The Kenyan property market has witnessed significant growth over the past years, however in 2020, the real estate sector started on a rather high note but later the Covid-19 pandemic affected the performance real estate sector especially in terms of access to finance. Access to funds has been a key challenge for most real estate developers with most of them having relied on bank lending as a source of their funding. In order to bridge this gap, the real estate industry players have had to come up with various innovative products, e.g. joint venture models and structured products to raise capital. In helping bridge this gap and in a bid to further develop the Capital Markets, the Capital Markets Authority, CMA, in 2013 put in place REITs regulations that most developers can use to raise capital and we have seen some success stories already in the market. This regulatory framework has been in existence in Kenya for the past 8 years, and we have since done a topical on Real Estate Investment Trusts, REITs, as an Investment Alternative in 2019. This week, we update our topical by covering the following topics;

- Overview of REITs

- Types of REITs

- Benefits and risks associated with investing in REITs

- Challenges investors have encountered in investing in REITs

- REITs performance in Kenya

- Case study of Australia

- Lessons learnt from the case of Australia

- Conclusion

- Overview of REITs

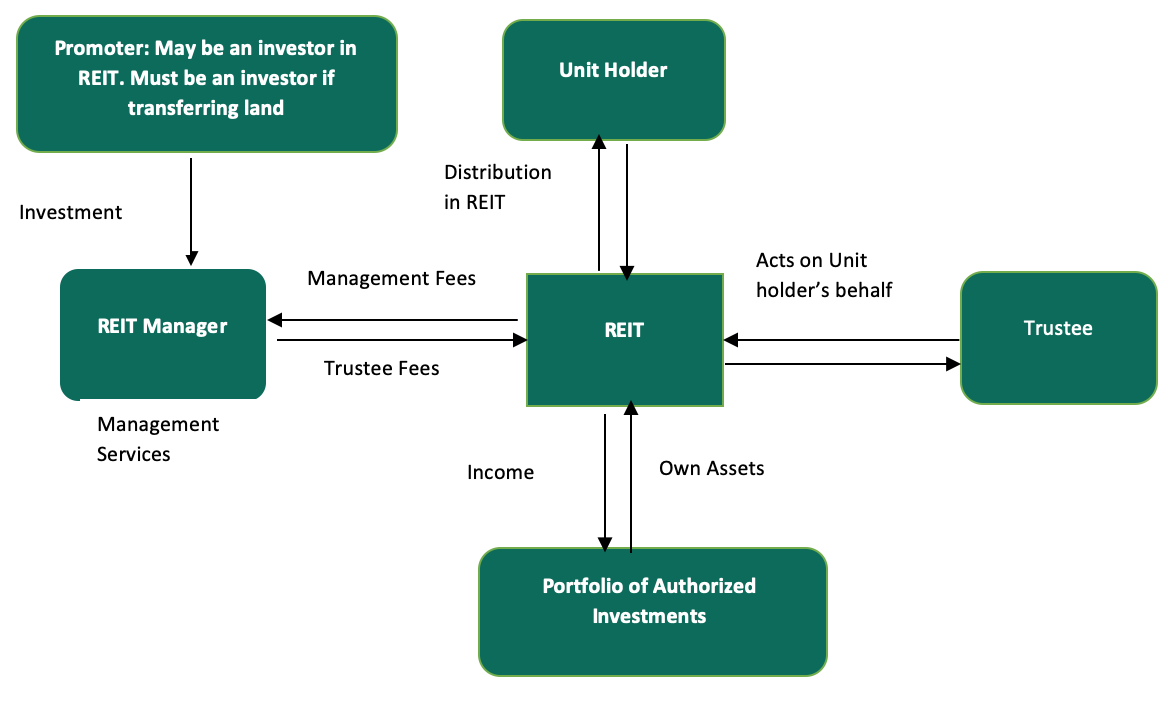

REITs are regulated collective investment vehicles which invests in real estate. REITs promoters source funds to build or acquire real estate assets, which they sell or rent to generate income. The income generated is then distributed to the investors as returns in investing in REITs. The property is held by a trustee on behalf of unit holders and professionally managed by a REIT manager. To help improve accountability and transparency within the REIT structure, there are four key parties who all work together to ensure that REITs interests are fully protected. These parties include:

