The concept of off plan buying has continued to gain traction over the years driven by the challenging financing environment for both the developers and the end buyer. Buying off-plan is a great way to purchase a property below its actual market value, which makes it a great investment opportunity. For investors, most are attracted to off-plan buying due to the promise of property appreciation. Developers on the other hand prefer off plan investments since they consider it an alternative source of financing mainly because of the capital intensive nature of Real Estate Projects

This week we seek to provide an in-depth assessment of the concept of off plan investments in the Real Estate sector to provide a basis for the justification of the concept. As such, we shall discuss the following:

- Introduction to Off Plan Investing,

- Overview of the Off Plan Buying Process and Investing Tips one should consider,

- Advantages and Disadvantages of Off Plan Investing,

- Off Plan Case Examples in Kenya, and,

- Conclusion

Section 1: Introduction to Off Plan Investing

Off plan investing is defined as the process through which an investor buys into a Real Estate development before it is completed. The selling or buying of property is done before the property is built, when there are only plans outlining the development concept alongside the relevant project approvals. For off plan sales, the payment terms always depend on the arrangement between the buyers and the sellers and at times they can be done in installments as the project progresses. Upon completion, the end buyer may decide whether to sell the unit on profits, to move into the property or rent out the property. Developers on the other hand stand to gain from capital injection since off plan investments have proven to be an effective mode of Real Estate financing. The concept has continued to gain popularity in the Real Estate market over the years driven by:

- Affordability: Units bought on an off plan basis have proved to be affordable compared to the ones purchased upon completion. Real Estate investors may end up paying up to 30.0%-50.0% less (depending on the project duration) for a house brought on an off plan basis. In most cases, buyers are provided with house prices that are valued at a lower price compared to the available market prices so that they get attracted to the investments, and,

- Capital Gains: Houses brought on off plan have the potential of capital gains which are higher compared to appreciations that individuals get when they purchase a property on completion. For instance, an individual who purchased a 1-bedroom unit off-plan at Kshs 5.5 mn in Cytonn’s Alma in Ruaka, stands to gain 55.0% in price appreciation as the unit’s current selling price is Kshs. 8.5 mn in Phase 4.

Section 2: Overview of the Off Plan Buying Process and Investing Tips

When purchasing properties off plan, it is important to exercise precaution and understand the track records of the developers to avoid financial losses. Buyers need to evaluate the legality of the projects and evaluate if developers have a history of delivering their projects by developers to avoid being swindled. As such, it is important to consider the important off plan buying tips and the necessary steps that should be followed when making off pan investments.

Off Plan Buying Tips

Buying a property that is yet to be developed or is in the pipeline poses greater risks to investors such as risk of delays. It is therefore important for an investor to undertake various strategies to minimize future risks and losses resulting from uncertainties such as projects stalling. Some of the important tips that needs to be considered before making off plan investments include;

- Market Research: The buyer needs to conduct a thorough market research and inspection of the preferred location of the development, in order to know the market performance of the area overtime and in turn maximize future returns. This can be well achieved through both desktop research and field data collection and analysis. Whereas it is essential and quicker to do the research through desktop study, it is very important to physically assess the area’s situation i.e. appearance and amenities available, and performance in order to get more accurate information. Effective research will help in determining if a project is worth investing in or not,

- Developer Due Diligence: Buyers need to run a background check on the developer and consulting firm that is implementing the project prior to purchasing a property. This is essential as it helps the buyer identify the developer’s reputation, the previous projects undertaken to completion, whether the developer is a registered company in the county of operation, etc. Additionally, having information of the company directors, their delivery to promise and proof of timelines met is also important in avoiding fraudulent off plan investment cases. This due diligence will help the buyer become aware of who he or she is to deal with before committing to a project,

- Project Due Diligence: This entails checking for the viability of a project through:

- Visiting the project site to ensure that the actual site exists,

- Evaluating the development titles to have proof that the owner of the land is genuine in the transaction,

- Evaluating the project plan approvals to understand if the developers have the legal rights to develop the properties and to prevent delays in project delivery,

- Evaluating the project team, experience, history and capability to gauge if they can deliver the project,

- Getting regular updates from the developer to ensure that timelines set for project delivery will not be compromised,

- Conducting research on Comparables to gauge the possibility of earning potential returns as promised by the developer, and,

- Understanding the project design team to understand the credibility of key individuals in the development process such as contractors and engineers.

