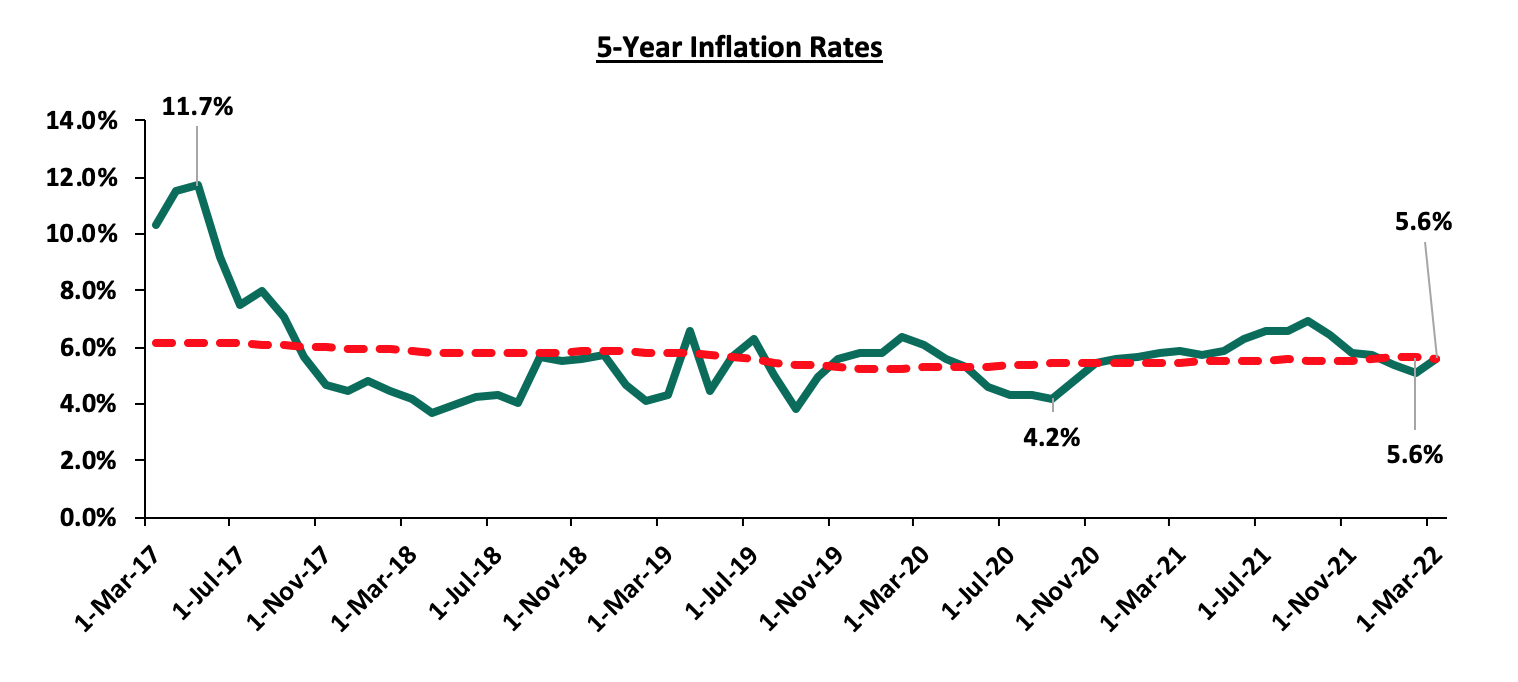

The average inflation rate declined to 5.3% in Q1’2022 compared to 5.8% in a similar period in 2021 mainly attributable to the unchanged fuel prices, during the period of review following a fuel subsidy programme under the Petroleum Development Fund. Below is the inflation chart for the last five years:

March Inflation

The y/y inflation for the month of March increased to 5.6%, from the 5.1% recorded in February 2022, in line with our expectations. The increase was mainly attributable to the increase in the y/y Food and non-alcoholic beverages, Housing, water, electricity, gas and other fuels as well as transport cost, which increased by 9.9%, 4.9% and 3.7%, respectively. Food and non-alcoholic beverages index has had the greatest increase both year on year and month on month mainly due the supply constraints of production materials and the erratic weather conditions.