- The Promoter: This is an individual or parties involved in setting up a real estate investment trust scheme. The promoter is regarded as the initial issuer of REIT securities and is involved in making a submission to the regulatory authorities to seek for approval of a draft trust deed, draft prospectus or an offering memorandum. For instance, in the existing Acorn D-REIT, Acorn Investment Management is the promoter. And for the attempted D-REITs, Fusion Investment Management Limited was the Promoter in the aborted Fusion D-REIT, and Cytonn Asset Managers Limited (CAML) was the Promoter in the aborted Cytonn D-REIT,

- The REIT Manager: This is a company that has been incorporated in Kenya and has been issued a license by the authority (CMA) to provide real estate management and fund management services for a REIT scheme on behalf of investors. There are currently 10 REIT Managers in Kenya, namely Cytonn Asset Managers Limited (CAML), Accorn Investment Management, Stanlib Kenya Limited Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited,

- The Trustee: This is a corporation or a company that has been appointed under a trust deed and is licensed by the regulatory authorities to hold the real estate assets on behalf of investors. The Trustee’s main role is to act on behalf of beneficiaries, usually the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed, and,

- Project/Property Manager: The role of the project manager is to oversee the planning and delivery of the construction projects in the REITs. The property manager on the other hand plays the role of managing the completed real estate development that has been acquired by the REIT.

The figure below shows the relationships between the key parties in a typical REITs structure;

Source: Capital Markets Authority

- Types of REITs

There are three main types of REITs and they include:

- Income Real Estate Investment Trusts (I-REITs): This is a real estate trust that primarily derives its revenues from rental properties. The investors gain through rental income and capital appreciation form the investments undertaken,

- Development Real Estate Investment Trust (D-REITs): This is a type of real estate trust where resources are pooled together for purposes of developing of real estate projects. Once a development has been completed, a D-REIT may be converted to an I-REIT and here the investors may choose to either re-invest their funds, sell, lease their shares or they can choose to sale the developments that have been undertaken, and,

- Islamic Real Estate Investment Trusts: This is a unique type of REITs which only undertakes Shari’ah compliant activities. A fund manager is required to do a compliance test before making an investment in this type of REIT to ensure it is Shari’ah compliant.

- Benefits of Investing in Real Estate Investment Trusts (REITs)

- Competitive Long-term returns: The performance of the REITs are derived from the real estate investments and we have seen that over time real estate have outperformed most other asset classes,

- Diversification: REITs, fixed income securities, and equities have different long-term investment characteristics creating diversification when combined within a single portfolio,

- Flexible Asset Class: REITs are regarded as a flexible payment option where investors are able to customize their REITs portfolio based on the fund characteristics, the various real estate sectors and geographic exposures,

- Liquidity: The REITs listed on securities exchange offer liquidity advantages for investors over the direct investments in real estate assets. The advantage of liquidity also extends to real estate developers as well since they may not need to completely sell their entire assets if they are seeking for some little liquidity,

- Stable and Consistent Income Stream: Investors especially those who take the I-REIT option have the advantage of getting rental income thus guaranteeing a stable and consistent income stream, I-REITs are required by the law to pay of at least 80.0% of their income to their unit holders in form of dividends,

- Taxation Benefits: REITs general have a number of tax benefits which include; i) REITs registered by the Commissioner of Income Tax are exempted from income tax except for the payment of withholding tax on interest income and dividends, ii) transfer of properties to a REIT also attracts a stamp duty exemption, as per Section 96A (1) (b) of the Stamp Duty Act, and, iii) REITs’ investee companies are exempted from income tax as stated in the Finance Bill 2019, section 20 of the Income Tax Act, and,

- Transparency: REITs provides operating transparency mainly because of how they are structured and operated. Additionally, the listed REITs are registered and regulated by the securities markets regulators adhering to high standards of corporate governance, financial reporting and information disclosure.

