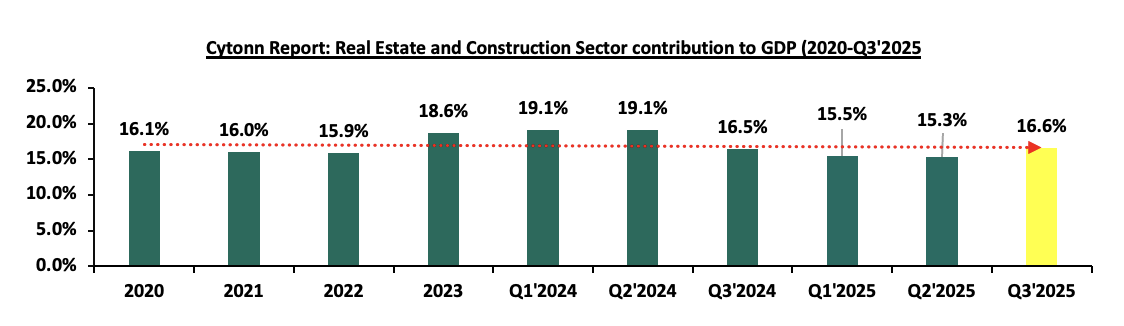

In 2025, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 7.6% to Kshs 368.7 bn in Q3’2025, from Kshs 342.6 bn recorded during the same period in 2024. In addition, the sector contributed 8.6% to the country’s GDP, 0.2% points decrease from 8.8% recorded in Q3’2024. Cumulatively, the Real Estate and Construction sectors contributed 16.6% to GDP, 0.1 % points increase from 16.5% in Q3’2024, attributable to a surge in construction sector contribution to GDP by 9.3 % points, to 6.7% in Q3’2025, from a contraction of 2.6% recorded in Q3’2024. The graph below highlights the Real Estate and Construction sectors’ contribution to GDP from 2020 to Q3’2025;

Source: Kenya National Bureau of Statistics (KNBS)

Some of the key factors that continued to positively shape the performance of the Real Estate sector include; i) The government's ongoing focus on the Affordable Housing Program has been a major driver of growth, ii) Continuous improvements in infrastructure, such as new roads, bridges, and utilities, have opened up previously inaccessible areas for real estate development, iii) Kenya Mortgage Refinance Company (KMRC) has continued to drive the availability and affordability of home loans to Kenyans by providing single-digit fixed rate, and long-term finance to Primary Mortgage Lenders (PMLs) such as banks and SACCOs, iv) the retail landscape has seen a surge in growth, with both domestic and international retailers like Naivas, QuickMart, China Square, and Carrefour aggressively expanding their market presence, v) Kenya continues to enjoy recognition as a regional business hub, vi) high urban population growth and population growth rates of 2.8% p.a and 2.0% p.a, respectively, against the global average of 1.4% p.a and 1.0% p.a, respectively, as at 2024, there is a sustained demand for more housing units in the country, vii) increase in investor confidence has greatly influenced hospitality sector and this is evident through mergers, acquisitions and expansions of hotels, viii) increased popularity of purpose-built properties to host Student housing, medical centers, diplomatic residentials, data centers which offer potential for growth to the Real Estate sector through alternative markets, and ix) Construction costs decreased by 9.0% in 2025 to an average of Kshs 76,230 per SQM from an average of Kshs 83,731 per SQM recorded in 2024,

Despite the above cushioning factors, there were various challenges that impeded the optimum performance of the Real Estate sector such as; i) existing oversupply of physical space in select sectors, ii) The Kenyan REITs market remains subdued, hampered by key challenges, which include, high capital requirements for trustees (Kshs 100.0 mn vs. Kshs 10.0 mn for pension funds), which effectively restricts the role to banks. Furthermore, the market faces prolonged approval processes, a scarcity of qualified legal entities for incorporation, and high entry thresholds, Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs, iii) constrained financing to developers as lenders continue to tighten their lending requirements and demand more collateral from developers as a result of the high credit risk in the real estate sector.

As the REITs continue to gain popularity in Kenya, we set to explore and review the REITs environment in 2025 building on the previous report we did: Kenya’s REITs H1’2025.

This week’s report will focus on the below sections as we dig deeper to understand REITs in Kenya.

