Economic Growth:

According to the International Monetary Fund (IMF), Sub Saharan Africa is projected to register a 3.7% GDP growth in 2022, slower than the 4.0% growth estimate recorded in 2021. The slowed economic growth is partly attributable to the emergence on new strains of COVID-19 such as the Omicron variant that necessitated imposition of measures to curb its spread coupled with increasing inflationary pressures due to broadening of price pressures of key imports such as oil. Economic growth has further been weighed down by slow COVID-19 vaccine roll out, with the region having fully vaccinated only 12.0% of its population, as compared to a global average of 58.5%. Additionally, the region is facing debt sustainability concerns, with most of the countries having huge debt levels, with the IMF highlighting in their Regional economic outlook that five African countries were in debt distress, a further thirteen in high risk of debt distress, and 17 in moderate risk of debt distress. This is partly attributable to significant shortfalls in revenue collection and depreciating local currencies which in turn undermined their ability to service maturing debt obligations. However, the region’s growth will be supported by increase in prices for commodity exports such as oil which are expected to support growth in Nigeria and Angola while high coffee and cotton prices will support near-term recovery in Kenya, Tanzania and Ethiopia.

Currency Performance:

The vast majority of the select currencies depreciated against the US Dollar in Q1’2022 continuing the trend witnessed in FY’2021, with only the South African Rand and the Botswana Pula gaining by 8.0% and 2.4%, respectively. The Ghanaian Cedi was the worst performer in Q1’2022 as it depreciated by 24.1% against the dollar. The performance is partly attributable to increasing concerns over public debt sustainability with public debt to GDP ratio reaching 80.1% in December 2021, coupled with affirmation of a negative outlook by Fitch ratings in January 2022. This has seen Ghana’s attractiveness to foreign investors decline and subsequent decline in foreign exchange inflows. On the other hand, the South African Rand appreciation is partly attributable to rallying of commodity prices of the country’s minerals such as gold, platinum, silver and coal. The increase in commodity prices, coupled with an expected hike in interest rates have increased trade and investment activities have increased in the country. The Kenya Shilling depreciated by 1.6% in Q1’2022 to close at Kshs 115.0 against the US Dollar, compared to Kshs 113.1 recorded at the end of 2021.Below is a table showing the performance of select African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Mar-21 |

Dec-20 |

Mar-22 |

Last 12 Months change (%) |

Q1’2022 change (%) |

|

South African Rand |

14.8 |

15.9 |

14.6 |

1.2% |

8.0% |

|

Botswanan Pula |

11.0 |

11.7 |

11.4 |

(3.6%) |

2.4% |

|

Malawian Kwacha |

776.3 |

817.3 |

818.9 |

(5.2%) |

(0.2%) |

|

Tanzania Shilling |

2,314.0 |

2,297.8 |

2,318.5 |

(0.2%) |

(0.9%) |

|

Nigerian Naira |

380.6 |

410.9 |

415.7 |

(8.4%) |

(1.2%) |

|

Ugandan Shilling |

3,660.0 |

3,544.3 |

3,595.1 |

1.8% |

(1.4%) |

|

Kenyan Shilling |

109.5 |

113.1 |

115.0 |

(4.7%) |

(1.6%) |

|

Mauritius Rupee |

40.7 |

43.3 |

45.4 |

(10.3%) |

(4.7%) |

|

Zambian Kwacha |

22.1 |

16.7 |

18.2 |

21.8% |

(8.7%) |

|

Ghanaian Cedi |

5.8 |

6.0 |

7.3 |

(20.6%) |

(21.7%) |

African Eurobonds:

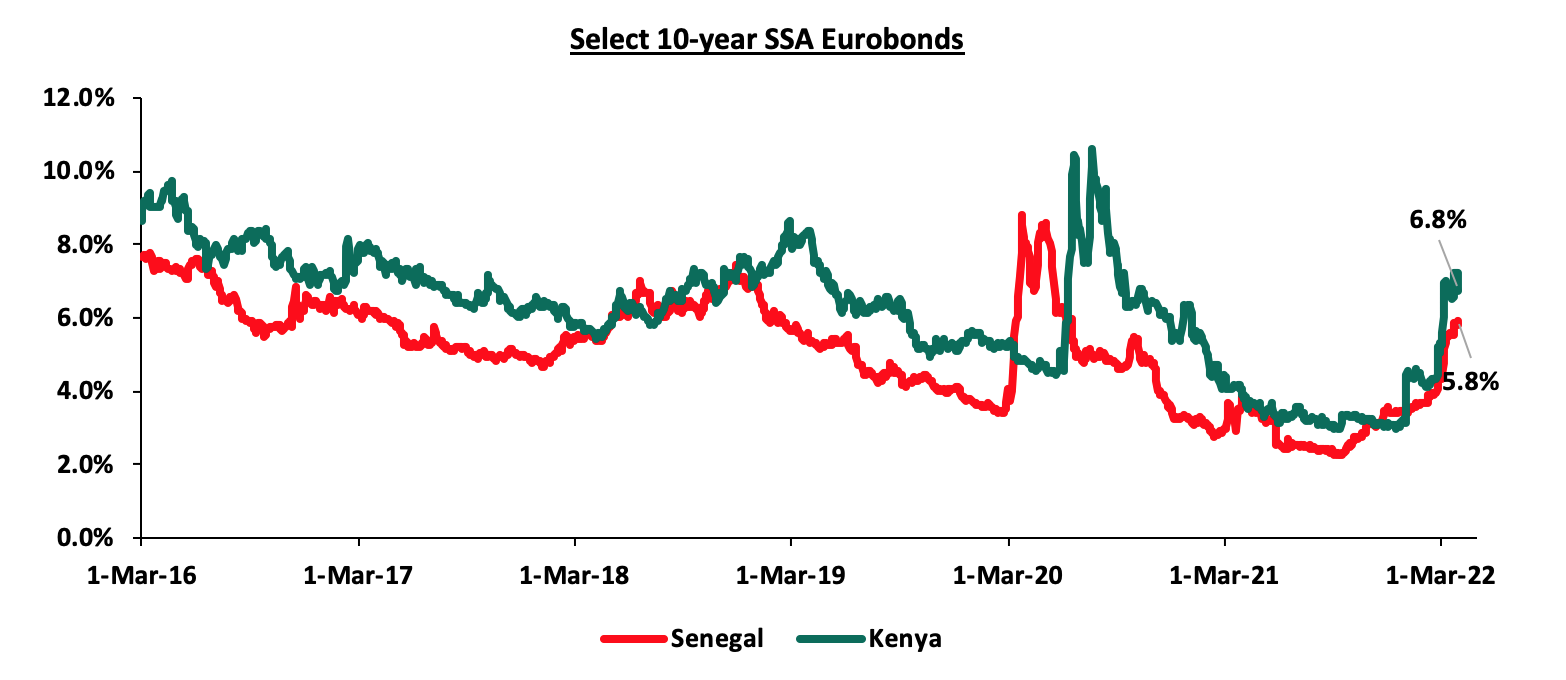

Yields on African Eurobonds generally increased in Q1’2022 partly attributable to investors attaching higher risk premium on the Sub-Saharan region and other emerging markets due to perceived higher risks arising from increasing inflationary pressures and local currency depreciation. The increase in Eurobond yields come on the back of inflationary pressures and local currency depreciation that has worsened the existing supply chain constraints. Yields on both the Kenyan and Senegal Eurobonds increased in Q1’2022 by 2.4% to 6.8% and 5.8%, from 4.4% and 2.4%, respectively, recorded in December 2021.

Below is a graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by their respective countries;

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q1’2022, with South Africa’s JALSH being the best performing market gaining by 11.2% attributable to the increased foreign investor sentiments following rallying of commodity prices coupled with the appreciating local currency. Ghana’s GGSECI was the worst-performing market with a loss of 19.1%, partly attributable to the re-imposition of capital gains tax on securities listed on the Ghanaian Stock Exchange, which has seen investors prefer fixed income securities with relatively higher yields. The GGSECI has also seen capital flight from foreign investors due to uncertainties caused by inflationary and currency depreciation pressures.

Below is a summary of the performance of key exchanges:

|

Equities Markets Performance (Dollarized*) |

||||||

|

Country |

Index |

Mar-21 |

Dec-21 |

Mar-22 |

Last 12 Months change (%) |

YTD change (%) |

|

South Africa |

JALSH |

4,502.4 |

4,638.8 |

5,160.0 |

14.6% |

11.2% |

|

Nigeria |

NGSEASI |

102.6 |

103.9 |

113.0 |

10.1% |

8.7% |

|

Zambia |

LASILZ |

182.3 |

363.4 |

377.2 |

106.9% |

3.8% |

|

Rwanda |

RSEASI |

0.2 |

0.1 |

0.1 |

(28.7%) |

(0.9%) |

|

Tanzania |

DARSDEI |

1.5 |

1.6 |

1.5 |

2.5% |

(3.9%) |

|

Uganda |

USEASI |

0.4 |

0.4 |

0.4 |

(8.5%) |

(8.5%) |

|

Kenya |

NASI |

1.5 |

1.5 |

1.4 |

(9.7%) |

(9.7%) |

|

Ghana |

GGSECI |

384.9 |

464.4 |

375.6 |

(2.4%) |

(19.1%) |

|

*The index values are dollarized for ease of comparison |

||||||

GDP growth in Sub-Saharan Africa region is expected to slow in 2022 in line with the rest of the global economy. The region still faces key challenges among them emergence of new COVID-19 variants coupled with inflationary pressures worsened by global geopolitical tensions. Additionally, the region continues to suffer from high debt levels that will make them less attractive to foreign capital and high costs of debt service following expiry of Debt Service Suspension Initiative and weakening of local currencies.