- Challenges facing the adaptation of REITs in Kenya & Suggested Solutions

- High Minimum Capital Requirements for a Trustee of Kshs 100.0 mn: This essentially limits the eligible trustees to only banks, efficiently eliminating corporate trustees and other fund managers. The Solution is to drop the minimum capital requirement to match what is required of a fund manager, to Kshs. 10.0 mn,

- Subdued Performance of the Real Estate Market: Some real estate sectors have experienced sluggish growth especially in 2020 attributed to the impact of the COVID-19 pandemic especially in the retail and commercial office sectors which are experiencing an oversupply of 3.1 mn SQFT and 6.3mn SQFT respectively and hence a resultant drop in the occupancy and rental returns,

- Lengthy Approval Process: The approval process can take time particularly to get the necessary documentations, and meet all the required regulatory requirements. This might discourage promoters from perusing their interests in focusing on REITs and look for other more efficient ways to raise capital. The Solution is to have a defined approval time within which an application must be processed and either approval or reasons for failure to approve clearly communicated to the applicant,

- Inadequate Investor Knowledge: REITs have been existence in the Kenyan market for the past 8 years, however, the popularity of the instrument has remained low mainly due to inadequate investor awareness or education of REITs hence low investment in the market. This is the main reason for low subscription rates and the consequent poor performance of the Ilam I-REIT and the failed issuance of the Fusion D-REIT in 2016 and 8 years since the establishment of the regulatory framework, there is not a single D-REIT in the market. The Solution is to have broader investor education on the benefits of REITs, but this will only make sense after several REITS have come to market, and,

- High Minimum Investment Amounts Set at Kshs 5.0 mn: Based on the current regulations, the minimum investment amounts for a D-REIT is 5.0 mn at 100X the medium income in Kenya, this is considered too high and might limit investors from preferring it as an investment option. The Solution is to bring down the minimum required investment amount for a REIT to Kshs. 100,000, which is the amount required by regulations for a private offer.

- REITs performance in Kenya

The regulatory framework, REITs was launched in Kenya in 2013, thus 8 years since inception in the Kenyan market. 8 years since the inception, the REITs market has remained underdeveloped with only one I-REIT, and no D-REIT with the Fusion Capital D-REIT, which was launched in 2016, having failed due to low subscription rates and the Cytonn D-REIT having failed due to conflicts of interest by the prospective bank Trustee. The current licensed REITs managers are 10 following the licensing of Acorn Investment Management by CMA in late 2020. Other examples of REIT managers in Kenya are; Cytonn Asset Managers Limited (CAML), Arcon Investment Management, Stanlib Kenya Limited Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited.

Acorn has made major strides with regards to investments in the REITs market and has since launched an investor road show for its Acorn Students Accommodation (ASA) REIT with the aim of establishing a D-REIT and an I-REIT in the next 2.5 years with an expected Internal Rate of Return of 18.0%. The development real estate investment trust (D-REIT) is expected to finance the student hostels whereas the Investment real estate investment trust (I-REIT) will be used to acquire property for rental income. The fund size for the two REITs is estimated at Kshs 4.0 bn for the D-REIT and Kshs 4.1 bn for the I-REIT in the initial fundraising. In their campaign, the organization plans to invest a total of 24.0% equity on the development of student accommodation D-REIT, and up to 67.0% in the I-REIT. In this regard, the firm announced that their anchor investor InfraCo, a private United Kingdom-funded injected Kshs 1.0 bn equity investment aimed at supporting their D-REIT and I-REIT.