- Overview of the REITs Sector in Kenya

- Key Drivers and Market Trends in 2025

- Challenges and Opportunities in the REITs Sector

- Conclusion and Outlook for the REITs Sector in 2026

Section I: Overview of the REITs Sector in Kenya

Real Estate Investment Trusts are crucial to the development given the limited funding available to the developers. Real Estate Investment Trusts (REITs) represent an innovative financing avenue for real estate development in Kenya. REITs provide a structured mechanism for pooling resources from multiple investors to finance or acquire income-generating real estate assets. The Capital Markets Authority (CMA) regulates REITs in Kenya, ensuring transparency and investor protection. Despite being relatively new in the Kenyan financial market, REITs have shown potential as a transformative tool for real estate financing.

In Kenya, REITs are classified into two main types:

- Development REITs (D-REITs): These focus on financing the construction of new real estate projects. Developers utilize D-REITs to raise capital for large-scale projects, such as residential complexes, commercial buildings, or mixed-use developments. Investors in D-REITs anticipate returns from the eventual sale or lease of the completed properties. Example of this REIT include Acorn D-REIT.

- Income REITs (I-REITs): These are designed for properties that generate consistent rental income. I-REITs appeal to investors seeking steady cash flow from established properties such as office buildings, shopping malls, or industrial parks. In Kenya examples of I-REITs include Acorn I-REIT and Stanbic Fahari I-REITs.

REITs in Kenya are governed by strict regulations aimed at safeguarding investors. REITs are formally established in accordance with regulations set forth for Real Estate Investment Trusts (REITs) and granted approval by the Capital Markets Authority (CMA) under the Capital Markets Real Estate Investment Trusts Collective Investment Schemes Regulations of 2013. Instead of taking the form of conventional companies, they are structured as trusts. The management of investment properties falls under the purview of a corporate REIT manager, licensed by the CMA. Units of listed REITs are traded on the Nairobi Securities Exchange (NSE), akin to shares of any other company listed on both the Main Market Segment and the Unquoted Security Platform (USP), providing investors with a liquid stake in Real Estate. Both individual and corporate investors have the opportunity to partake in a public offering on the NSE, as outlined in the Regulations of 2013.

Furthermore, the regulations stipulate that Kenyan REITs are mandated to distribute a minimum of 80.0% of distributable earnings to their unitholders as dividends, making them attractive to those seeking regular income. Additionally, REITs automatically qualify for several tax exemptions such as the Income Tax Act (ITA), Value Added Tax (VAT), and Capital Gains Tax (CGT) under the authorization of the Kenya Revenue Authority (KRA) which enhance their appeal to both developers and investors.

In 2013, the Capital Markets Authority (CMA) introduced a detailed framework and regulations for REITs, enabling developers to secure capital through this investment avenue.

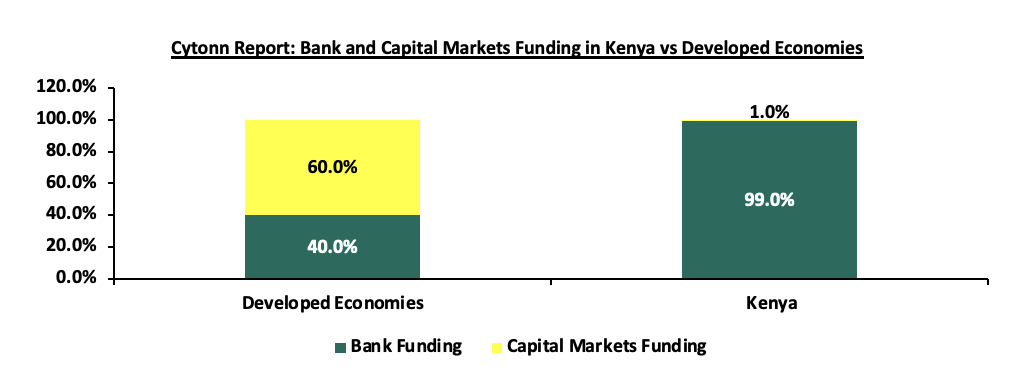

Kenya's Real Estate sector has been expanding due to ongoing construction activities driven by strong demand for real estate developments. The residential market is significantly under-supplied, with a 2.0 mn units housing deficit growing by 250,000 units per year; only 50,000 units are delivered annually against an estimated need for 200,000 units per year. Additionally, the formal retail market in Kenya is still in its nascent stages, with a penetration rate of approximately 30.0%, as reported by the World Bank. Despite the high demand, developers in Kenya encounter limited financing options, with local banks providing nearly 99.0% of construction financing, in stark contrast to the 40.0% typically seen in developed countries. The graph below illustrates the comparison of construction financing in Kenya versus developed economies;