- Contracts Due Diligence: Before signing any agreement from the seller such a sale agreement, it is advisable for the buyer to carefully read the terms and conditions in order to avoid risks of malpractices or compromise. Moreover, the buyer should engage a conveyance lawyer to ascertain the effectiveness and legitimacy of the agreement to prevent fraudulent cases in future, and,

- Financial Strategy: The buyer should have a financial plan as to how the property will be purchased, from the options that exist such as mortgages, instalment plans, and, cash at hand among others. Mortgages are regarded as debt instruments and are usually secured against a collateral of a Real Estate nature, on the other hand, instalment payments refer to a payment plan made in agreement by both developers and buyers where the investors make payments in small portions throughout a fixed period of time. With the limited funding options in Kenya, the buyer can consult his or her bank for financial advice and position, to avoid financial losses, i.e. the initial deposit, as result of failure to make subsequent payments.

Off Plan Buying Process:

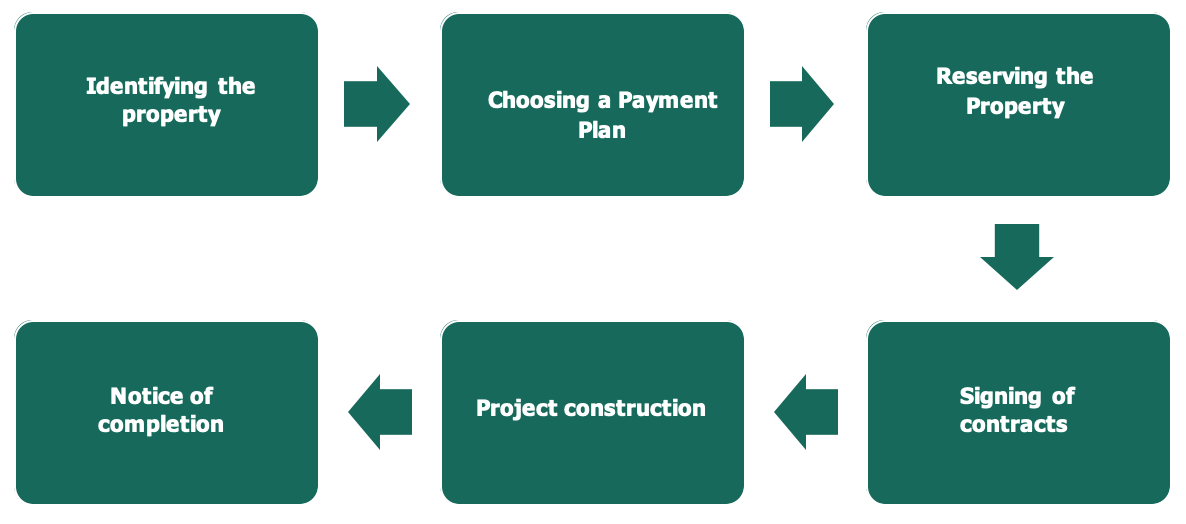

It is important for buyers to understand the processes involved in off plan investments in order to have an understanding of areas where they need to be actively involved in. The figure below shows the necessary steps that should be considered in the off plan investing process;

- Identifying the Property: This first step involves an investor identifying the development project that is ongoing or yet to be executed. During this period, the investor has to do proper due diligence on the developer undertaking the project. Doing market research is also an important necessity for this step as it provides the buyer with information of the performance of the development against similar Comparables,

- Choose a Payment Plan: After identifying the property to be purchased, the buyer and seller have to come to terms on the payment plans and schedules for the development. There are various payment plans used to make purchases for off plan developments which include cash payments, installments, and mortgages, among many others. Here, it is important for the buyer to choose from the various payment plans available; the one that best works for him/her,

- Reserve the Property: After identifying a suitable payment plan, the buyer will be able to reserve the desired property awaiting for the project completion. This is achieved by making an initial deposit for the property which is in other terms a reserve or holder for the property,

- Signing of Agreement: This process entails signing of contracts such as the sale agreement contract that will be presented to the buyer by the seller. Prior to signing any binding agreement, it is important for the buyer to read through the document thoroughly to ensure it is not compromised and that they are aware of what they are signing. Here, the buyer should also seek legal advice from a well-qualified lawyer to further ensure smooth and effective conveyance process before settling,

- Project Construction: This is the actual execution of the development project. The period of construction varies depending on the development design, type, and mix. During this period, the buyer should also track the development process i.e. by doing periodic site visits and inspections in order to be well informed on the process. The developer also needs to make frequent updates on the status of the project to the buyer and communicate in any case of anticipated delays, and,

- Notice of Completion and Hand Over: Once the project is fully implemented, the buyer will be notified of the project completion, and the property officially handed over to him/her.