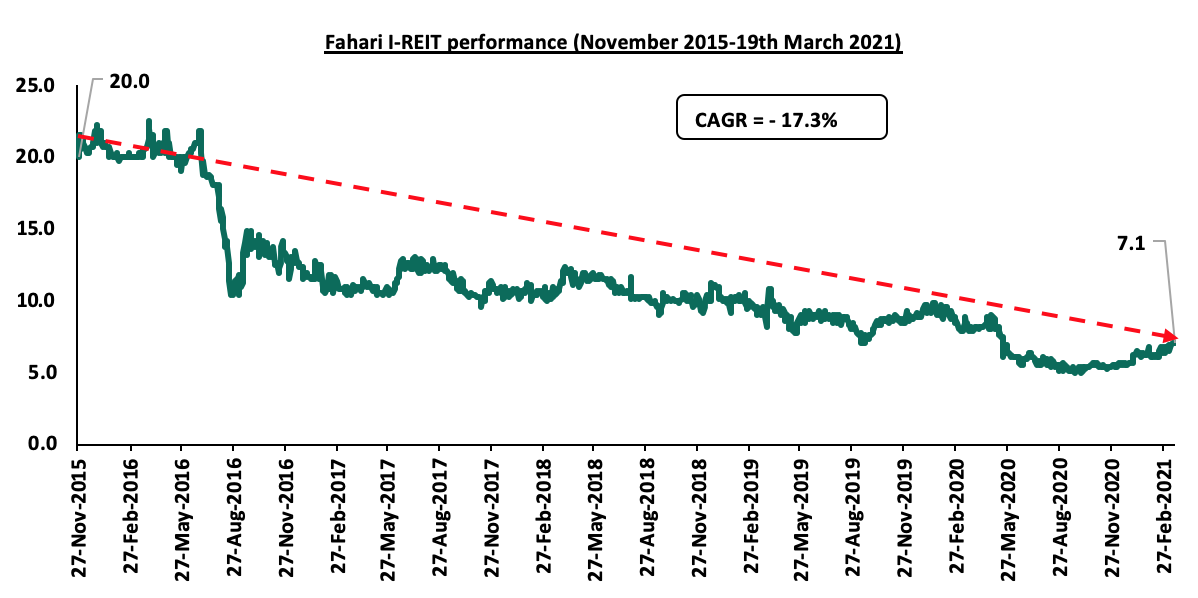

Kenya has only one listed REIT i.e. the Ilam Fahari i-REIT, listed on the Nairobi Securities Exchange (NSE) which started trading in November 2015. However, Ilam Fahari I-REIT’s performance, has been on a downturn since November 2015 when it was first listed, an indication of the dwindling interest for the instrument by investors. The Fahari I-REIT is currently trading at an average of Kshs 6.4 per share since the year started, representing a 28.1% decrease compared to the same period under review in 2020 trading at an average Kshs 8.9. Since inception, the instrument has recorded a decline of 64.5% from Kshs 20.0 in November 2015 to Kshs 7.1 as at 19th March 2020.

The graph below shows performance of the Fahari I-REIT since inception;

Based on the above, we believe that in order for REIT Market to improve and make it more attractive to local and foreign investors, the following supportive frameworks need to be put in place;

- Broaden the pool of trustees by reducing the minimum capital requirement which currently stands at Kshs 100.0 mn to avoid excluding corporate trustees; we have suggested Kshs 10.0 mn of capital,

- Reduce the minimum investments for real estate finance vehicles. The minimum of Kshs 5.0 mn per investor for the formation of a development REIT (D-REIT) is too high for a country where the median income is just Kshs 50,000, hence the minimum investment is 100 times higher than the median income, no wonder there is not a single Development REIT formed so far, making it hard to finance real estate initiatives such as the President’s housing agenda; we have suggested Kshs. 100,000 as the minimum, and,

- Develop institutional grade real estate assets which will lead to high returns.