Source: World Bank, CMA

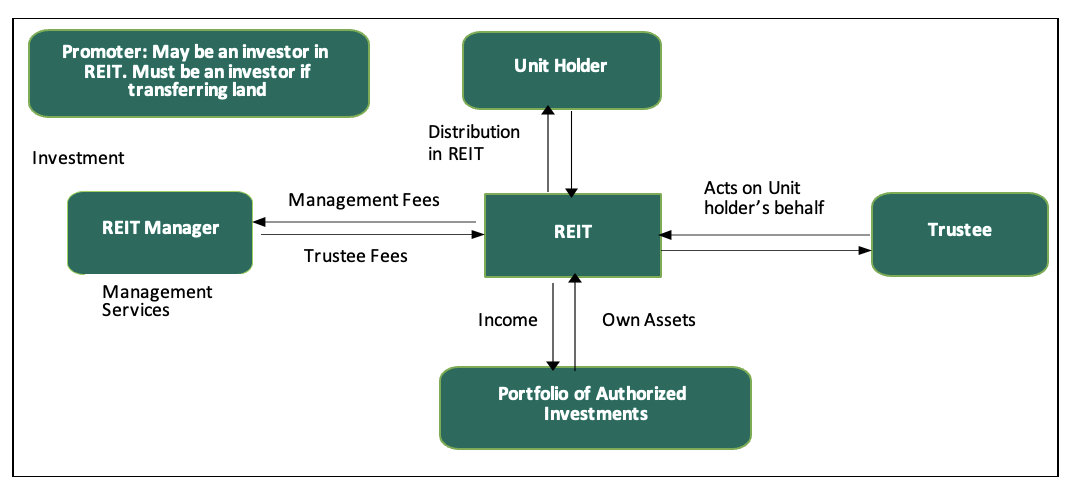

To bridge the funding gap, developers are increasingly turning to alternative financing methods. In 2013, the Capital Markets Authority (CMA) introduced a regulatory framework for Real Estate Investment Trusts (REITs) in Kenya. REITs are collective investment vehicles that pool funds from investors, who then acquire rights or interests in a trust divided into units. Investors benefit from profits or income generated by the real estate assets held within the trust. To ensure transparency, accountability, and the protection of investors' interests, four essential entities play key roles in the REIT structure in Kenya:

- The Promoter: This entity is responsible for establishing the REIT scheme. The promoter acts as the initial issuer of REIT securities and handles submissions to regulatory authorities for approvals of trust deeds, prospectuses, or offering memorandums. Examples of REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust.

- The REIT Manager: This is a licensed company in Kenya that provides real estate and fund management services for a REIT scheme on behalf of investors. There are currently 10 REIT Managers in Kenya, including Cytonn Asset Managers Limited, Acorn Investment Management, and Stanlib Kenya Limited.

- The Trustee: A corporation or company appointed under a trust deed and licensed by the CMA to hold real estate assets on behalf of investors. The trustee's primary role is to act in the best interests of investors by evaluating investment proposals from the REIT Manager and ensuring compliance with the Trust Deed. REIT trustees in Kenya include Kenya Commercial Bank (KCB) and Co-operative Bank.

- Project/Property Manager: The project manager oversees the planning and execution of construction projects within the REITs. Meanwhile, the property manager handles the management of completed real estate developments acquired by a REIT, with a focus on generating profit.

The relationship between key parties in a typical REIT structure is depicted in the figure below;

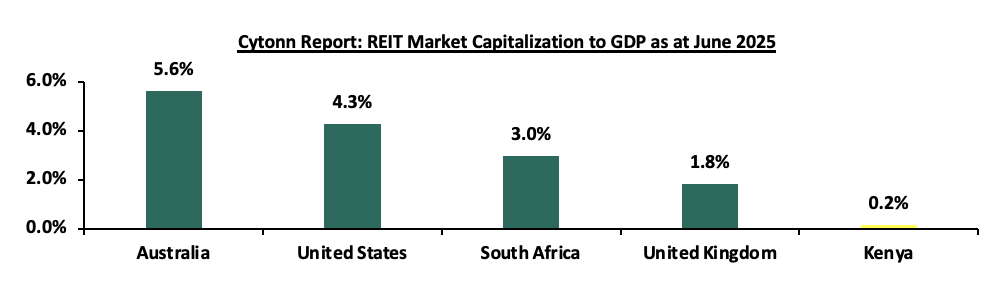

Since its introduction in 2013, the REIT market in Kenya has faced several hurdles that have hindered its growth. Key challenges include the hefty capital requirement of Kshs 100.0 mn for trustees, limiting this role largely to banks, and a protracted approval process for setting up REITs. Additionally, the high minimum investment threshold of Kshs 5.0 mn discourages potential investors, while a lack of sufficient investor education and awareness further impedes market expansion. As a result, the REIT market capitalization in Kenya remains significantly lower compared to other regions