Section 3: Advantages and Disadvantages of Off Plan Investing

In off plan investments, both the developers and the end buyers stand to gain in the process if the projects are well executed. Some of the advantages of off plan investing include;

- Opportunity to Lock in Price: Buying off-plan enables investors and homebuyers to acquire a property at a lower price as opposed to purchasing upon completion. In most cases, the developers offer low prices at the beginning of a project to make sure that they secure buyers and investors as soon as possible. Buyers are able to acquire future asset at today’s prices therefore enabling them to achieve capital gains on completion. A home bought off-plan will likely increase in price over time thus guaranteeing investors returns,

- Flexible Payment Plans: Most developers offer flexible payment plans such as cash, installments, and mortgages being the most popular options available. Some developers also consider zero deposits as an effective plan which is aimed at significantly reducing the initial upfront costs of units. This implies that buyers have the freedom to choose the payment terms that they deem fit for them, plans that would enable them make payments at their comfort without straining,

- Buyer’s Choice: The buyer/investor gets to pick where he/she would want the house located, as such, they are able to get the best location for their developments,

- Design Modification: The buyer has the ability to modify the interior designs of their selected properties including the type of finishes. Depending on the developers/level of completion an individual may have room to make design changes to their units, and,

- High Capital Appreciation: The value of an off plan development increases with level of completion and as development progresses. Some developments have been able to achieve over 50.0% price appreciation, for example the Alma in Ruaka which has achieved more than 30.0% in price appreciation since inception.

Despite the various advantages offered by off plan investing, there are some pitfalls that both developers and investors needs to be aware of. They include:

- Poor Product Quality: Developers cutting the total project costs can lead to a low quality final product, and as such, the products delivered will not meet the expectations of the buyers,

- Possibility of Capital Depreciation: In the event that the market rates go down or flatten, the investor may lose their capital. This usually happens in cases where developers over promises on returns such as yields and appreciations or when market conditions change. Capital depreciations may also be realized in the event of market uncertainties; for example, if the market goes into a Real Estate bubble. A Real Estate bubble is regarded as an increase in property prices in the market due to increased demand against limited supply, and an eventual slump in the demand for the properties in what is called a ‘burst’,

- Risk of Delays: The risk of delays will also be greater than when purchasing a completed property. These will generally be an inconvenience rather than a deal-breaker, as it interferes with the financial plans of the buyers. Moreover, this risk has been further fueled by the presence of the pandemic which saw to it a reduced purchasing power of prospective clients and in turn most development projects stalling,

- Failure to Deliver: Failure to deliver projects may result into financial strain, or fraudulent cases. Some developers over the past few years have swindled off-plan Real Estate buyers therefore affecting plans by buyer’s investments and financial plans,

- Unmet Finishing Requirements: A buyer might end up being disappointed with the quality of finishes presented to him/her, sometimes what is in the plan is not what is delivered especially when developers try to cut the project costs or miss out on particular details of the requirements by the developers,

- Unfavorable Payment Terms: Most payment plans may not be tailored towards the needs of the off plan buyer and this may be a source of dispute between the developers and buyers during the off plan buying process,

- Incomplete Developments: Incomplete developments may scare away potential investors as most people prefer to purchase existing structures that they can see. This may impact the ability of the developer to get finances to complete their projects, and,

- Dependence on Savings: The main form of housing finance in the country is personal savings accounting for 54.0% of all housing financing alternatives while bank loans come in second at 19.0% according to the Kenya Bankers Association-Home Ownership Survey. Dependence on savings to finance home acquisition may limit the number investors who can afford purchasing off plan.