- Case Study of Australia

The Australian REIT market was established in 1971 under the name Listed Property Trusts (LPTs) but was later renamed to Australian Real Estate Investment Trusts (A-REITs) after the Australian Stock Exchange Limited (ASX) decided to adopt the new naming convention in 2008. Australia is also receiving growing recognition as having the world's largest REITs market outside the United States with more than 12.0% of global listed property trusts listed in the ASX. The Australian REITs have grown to a market capitalization of $143.4 bn since its inception. There are currently 47 REITs listed on the Australian Securities Exchange (ASX). The ASX houses among the largest real estate groups in the world including the Goodman Group and the Scentre Group. The REIT market in Australia is highly corporatized given the large pools of pension fund cash due to compulsory saving in Australia. In Australia, listed REITs can be classified into a number of subsectors namely; i) Retail (45% of market capitalization of all REITs), ii) Office (12%), iii) Industrial (12%), iv) mixed use developments (27%), and v) Alternatives (4%). In the Australian market, there are two common REITS investment areas where people have focused on. These includes: i) the equity REITs which invests in and own properties and typically, income is generated through leasing out of properties and colleting rent, and, ii) mortgage REITs where investors are involved in the investment and ownership of property mortgages, these type of REITS loan money to the owners of real estate for mortgages and mortgage backed security and income is generated through the interests paid on the loan.

Some of the driving forces for the development of REITs in Australia Include:

- Diverse Property Offerings: The property sector in Australia is well diversified with large institutional developers in the real estate subsectors who have built a strong track record in real estate delivery, while at the same time giving attractive returns. This has had an effect on investors encouraging them to pull their investments in the real estate sector,

- Increased awareness: The Australian Stock Exchange (ASX) has made efforts to ensure that people are aware of the existence of REITs, as a result, more people have been able to invest in the instrument making it the second largest REITs market,

- Minimum Investment: In Australia, listed real estate have to be in compliance with the rules of the Australian Stock Exchange, the minimum amount of capital needed for one to invest in REITs is Kshs 50,000 ($500) for the equity REITS and mortgage REITS. In Kenya on the other hand the minimum capital outlay by an investor in a D-REIT is Kshs 5.0 mn. Taking the median income in Kenya of Kshs 50,000.0, the minimum for a REIT is 100 times their median income, and,

- Effective corporate Governance: Good regulation practices and corporate governance have acted as an incentive to both local and foreign investors, who have the assurance that their funds are being properly administrated and utilized.

- Lessons learnt from the case of Australia

The Kenyan REITs market has the potential to grow and this is possible if there is a supportive framework set up. Based on the case study of Australia, the following measures can be implemented to rejuvenate the REIT Market;

- Develop common workable standards that meet with international best practices especially in the areas of financial reporting, disclosure and corporate governance,

- Increased awareness of the existence of the REITs instruments to investors thus boosting their confidence,

- Kenya can initiate continuous improvement on the regulation and government support for REITs by providing regulations that assist in real estate uptake to help increase cash flows into the property market,

- Key industry players in the real estate market can work on developing institutional grade real estate assets. In this regard, development of institutional grade real estate assets would provide strong underlying assets for REITs, which can support the returns to investors,

- The Kenyan Industry players can seek ways to enhance confidence of investors in Kenyan REITs market through Providing minimum return guarantees for investors, and, promoting clearer and more transparent financial statements of real estate firms, listed properties and REITs in general, and,

- The REITs regulators in Kenya can work on reducing the minimum investments to a reasonable level in order to attract capital in the capital markets vehicles.

- Conclusion

Generally, REITs are a good investment option as they provide investors the opportunity to participate in real estate projects. For Kenya, REITs are still at the initial stages with only one being listed, the Fahari I-REIT. One of the main factors affecting the performance of the REITs market is minimal investor knowledge on the instrument. However, the REITs market in Kenya has a potential for growth with increased government support, and public sector sensitization of the REITs.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.