The underdeveloped capital markets in Kenya has continually failed to provide alternative means of financing Real Estate developments. Due to this, most property developers rely on conventional sources of funding such as banks, compared to other developed countries. As a result, Kenya’s REIT Market Capitalization to GDP has remained significantly low at 0.2%, compared to other countries such as South Africa with 3.0%, as shown below;

Source: European Public Real Estate Association (EPRA), World Bank, Cytonn Research

Most property developers in Kenya continue to rely on traditional funding sources, such as banks, unlike in more developed markets. Since the establishment of REIT regulations, four REITs have been approved in Kenya, all structured as closed-ended funds with a fixed number of shares. However, none of these REITs are actively trading on the Main Investment Market Segment of the Nairobi Securities Exchange (NSE). Following the delisting of ILAM Fahari I-REIT on February 2024, LAPTrust Imara I-REIT is the only listed REIT in the country, quoted on the restricted market sub-segment of the NSE's Main Investment Market. It is important to note that Imara I-REIT did not raise funds upon listing. The ILAM Fahari I-REIT, Acorn I-REIT and D-REIT are not listed but trade on the Unquoted Securities Platform (USP), an over-the-counter market segment of the NSE. The table below outlines all REITs authorized by the Capital Markets Authority (CMA) in Kenya

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

# |

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

July 2024 |

Unquoted Securities Platform (USP) |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

March 2023 |

Restricted Market Sub-Segment of the Main Invesment Market |

Restricted |

Source: Nairobi Securities Exchange, CMA

Advantages of REITs

- Access to real estate with lower capital outlay: REITs allow investors to gain exposure to income-generating real estate without the large capital requirements associated with direct property ownership. Instead of purchasing land or buildings outright, investors can buy REIT units with comparatively smaller amounts, making property investment more accessible to retail, diaspora, and institutional investors.

- Stable and predictable income streams: Kenyan REITs, particularly Income REITs (I-REITs), generate regular cash flows from rental income. Regulations require REITs to distribute a significant portion of their taxable income to unit holders, providing investors with consistent dividend yields, which is especially attractive in an environment of volatile capital markets.

- Portfolio Diversification: REITs offer investors a way to diversify across asset classes, locations, and tenant profiles without directly managing properties. By holding a single REIT unit, investors gain exposure to multiple properties such as offices, retail, student housing, or residential assets, reducing concentration risk compared to owning a single property.

- Professional Management and Governance: REITs in Kenya are managed by licensed and regulated professional fund managers under the oversight of the Capital Markets Authority (CMA). This structure ensures stronger governance, transparent reporting, and professional asset management advantages that individual property owners often lack.

- Liquidity compared to direct property ownership: Unlike physical real estate, which can take months to sell, REIT units can be traded (subject to market conditions) on the Nairobi Securities Exchange or the Unquoted Securities Platform. While liquidity is still developing, REITs offer relatively faster exit options compared to traditional property investments.

- Tax efficiency: REITs in Kenya offer a highly tax-efficient vehicle for real estate exposure, primarily through an exemption from the standard 30.0% corporate income tax for both the registered REIT and its investee companies, provided they distribute the mandated portion of earnings to unitholders. While distributions are subject to withholding tax for non-exempt investors, the structure benefits from significant Capital Gains Tax (CGT) exemptions on unit redemptions and property sales by the REIT. Furthermore, although a 15.0% CGT and Stamp Duty typically apply to property transfers and D-REIT to I-REIT transitions, exemptions are available for transfers from life insurance companies to a REIT, internal restructurings via SPVs, and direct asset transfers which are also VAT-exempt. This combination of incentives enhances net returns and provides a superior alternative to owning property through traditional corporate entities,

- Risk mitigation through regulation: REIT regulations impose limits on leverage, asset concentration, and related-party transactions, reducing systemic and governance risks. These safeguards protect investors and promote market stability, especially important for pension funds and long-term institutional investors.