The table below shows a summary of both the year on year and month on month commodity groups’ performance;

|

Major Inflation Changes – March 2022 |

|||

|

Broad Commodity Group |

Price change m/m (March-22/February-22) |

Price change y/y (March-22/March-21) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.5% |

9.9% |

The m/m increase was mainly contributed by increase in prices of cooking oil, wheat flour and tomatoes among other food items. The increase was however mitigated by a decline in prices of green grams, carrots and oranges |

|

Housing, Water, Electricity, Gas and other Fuel |

0.7% |

4.9% |

The m/m increase was as a result of increase in the price cooking gas by 7.8% m/m and 38.2% since March 2021

|

|

Transport Cost |

0.6% |

3.7% |

The m/m increase was as a result of the increase in prices of super petrol and diesel in the month of March following the rise in global oil prices. This was the first rise in fuel prices since September 2021 |

|

Overall Inflation |

0.9% |

5.6% |

The m/m increase was due to a 1.5% increase in the food and non-alcoholic beverages index as compared to the 0.8% increase in the month of February |

Source: KNBS

Going forward, we expect the inflation pressures to remain elevated but within the government’s set range of 2.5% - 7.5%. However, concerns remain high on the rising food and fuel prices which are expected to put pressure on inflation, given that these are a major contributor to the inflation basket. Additionally, we believe that the fuel subsidy program by the National Treasury stands at risk of being depleted and is unsustainable, as evidenced by the increased compensation amounts which further increase the possibility of depletion. As such, fuel prices are likely to keep rising should the landed cost continue increasing and thus exert upward pressure on the inflation basket.

The Kenya Shilling:

The Kenya Shilling depreciated against the US Dollar by 1.6% in Q1’2022, to close at Kshs 115.0, from Kshs 113.1 in December 2021, marking an all-time low. The depreciation is partly attributable to increased dollar demand from the oil and energy sectors. During the week, the Kenya Shilling depreciated marginally against the US Dollar by 0.2% to close at Kshs 115.0, from Kshs 114.7 the previous week. We expect the shilling to remain under pressure as a result of:

- Rising global crude oil prices on the back of supply constraints and geopolitical pressures at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound the recovery following the emergence of the new COVID-19 variants,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.6% of GDP in the 12 months to February 2022 compared to the 4.3% for a similar period in 2021. The wider deficit reflects a higher import bill, particularly for oil, which more than offset increased receipts from agricultural and services exports, and remittances, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.4% to Kshs 8.0 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt.

The shilling is however expected to be supported by:

- High Forex reserves currently at USD 7.8 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July 2021, USD 972.6 mn IMF disbursement, USD 130.0 mn World Bank loan financing received in June 2021 and the recently approved USD 750.0 mn World Bank loan facility, and,

- Improving diaspora remittances evidenced by a 23.5% y/y increase to USD 321.5 mn as of February 2022, from USD 260.3 mn recorded over the same period in 2021, which has continued to cushion the shilling against further depreciation.

Monetary Policy:

During the quarter, the Monetary Policy Committee (MPC) met twice and in both sittings, maintained the Central Bank Rate (CBR) at 7.0% for the thirteenth consecutive time after concluding that the accommodative stance implemented in March 2020 was having the intended effects on the economy.

However, during the 29th March 2022 sitting, the committee raised concerns on the elevated global risks on the back of heightened geopolitical tensions, volatile commodity prices as well as the COVID-19 pandemic and their potential impact on the domestic economy. Below are some of the key highlights from the meeting:

- Overall inflation declined to 5.1% in February 2022 compared to 5.4% in January, 2022 mainly attributable to lower food and fuel prices which declined by 8.7% and 6.5%, respectively. Inflation is expected to remain within the Government’s target range of 2.5%-7.5% but pressure abounds in the short term following the rise in fuel and food prices,

- Private sector credit growth has been recovering, having grown by 9.1% in the twelve months to February 2022, an increase from the 8.6% recorded in December 2021. The key sectors supporting this growth include Transport and Communication (24.1%), Consumer durables (14.0%) and Manufacturing (7.6%), and,

- The current account deficit to GDP is estimated at 5.6% in the 12-months to February 2022, a 1.3% points increase, from 4.3% recorded over a similar period in 2021. Exports of goods remained strong, growing by 12.1% in the twelve months to February 2022, compared to a similar period in 2021. Receipts from exports of horticulture and manufactured goods increased by 7.9% and 31.3%, respectively, in the twelve months to February 2022 compared to a similar period in 2021. However, receipts from tea exports declined by 0.3 %, partly attributable to the impact of accelerated purchases in 2020.

The MPC concluded that the current accommodative monetary policy stance remains appropriate and therefore decided to retain the Central Bank Rate (CBR) at 7.00%, in line with our expectations. The Committee will meet again in May 2021, but remains ready to re-convene earlier if necessary.