Section 4: Off plan case examples in Kenya

In Kenya, we have continued to witness developers opting for off plan investments as a strategy to increase their funding capabilities. Developers who are focused on delivering to promise have shown that the concept if well executed can be beneficial providing a win-win situation for them and the end buyers. Below are notable case studies of successful projects that have been completed with part of the funding from off plan investments:

|

Capital Appreciations of Successful Off Plan Investments |

||||||||

|

Development Name |

Location |

Developer |

Number of Bedrooms |

Unit Size |

Price before completion (Kshs mn) |

Price after completion (Kshs mn) |

Capital Appreciation |

Summary |

|

Amara Ridge |

Karen |

Cytonn Real Estate |

5 |

470 |

85.0 |

108.6 |

27.8% |

The project was launched in 2015 and completed in 2017, with a 100.0% off plan sales achieved. It is a private gated community located in Karen, comprising of 10 luxurious 5 Bed Room Villas of 470SqM each, and with easy access to Ngong and Lang’ata roads |

|

Loresho Ridge |

Loresho |

Kenya Power Pension Fund |

3(Johari) |

150 |

11.5 |

16.5 |

30.3% |

Loresho Ridge project is a gated community whose construction was initiated in 2012 and completed in 2015. It comprises of a total of 164 units, out of which 29.3% off plan sales were achieved |

|

4(Fahari) |

265 |

28.0 |

38.5 |

27.3% |

||||

|

4(Kilele) |

242 |

25.0 |

35.5 |

29.6% |

||||

|

4(Makao) |

222 |

22.5 |

31.5 |

28.6% |

||||

|

4(Watani) |

238 |

24.0 |

34.5 |

30.4% |

||||

|

Alma (Phase 1, 2 and 3) |

Ruaka |

Cytonn Real Estate |

1 |

51 |

5.5 |

8.5 |

54.5% |

The comprehensive mixed use development project consisting of 477 units broke ground in 2016. Out of which, 201 units were sold as off plan in phase 1, 2 and 3, representing a 42.1% sales realized |

|

2 |

84 |

7.5 |

12.5 |

66.7% |

||||

|

3 |

117 |

9.0 |

15.5 |

72.2% |

||||

|

Pearl Heights |

Kileleshwa |

|

3 |

223 |

19.0 |

26.0 |

26.9% |

This is an 8-storey apartment complex consisting of 32 units. It was launched in 2013 and completed in 2016, with a 31.3% off plan sales achieved during the period |

|

Muthaiga Valley Apartments |

Parklands |

|

3 |

174 |

14.0 |

19.0 |

26.3% |

The development project consisting of 50-3 bedroom apartments broke ground in 2015 and completed in 2017 with an overall 42.0% off plan sales achieved |

|

3 With SQ |

|

15.0 |

20.0 |

25.0% |

||||

|

Ramata Greens Phase I |

Baba Dogo |

|

2 |

|

7.5 |

10.0 |

25.0% |

Construction of the 70-unit project began in 2013 and completed in 2016, with a 32.9% off plan sales made |

|

3 |

|

8.8 |

11.5 |

23.5% |

||||

|

Kings Millenium |

Imaara Daima |

Kings Developers Limited |

3 |

124 |

6.5 |

12.0 |

45.8% |

Construction began in 2013 and completed in 2016. During the period, 25.0% off plan sales were realized out of the 220 unit development project |

Source: Online Research

The above case examples show that off plan investments if well executed can be rewarding to both buyers and developers. Buyers are rewarded in terms of gains from capital appreciation while on the other end the developers gain from having adequate funds to develop their units which is not tied to interest payments.

Section Five: Conclusion

In conclusion, off plan investments have proven to be beneficial to investors due to their affordability, flexible payment plans, high capital appreciations and the ability to make design modifications. Additionally, purchasing off plan is a great way of investing in Real Estate which has continued to perform better than other asset classes such as the Equities market. Developers also stand to gain since they are able to acquire alternative sources of financing from the off plan buyers. Off Plan investing continues to be a lucrative investment opportunity that provides the possibility of earning high returns which may go up to 30.0%-50.0% p.a. However, it is also important for investors to develop an understanding of what they are getting into, the terms of the contract and the expected challenges they may face in the process. This can be further ensured by the buyer engaging a conveyance lawyer to certain the effectiveness and legality of the agreement to development project thus prevent fraudulent cases in future.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.