- Inflation Hedge: Rental income and property values tend to adjust upward over time, making REITs a natural hedge against inflation. In Kenya’s inflationary environment, REITs help preserve purchasing power while generating real (inflation-adjusted) returns.

- Gateway for institutional and foreign capital: REITs provide a structured, transparent vehicle through which institutional investors, DFIs, and foreign investors can deploy capital into Kenya’s real estate market. This supports sector formalization, deepens capital markets, and reduces reliance on bank lending.

- Support for housing and infrastructure development: Development REITs (D-REITs) mobilize long-term capital for housing, student accommodation, and mixed-use developments, supporting Kenya’s urbanization and housing agenda. This aligns private capital with national development priorities while offering investors exposure to growth assets.

- Reduced operational burden for investors: REIT investors are insulated from day-to-day property management issues such as tenant management, maintenance, and regulatory compliance. This makes REITs particularly attractive to passive investors seeking real estate exposure without operational complexity.

Section II: Themes that Shaped the REIT Sector in 2025

In this section, we examine the key themes that have significantly shaped the REIT sector in 2025. We explore how strategic acquisitions, and capital-raising initiatives have influenced the REIT industry's trajectory. Additionally, we provide insights into the broader factors that have impacted the sector's performance and overall direction during this period.

- Portfolio Holdings & Acquisitions

Acquisitions play a pivotal role in the dynamic landscape of the Kenyan REITs industry. These strategic moves signify the industry's evolution, adaptability, sustainability, and growth potential. As of January 2025, the industry has witnessed noteworthy acquisitions that are reshaping the sector. These acquisitions hold a promising outlook for the industry, contributing to its progress and value proposition. They exemplify how REITs are actively enhancing their portfolios, expanding their market presence, and optimizing their performance. Some of the notable acquisitions and developments in 2025 include;

- In 2025, Acorn Student Accommodation Development REIT continued to be the most active acquirer and developer within Kenya’s REIT market, expanding beyond Nairobi into key university towns. During the year, the D-REIT acquired land near Masinde Muliro University of Science and Technology (MMUST) in Kakamega, marking its entry into Western Kenya’s student housing market. In addition, the REIT progressed with the Eldoret CBD student accommodation development, comprising Qwetu and Qejani branded hostels, collectively adding approximately 2,100 new student beds to its development pipeline. These acquisitions and developments reinforced Acorn D-REIT’s strategy of geographic diversification and scale-driven growth within the purpose-built student accommodation segment.

- During 2025, LAPTRUST Imara I-REIT did not record any publicly disclosed new property acquisitions. The REIT maintained its existing diversified portfolio comprising office, retail, residential, and institutional assets, focusing on asset stabilization, rental performance, and portfolio optimization rather than expansion. As such, no material additions to its property holdings were reported during the year.

- ILAM Fahari I-REIT similarly did not announce any new portfolio acquisitions. The REIT continued to hold its existing commercial real estate assets, including retail and office properties, with performance during the year driven mainly by asset revaluations, rental income management, and balance-sheet optimization rather than active acquisition activity.

In the future, we expect REITs to maintain a strategic acquisition strategy. This will involve actively seeking opportunities to expand their portfolios, diversify their holdings, and respond to evolving market demands. Additionally, REITs are likely to prioritize environmental sustainability, as exemplified by Acorn Holding's issuance of green bonds. Such acquisitions can also stimulate innovation within the industry, encouraging the development of new ideas, designs, and services that cater to the needs of both investors and tenants.

- Capital Raising

Raising capital is essential in the REITs industry, fueling growth, development, and innovation. Securing funds from diverse sources, whether through debt or equity, enables REITs to expand their portfolios, improve existing properties, and explore new investment opportunities. This practice benefits the REITs and significantly shapes the Real Estate landscape, providing attractive investment options to stakeholders. Some of the notable capital infusion in the REITs industry as of 2025 include;

- Mi Vida Homes announced plans to raise between Kshs 15.0 bn and 20.0 bn from both local and international institutional investors in the first quarter of 2026. This is considered a big stride in Kenya’s Real Estate sector because this is set to be earmarked as Kenya’s first hybrid real estate fund. A hybrid Real Estate fund describes an investment vehicle that is designed to pool capital from investors by combining both an Income and Development Real Estate Investment Trust (REIT).