Q1’2022 Highlights;

- The Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 9.9% growth in Q3’2021, up from the 2.1% contraction recorded in a similar period in 2020 pointing towards continued economic recovery. For more information, see our Cytonn Weekly #1/2022,

- The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q3’2021 report highlighting that Kenya’s balance of payments improved in Q3’2021, coming in at a deficit of Kshs 34.4 bn, from a deficit of Kshs 103.9 bn in Q3’2020. The decline was mainly attributable to an 11.9% increase in the stock of gross official reserve to Kshs 1,064.2 bn from Kshs 951.0 bn in Q3’2020. For more information, see our Cytonn Weekly #1/2022,

- The World Bank released the Global Economic Prospects and the Sub–Saharan Africa outlook highlighting that the Kenyan economy is expected to grow by 5.0% in 2021 and 4.7% in 2022, supported by improving exports and the positive vaccine rollout. However, the erratic weather conditions in the country is expected to weigh down the economic growth as Agriculture is the largest contributor to Kenya’s GDP growth at 20.5% in Q3’2021. For more information, see our Cytonn Weekly #2/2022,

- The National Treasury presented the Supplementary Budget for the fiscal year 2021/22 to the National Assembly. The treasury is seeking to increase the gross total budget by 3.3% to Kshs 3,377.8 bn, from the previous estimates of Kshs 3,269.2 bn. The increase in the supplementary budget is mainly on account of a 12.3% increase in funds allocated towards the Ministry of Health to Kshs 136.0 bn from the original estimates of Kshs 121.1 bn as the government amps up its fight against COVID-19, coupled with a 3.7% increase in the infrastructure budget to Kshs 202.5 bn from the earlier approved Kshs 195.2 bn. For more information, see our Cytonn Monthly - January

- Stanbic Bank released its monthly Purchasing Manager’s Index (PMI) highlighting that the index for the month of February 2022 increased to 52.9 following a nine months low of 47.6 recorded in January 2022. The index points towards strengthened business environment in the country on the back of continued economic recovery as COVID-19 cases continue to decline. For more information, see our Cytonn Monthly – February,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum fuel prices in Kenya effective 15th March 2022 to 14th April 2022 highlighting that super petrol and diesel prices increased by 3.9% and 4.5% to Kshs 134.7 per litre and Kshs 115.6 per litre, respectively, from Kshs 129.7 per litre and Kshs 110.6 per litre recorded last month. The price of Kerosene remained unchanged at Kshs 103.5 per litre, same as recorded in the previous month. For more information, see our Cytonn Weekly #11/2022,

- The World Bank approved a USD 750 mn (Kshs 80.9 bn) loan facility aimed at accelerating Kenya’s ongoing inclusive and resilient recovery from the COVID-19 pandemic, and, strengthening fiscal sustainability reforms that contribute to greater transparency and the fight against corruption. For more information, see our Cytonn Weekly #11/2022,

- The National Treasury gazetted the revenue and net expenditures for the first eight months of FY’2021/2022, ending 28th February 2022 highlighting that Total revenue collected as at the end of February 2022 amounted to Kshs 1,192.8 bn, equivalent to 67.2% of the original estimates of Kshs 1,775.6 bn and is 100.8% of the prorated estimates of Kshs 1,183.8 bn. Notably, the performance is a decline from the 103.8% outperformance recorded in the first seven months to January 2021, mainly attributable to a 26.9% decline in the monthly revenue collection to Kshs 117.6 bn in February 2022, as compared to a monthly average of Kshs 160.9 bn in the first seven months to January 2021. Cumulatively, tax revenues amounted to Kshs 1,126.4 bn, equivalent to 66.0% of the original estimates of Kshs 1,707.4 bn and 99.0% of the prorated estimates of Kshs 1,138.3 bn. For more information, see our Cytonn Weekly #11/2022, and,

- Fitch Ratings affirmed Kenya’s Long-Term Foreign- Currency Issuer Default Rating (IDR) at ‘B+’ with a Negative Outlook, unchanged from the previous review in March 2021. The B+ rating was on the back of the strong economic growth, with Kenya’s economy having recorded a 9.9% growth in Q3’2021, up from a 2.1% contraction recorded in a similar period in 2020, coupled with the continued macroeconomic stability. Fitch Ratings estimates Kenya’s real GDP growth to come in at 6.5% in 2021 and to slow down to 6.0% in 2022, due to downsides posed by the upcoming August general elections. Below is a summary of the credit ratings on Kenya released in the last two years:

|

Rating Agency |

Previous Rating |

Current Rating |

Current Outlook |

Date Released |

|

Fitch Ratings |

B+ |

B+ |

Negative |

22nd March 2022 |

|

S&P Global |

B+ |

B |

Stable |

5th March 2021 |

|

Moody’s |

B1 |

B2 |

Negative |

19th June 2020 |

For more information, see our Cytonn Weekly #12/2022.

Going forward, we expect Kenya’s economy to record a gradual recovery in 2022, growing at a rate of 4.9%, from the 5.6% estimated growth recorded in 2021. However, we foresee the emergence of new COVID-19 variants, rising global fuel prices, erratic weather conditions coupled with the high debt appetite to slow down the recovery.