- Africa Logistics Properties (ALP) received approval from the Capital Markets Authority (CMA) to proceed with a restricted offer for its ALP Industrial Real Estate Investment Trust (I-REIT), targeting professional investors only. The offer involves issuing up to 30 mn units at USD 1.0 per unit to raise up to USD 30.0 mn, alongside a promoter consideration of up to 15 mn units issued in exchange for seed logistics assets. The I-REIT will invest in modern Grade A and B warehousing and logistics facilities across East Africa, with initial seed assets located in Imara Daima and Tatu City, Nairobi.

- Centum Investment Company announced that they expect to issue a dollar denominated Income Real Estate Investment Trust (I-REIT) at its Two Rivers Special Economic zone in Nairobi in January 2026. Centum is eyeing Kshs 4.8 bn from the proposed I-REIT, which is pending regulatory approval, with the proceeds budgeted for the construction of green commercial property in the Two Rivers International Finance and Innovation Centre (TRIFIC). The launch will be done within the month of February 2026

Section III: Challenges and Opportunities in the REITs Sector

Kenya’s REIT market is evolving, and while it offers promising investment prospects, several challenges continue to shape its growth trajectory. At the same time, these challenges create opportunities for strategic improvements and market expansion of the sector;

- Challenges

- Regulatory and compliance hurdles

One of the major challenges confronting the REIT market in Kenya is the evolving regulatory framework. Although the Capital Markets Authority (CMA) has introduced guidelines to enhance transparency and protect investors, frequent changes and complex compliance requirements often create uncertainty for REIT managers and potential issuers. The intricate registration process and continuous updates in regulatory policies can discourage market participants, limiting the number of listings. However, this challenge also provides an opportunity for the industry to collaborate more closely with regulators, streamlining processes and establishing more predictable compliance standards that could, in turn, bolster investor confidence and market stability. The REITS association of Kenya can help to advocate for clear, stable and supportive frameworks and streamlining of compliance processes to reduce uncertainties for REIT managers and issuers. Some of the regulatory and compliance challenges include:

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs,

- Lengthy approval processes for REIT creation,

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties. However, Mi Vida Homes announced plans to have a hybrid REIT to raise up to Kshs 20.0 bn, and,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only.

- Limited Liquidity and Thin Trading

One of the most persistent challenges facing Kenya’s REIT market in 2025 was limited liquidity on public markets. Most REITs, including Acorn Student Accommodation I-REIT, ASA D-REIT, and ILAM Fahari I-REIT, continued to trade on the Unquoted Securities Platform (USP) rather than the Main Market of the Nairobi Securities Exchange (NSE). Even for LAPTRUST Imara I-REIT, which is listed on the NSE, trading remained restricted to the professional investor segment with low turnover and limited price discovery. This constrained investor participation, making it difficult for some unit holders to exit positions or achieve market valuations reflective of underlying asset performance.

- Investor awareness and confidence

A critical challenge in the Kenyan REIT landscape is the insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products. The low level of investor awareness about these investment vehicles. Many local investors are still more comfortable with traditional bank deposits and direct property investments. Historical performance issues in some segments of the real estate market, coupled with a lack of comprehensive educational initiatives, have contributed to cautious investor sentiment. This challenge, however, presents a considerable opportunity. By launching targeted investor education programs, hosting seminars, and enhancing market transparency through better reporting and digital platforms, REIT managers can gradually shift public perception. Building a robust narrative around stable, income-generating real estate investments can lead to increased participation and sustained growth in the market.

- Limited Institutional Participation

While institutional investor interest remained in principle, actual deployment by pension funds and insurers was still measured. Many institutional frameworks require longer track records, transparent governance structures, and broader market participation before allocating meaningful portions of portfolios to REITs. This slowed down large ticket capital inflows that could otherwise scale the market quickly.

- Operational and management challenges

Managing a diverse portfolio of real estate assets across different regions requires advanced operational systems and strategic expertise. Inefficient property management, underutilization of assets, and the lack of technological integration can hinder the overall performance of REITs. This challenge, however, also opens the door for innovation. The adoption of modern property management software, digital leasing platforms, and data-driven decision-making tools can significantly enhance operational efficiency. By embracing technology, REITs can reduce costs, improve tenant satisfaction, and increase overall yields, thereby creating a more attractive proposition for investors.

- Opportunities for growth and expansion

Despite the challenges, the opportunities in the Kenyan REIT market are significant. Rapid urbanization in major cities such as Nairobi, Mombasa, and Kisumu are driving demand for quality commercial and residential spaces. Government initiatives to improve infrastructure and attract foreign investment further enhance the market potential. With supportive policy reforms and a growing emphasis on financial inclusion, REITs are well positioned to tap into new asset classes and diversify their investment portfolios. By capitalizing on these trends, REITs can not only improve their performance but also play a crucial role in shaping Kenya’s broader real estate landscape. The two upcoming Cities: Eldoret and Nakuru will see an increase in demand for Real Estate infrastructures in retail, hospitality, office, residential, and industrial spaces. Below are the opportunities available for the REITs in Kenya in 2026

- Growth of student accommodation as a core asset class

A standout opportunity in 2025 was the expansion of purpose-built student accommodation as a REIT-eligible asset class. The Acorn Student Accommodation REITs leveraged this demand, expanding bed capacity not only in Nairobi but into Tier-2 university towns like Eldoret and Kakamega. High occupancy rates and stable cash flows made this segment attractive for both income-oriented and long-term investors, proving resilience even in a tighter economic environment.

- Emergence of dollar-denominated and hybrid REIT structures

To mitigate currency risk and broaden investor appeal, 2025 saw early development of USD-denominated REIT products and hybrid structures that blend income and development features. These products attracted interest from diaspora investors and offshore funds seeking hard currency yields. Such innovations expanded the investor base and reduced reliance on local currency exposure.

- Institutional anchor capital and creative funding models

As traditional public capital raising faced headwinds, REIT sponsors increasingly turned to institutional anchor capital, consortium funding, and phased equity calls. For example, structured deals involving development capital from infrastructure funds and development finance institutions (DFIs) helped launch new REIT vehicles and reduced sponsor risk. These hybrid models increased deal feasibility and established new pathways for growth.

- Increased investor education and market sophistication

With more REIT product launches and deeper media coverage in 2025, investors, both retail and institutional, became more knowledgeable about REIT mechanics, yield profiles, and diversification benefits. This improved investor literacy laid the groundwork for increased future participation and deeper capital markets activity.

- Policy support and tax incentives potential

While regulatory frameworks remained imperfect, incremental reforms in tax treatment, listing incentives, and pension fund guidelines signaled government recognition of REITs as capital market deepening tools. Should these reforms accelerate in 2026 and beyond, the sector is well positioned to benefit from enhanced investor confidence and cleaner regulatory triggers for broader adoption.

Addressing these challenges will go a long way ensuring the sector thrives and the funding constraint improves. The REITS association of Kenya can intervene and advocate for the rights and welfare of the REITs managers and issuers

Section IV: Conclusion, Recommendations, and Outlook for the REITs Sector

Kenya's REITs market has seen moderate performance, shaped by various factors. Despite challenges, there are encouraging trends, such as growth in net operating incomes, indicating improved financial performance. Additionally, leverage ratios for most REITs have remained low, with many REITs being ungeared and relying on short-term debt for their operations to avoid overexposure to rising interest rates. This trend is expected to continue as REITs seek to maintain financial sustainability, as evidenced by Acorn Holdings' issuance of a green bond. Moreover, the recent regulatory proposal by the Capital Markets Authority (CMA) to reduce the minimum investment amounts for professional investors to Kshs 10,000 is anticipated to increase interest in the sector and attract a broader investor base.

Recommendations to Enhance the REITs Sector:

- Stakeholder education: There is an urgent need to enhance understanding of the REIT framework among all key stakeholders. Comprehensive investor education and awareness initiatives should be implemented to clearly communicate both the benefits and risks associated with REIT investments. Improved investor literacy will expand participation, deepen market confidence, and support the long-term growth and sustainability of the REIT sector.

- Broadening permissible legal structures: In contrast to Kenya’s predominantly trust-based REIT framework, markets such as South Africa, Belgium, and the United States permit REITs to be established under various legal forms, including public limited companies, limited liability companies, cooperatives, and partnerships. This structural flexibility accommodates diverse business models and investor preferences. To enhance the competitiveness and accessibility of Kenya’s REIT market, it is recommended that allowable structures be expanded beyond trusts to include corporate and partnership models. Such diversification would reduce entry barriers and foster a more resilient and dynamic REIT ecosystem.

- Streamlining the approval and regulatory process: The current REIT approval process involves oversight by both the Capital Markets Authority (CMA) and the Kenya Revenue Authority (KRA), creating procedural duplication and delays. Consolidating the approval function under a single regulatory framework would significantly improve efficiency. A unified approval process would reduce compliance costs, shorten timelines, and enhance transparency, thereby making REIT formation more attractive to issuers and fund managers.

- Encourage hybrid REIT vehicles: Currently, investors are required to subscribe separately to income and development REITs, resulting in duplicated costs and administrative complexity. Introducing hybrid REIT vehicles that combine development-stage growth potential with stable income-generating assets would offer investors a more balanced risk-return profile. Such structures would simplify investment decisions, reduce costs, and enhance overall market attractiveness.

- Flexibility in listing: Given the apprehensions of many companies regarding an immediate shift to public listing, a phased approach is recommended. Providing REITs with an initial period of private operation before mandating public listing could ensure a smoother transition and align with corporate comfort levels. For example, Belgium’s model, requiring 30% public shareholding, strikes a balance between public participation and promoter flexibility. Kenya could adopt a similar strategy, or even consider offering REITs the choice between public and private listings, which would foster inclusivity and better accommodate diverse investor preferences while bolstering market liquidity.

- Lower capital requirement for trustees: Currently, the minimum capital requirement for REIT trustees is set at Kshs 100.0 mn, a threshold that effectively restricts trusteeship primarily to major banking institutions. With only a handful of banks registered as REIT trustees, such as Kenya Commercial Bank (KCB), Co-operative Bank, Housing Finance Bank, and NCBA Bank Kenya, it is recommended that this minimum be reduced to Kshs 10.0 mn. This adjustment, aligning with the minimum standards set for Pension Fund Trustees, would expand the pool of potential trustees and encourage more competitive, innovative service provision for REIT managers.

- Introduce tokenization of REITs: Embracing the concept of tokenization presents an innovative avenue to broaden market participation. By digitizing REIT units into smaller denominations, potentially allowing investments as low as Kshs 100.0, it becomes possible to lower entry barriers, enhance liquidity, and attract a broader range of investors, including those with limited capital.

- Diminishing Entry Barriers: Revisiting the current minimum investment requirement of Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for the restricted I-REIT, is essential to eliminate barriers that restrict individual participation. Notably, given that D-REITs are riskier compared to I-REITS, it makes no sense having I-REITs with higher minimum investment requirements compared to D-REITs. Lowering this threshold to Kshs 50,000 for I-REITs would foster a more inclusive investment environment, allowing a wider array of investors to access and benefit from the REIT market, ultimately bolstering overall market vibrancy and liquidity.

The outlook for Kenya's REITs sector remains cautiously optimistic. While challenges such as high construction costs and market saturation in certain areas persist, the continued government support through infrastructure development and affordable housing initiatives provides a positive backdrop. Investors are expected to remain focused on income-generating REITs, particularly those tied to resilient sectors like retail and commercial properties. The sector's growth will likely hinge on increased investor awareness and the broadening of investment options within the REITs market.

In 2026, we expect REITS to gain popularity as developers such as Centum Real Estate looking forward to launch a dollar based Income REIT and we expect that the dollar based I-REIT will: i) increase foreign investments by boosting investors’ confidence against local currency uncertainties, ,ii) dollar-denominated REITs provide an alternative for investors seeking more liquid and globally recognized investment options, iii) the dollar based move is likely to set a precedent for other players in the market, encouraging the development of more innovative and investor-centric financial products, and, iv) the fund could force policy regulatory framework improvement to ensure transparency and investments protection.

In addition, we expect the sector will continue to lag behind in comparison to other African countries such as South Africa, attributable to several challenges facing the sector such as; i) lack of sufficient investor awareness regarding the potential of REITs as an investment tool, ii) lengthy approval procedures for establishing REITs have hindered their formation and deployment in the market, iii) high minimum capital requirement of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only,, and, iv) steep minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs.

However, we also expect the trend of strategic acquisitions to persist, with REITs actively seeking opportunities to broaden and diversify their portfolios, cater to evolving market demands and also set standards in promoting environmental sustainability such as execution of green bonds by Acorn holding. While there are supportive factors for the growth of REITs in Kenya, such as urbanization and government infrastructure projects, challenges like high interest rates and regulatory constraints may tamper performance. Stakeholders in the REIT sector are advised to monitor these dynamics closely and engage in strategic planning to navigate the evolving market landscape effectively.

Moving forward, we also expect the trend of strategic acquisitions to persist, with REITs actively seeking opportunities to broaden and diversify their portfolios, cater to evolving market demands and also set standards in promoting environmental sustainability such as execution of green bonds by Acorn holding.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.